Highlights:

- Schlumberger NVV (NYSE:SLB) renamed itself as SLB on October 24.

- Chesapeake Energy would pay about US$ 1.2 billion in total dividends in 2022.

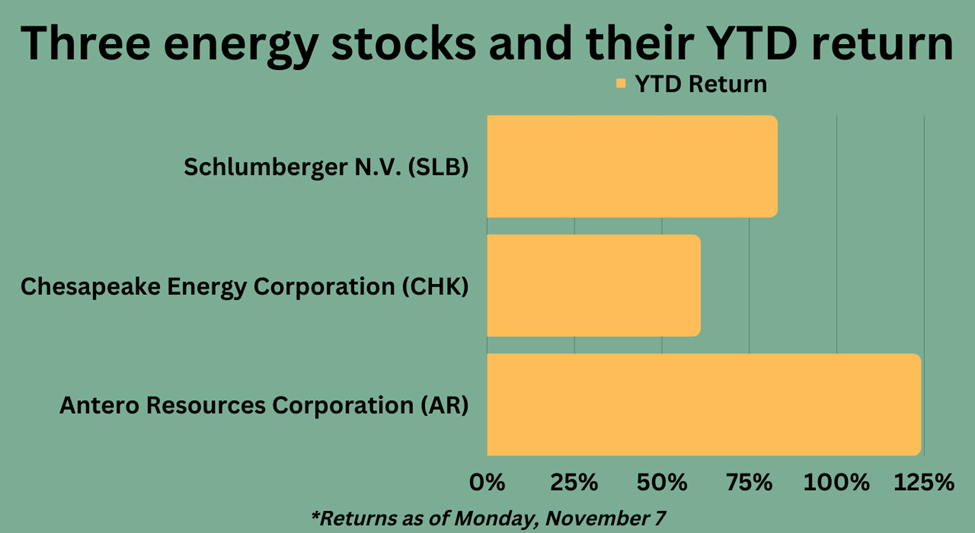

- The AR stock rose over 124 per cent YTD.

All eyes are on the US midterm elections, which could prove to be a defining moment for Wall Street investors. There could be several developments or changes in several sectors witnessed depending on the results of which party would be in control of the Congress.

While some sectors are expected to be neutral, regardless of the results of the elections, it might spur moves in others like energy, cannabis, etc. The analysts anticipate a split government, with the Republicans picking their momentum in polls.

Some analysts expect that the Republicans could take control of the House of Representatives and maybe the Senate. The expected results might impede several agendas of the Democrats.

So which sectors might gain attention of the stock market enthusiasts if Republicans gain control of the Congress? Although the answer is not limited to any particular sector or a set of stocks, some investors might keep a close watch on the energy sector.

Energy stocks have had a flourishing journey in 2022, mainly due to the soaring commodity prices. The Russia-Ukraine war, which bumped energy prices, ended up benefiting the energy companies in recent months.

Some analysts are hoping that if the Republicans gain control of both the House of Representatives and Senate, it could encourage several policies to boost US energy production.

If the GOP wins both the Senate and House, they are likely to oppose proposals like the windfall tax on oil producers. The recent threat by President Joe Biden's administration to impose a windfall tax on energy firms has dragged down several companies in recent days.

Several Republican Lawmakers have reportedly made it clear that they would block any measures for imposing a windfall tax on US oil producers. Earlier, several House Republicans had pointed out multiple concerns to Treasury Secretary Janet Yellen about a windfall tax that targets the excess profits of energy firms.

The GOP lawmakers had suggested that the US has had a negative experience with a windfall tax around four decades ago. Such a proposal is likely to harm the domestic energy production of the nation while making them more reliable on the foreign energy sources and bumping up costs for the consumers, they added.

So, let's explore some energy stocks, which include Schlumberger (NYSE: SLB), Chesapeake Energy (NASDAQ:CHK), and Antero Resources Corporation (NYSE:AR), and see how they have performed in recent quarters.

Schlumberger N.V. (NYSE:SLB)

The stock of the leading oilfield services firm, Schlumberger was at its 52-week high of US$ 55.11 on Monday, November 7. However, its closing price on the November 7 was US$ 54.81, up 3.22 per cent from its previous close.

The company, doing business as SLB, is a leading offshore drilling and contractor firm. At its closing price of November, the SLB stock was up over 83 per cent through the continuing year and about 63 per cent YoY.

On October 31, the company entered into a strategic collaboration with a leading chemical company, Linde plc (NYSE:LIN). Under the strategic partnership, the companies would focus on carbon capture, utilization, and sequestration projects to enhance the decarbonization services across the industrial and energy sectors.

Schlumberger announced its new name, SLB, on October 24, which reflects the company's vision for a decarbonized energy future and its transformation from an oilfield services firm to a technology-driven energy firm.

Chesapeake Energy Corporation (NASDAQ:CHK)

Shares of Chesapeake Energy Corporation closed at 3.33 per cent higher to US$ 104.23 on November 7. The stocks of CHK were at its 52-week high of US$ 107.31 last Wednesday, November 2, and it returned gains of about 61 per cent YTD and 58 per cent YoY.

It is an oil and natural gas exploration and production firm with a robust portfolio of unconventional, onshore oil and natural gas assets in the US.

Chesapeake Energy Corporation's net cash provided by operating activities was US$ 1.31 billion in Q3 FY22, and its net income totaled US$ 883 million.

The Oklahoma City-based energy company declared a total quarterly dividend of US$ 3.16 apiece, which would be paid to investors in December 2022. It said that around US$ 1.2 billion in total dividends would be paid in the ongoing year.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Antero Resources Corporation (NYSE:AR)

Antero Resources is an independent natural gas and oil company. The energy company’s shares closed at US$ 39.33 on Monday, November 7, up over five per cent from its prior session's close.

At its closing price of November 7, the AR stock rose over 124 per cent YTD and 87 per cent YoY. The hydrocarbon exploration firm focuses on exploring and producing natural gas liquids or NGLs, natural gas, and oil properties.

The energy company's net cash from operating activities was US$ 1.08 billion in Q3 FY22, against US$ 312.68 million in Q3 FY21. Antero Resources Corporation's net income was US$ 1.72 per diluted share in the quarter versus a loss of US$ 1.75 per share in the preceding year's same period.

Bottom line:

The anticipation over a split government, which might spur a political gridlock in the US, has raised the investors' sentiment, as it is often seen as favorable for the equity market. Whatever the results of midterm polls are, historically an upward trend is seen in the market after a midterm poll.

The split government is generally seen as a positive catalyst for the market, paving the way for partisan standoffs while reducing several uncertainties. Assuming that the GOP gains full control of Congress through a victory in both the House and Senate, which could help them easily push their priority policies, President Joe Biden would still use his veto power.

This could end Mr. Biden's ability to use lawmakers to execute his agendas, which might also cause him to depend more on executive action to advance his preferences.

Meanwhile, the S&P 500 energy sector soared over 61 per cent YoY and nearly 69 per cent YTD, while the broader index slumped nearly 19 per cent YoY and about 20 per cent YTD.

.jpg)