Highlights

- Evoke Pharma is a specialty pharmaceutical company focused on drugs for treating gastrointestinal disorders and diseases.

- The US Food and Drug Administration (FDA) has granted new drug product exclusivity for the company’s GIMOTI nasal spray.

- Recently its two patents entitled “Nasal Formulations of Metoclopramide” were listed in the Orange Book.

Evoke Pharma, Inc. (NASDAQ:EVOK) skyrocketed 140.07% to US$0.9449 at 10:42 am ET on Tuesday.

On April 26, the company announced that the US Food and Drug Administration (FDA) granted new drug product exclusivity for the company’s GIMOTI nasal spray. With this designation, Evoke Pharma gets exclusive marketing rights for three years from the original date of approval to protect the product from competition under the Hatch-Waxman Act.

The healthcare company is patent rich. Recently, its two patents titled “Nasal Formulations of Metoclopramide” were listed in the Orange book or Approved Drug Products with Therapeutic Equivalence Evaluations.

Also Read: CELU to CMPI: Explore top 5 biotech stocks with over 100% YTD return

The EU, Japan, and Mexico have granted gender-specific patents to the company with coverage until 2032. Besides getting marketing exclusivity rights for GIMOTI, Evoke Pharma also has other patent applications with expiration dates of 2032, 2037, and 2038.

GIMOTI is an investigational metoclopramide nasal spray for relief from acute and recurrent gastroparesis.

According to Evoke Pharma Chief Business Officer Matt D’Onofrio, the marketing exclusivity rights by the FDA establish its proprietary concept of medication through the nasal pathway for diabetic gastroparesis symptoms.

Evoke Pharma Inc.

Solana Beach, California-based Evoke Pharma is a specialty pharmaceutical company focused on developing drugs to treat gastrointestinal disorders and diseases.

Also Read: Five student loan stocks to watch in April: DFS to SLM

Also Read: MRNA to PFE: Top vaccine stocks to watch amid fresh covid surge

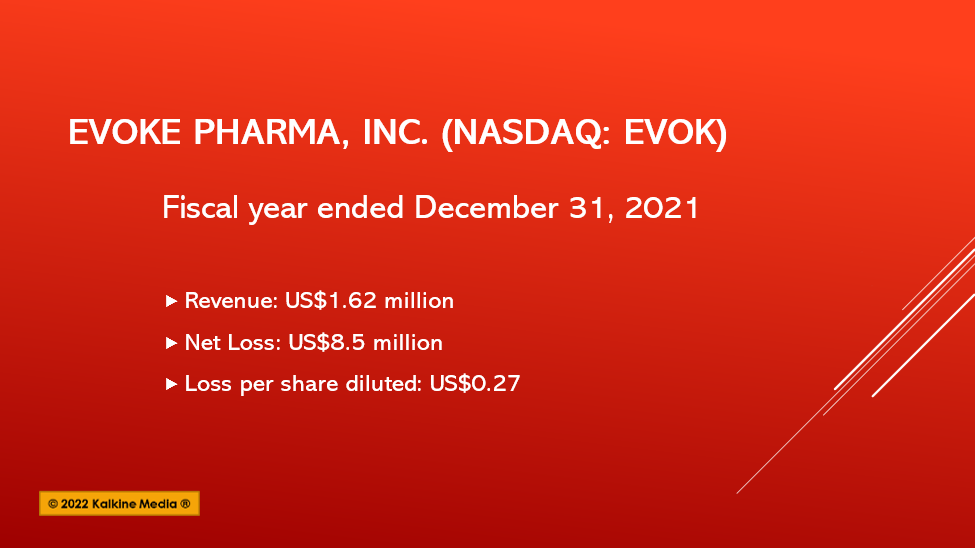

Financials:

The company’s net product sales were US$1.62 million for the fiscal year ended December 31, 2021, compared to US$0.023 million in the previous fiscal year 2020.

Its net loss was US$8.5 million or US$0.27 per share diluted in FY 2021 compared to US$13.15 million or US$0.52 per share diluted in FY 2020.

Also Read: SYY to KO: 5 inflation-beating consumer staple stocks to watch in Q2

As of December 31, 2021, its cash and cash equivalents were US$9.14 million compared to US$8.07 million as of December 31, 2020.

It has a market capitalization of US$32.18 million. The stock price touched the highest of US$1.81 and the lowest of US$0.36 in the last 52 weeks.

Bottom line:

The EVOK stock fell 33.56% YTD and declined 78.01% in one year. The stock market is volatile and fraught with various risks; investors should exercise due diligence before investing in stocks.

.jpg)