Highlights

- Aridis Pharmaceuticals Inc. (NASDAQ:ARDS) announced on Tuesday that its monoclonal antibody cocktail retained effectiveness against various covid strains, including Omicron.

- The company had cash and cash equivalents of about US$18,000 as of Sept 30, 2021.

- The stock fell 58.17% YTD but grew 12.38% month-to-date.

Shares of Aridis Pharmaceuticals Inc. (NASDAQ:ARDS) jumped more than 77% in pre-market on Tuesday after it announced that its monoclonal antibody cocktail was effective against different coronavirus strains, including Omicron.

The Los Gatos, California-based company said its antibody dubbed AR-701 was also useful against the middle east respiratory syndrome, acute respiratory syndrome, etc.

The stock jumped 77.17% to US$4.50 on Tuesday morning after the news.

Also Read: These 5 US stocks returned between 500% and 5,000% in 2021

What is the new product?

Aridis’ product candidate, AR-701, is a cocktail of human monoclonal antibodies found in Covid-19 patients. It is intended to be used through injections or inhalations. The drug remains active in the blood for six to 12 months, according to the company.

The company developed the drug in collaboration with researchers at the University of Alabama, Birmingham, and Texas Biomedical Research Institute in San Antonio.

Also Read: Yearender: Top 5 shipping and logistics stocks of 2021

Also Read: 5 best US oil & gas stocks that returned over 100% in 2021

What does Aridis do?

The California-based company develops novel therapies for treating life-threatening infections. For instance, it develops immunotherapy from "fully human monoclonal antibodies" (mAbs) against life-threatening diseases such as nosocomial pneumonia and Covid-19.

The company went public in 2018.

Also Read: 2 US energy stocks with over 7% dividend yield

Financials

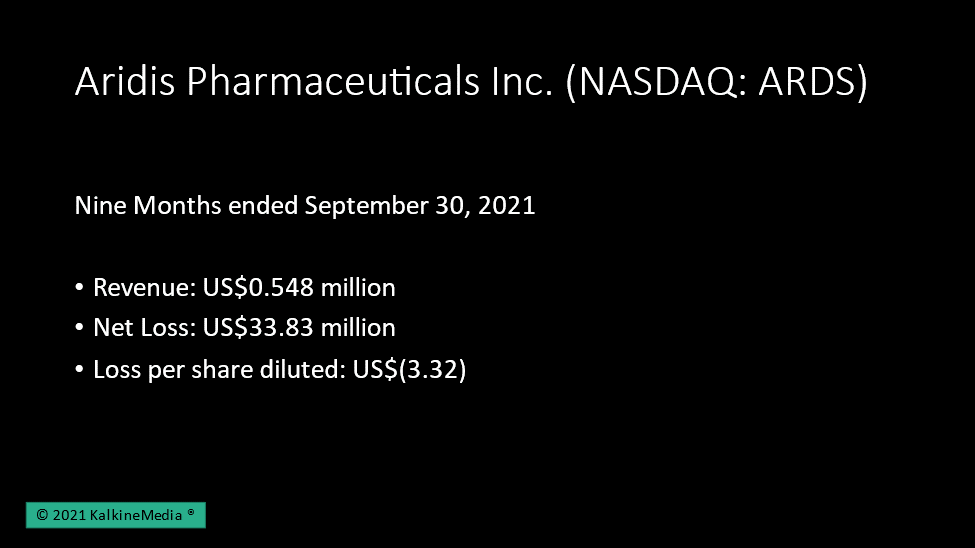

For the nine months ended Sept 30, 2021, the company earned revenue of US$0.548 million against US$1.0 million in the same period a year ago. The net loss was US$33.38 million compared to US$16.51 million in the first nine months of 2020.

Its loss per share was US$(3.32) versus US$(1.85) in the same period of 2020. Its cash and cash equivalents were US$18.22 million as of Sept 30, 2021, against US$8.23 million as of Dec 31, 2020. The company has a market capitalization of US$35.7 million. Its stock traded in the range of US$8.47 to US$1.89 in the last 52 weeks.

Also Read: Top 3 US 5G stocks to watch in 2022

Bottomline

The ARDS stock fell 58.17% YTD but grew 12.38% month-to-date. In contrast, the Dow Jones US Pharmaceuticals Index generated a 20.53% return YTD and about 4.70% in a month.