Summary

- Livent Corporation (NYSE:LTHM) reported revenue of US$91.7 million in Q1, 2021, up by 12% YoY.

- EnerSys (NYSE:ENS) reported net sales of US$348.8 million in Q4, 2021, up by 10.7% YoY.

- Plug Power, Inc. (Nasdaq:PLUG) reported revenue of US$72 million in Q1, 2021, up by 76% YoY.

Demand for mobiles, laptops, electric cars, tablets, smartwatches is going up. Hence, batteries, mainly lithium-ion batteries used in these gadgets, are also in high demand. More and more battery companies also have popped up in the past few years as the focus changes to renewable energy.

Some battery companies have tied up with electric vehicle makers for battery supplies. Hence, the push for green energy by the government is also helping the ancillary industries to grow.

Here we explore seven battery stocks amid the push for green energy in the US.

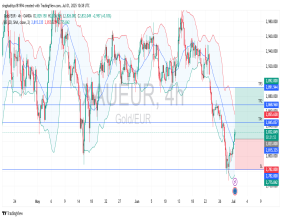

Livent Corporation (NYSE:LTHM)

Livent Corporation produces lithium compounds like lithium hydroxide for battery, lithium metal, and butyllithium. These lithium products are used in batteries for electric vehicles, aerospace applications, and so on.

Source: Pixabay.

Its stock traded at US$18.81 at 7.47 am ET on July 8, down by 0.53 percent over the previous closing price. Its stock prices increased by 0.15 percent YTD and 201 percent YoY. Its market capitalization is US$3 billion. Forward P/E 1 Year is 157.58. Earnings per share are US$-0.12. Beta is 2.15. The 52 weeks highest stock price is US$23.99, and the lowest is US$5.89. Share volume is 1,412,196.

It reported total revenue of US$91.7 million in Q1, 2021, up by 12% YoY. It reported a net loss of US$0.8 million or one percent per diluted share. Adjusted EBITDA was US$11.1 million, up by 98 percent over the previous quarter.

Also read: Is Rimac publicly traded? How to buy the EV makers' stock?

EnerSys (NYSE:ENS)

EnerSys manufactures power batteries, battery chargers, and battery accessories for the electric vehicle industry.

Its stock traded at US$95.86 at pre-market ET on July 8, down by 0.3 percent over the previous closing price. Its stock prices increased by 18.17 percent YTD and 52.78 percent YoY. Its market capitalization is US$4 billion.

Its P/E ratio is 28.87, and the forward P/E 1 Year is 17.62. Earnings per share are US$3.32. Beta is 1.45. Annualized dividend is US$0.70. And the current yield is o.73%. The 52 weeks highest stock price is US$104.47, and the lowest is US$60.16. The share volume is 117,593.

It reported net sales of US$348.8 million in Q4, 2021, which ended on March 31. 10.7 percent up YoY.

Source: Pixabay.

Plug Power, Inc. (Nasdaq:PLUG)

Plug Power, Inc. manufactures hydrogen fuel cells for the transportation, telecommunication, and utility sector.

Its stock traded at US$28.47 at 8.47 am ET on July 8, down by 5.63 percent over the previous closing price. Its stock prices decreased by 11.40 percent YTD and increased by 200 percent YoY. Its market capitalization is US$17 billion.

The forward P/E 1 Year is -111.74. Earnings per share are US$-1.38. Beta is 1.41. The 52 weeks highest stock price is US$75.49, and the lowest is US$7.07. Share volume is 24,069,904.

It reported US$72 million in Q1, 2021, up by 76 percent YoY. Gross billings were US$73.7 million, as compared to US$43 million YOY.

Also read: ELMS stock: EV maker Electric Last Mile pops on NASDAQ after SPAC merger

QuantumScape Corporation (NYSE:QS)

QuantumScape Corporation develops technology for the solid-state battery for electric cars. Its stock traded at US$24.30 at 9.06 am ET on July 8, down by 2.96 percent over the previous closing price. Its stock prices decreased by 51.36 percent YTD. Its market capitalization is US$10.1 billion.

Beta is 15.38. The 52 weeks highest stock price is US$132.73, and the lowest is US$9.74. Share volume is 14,787,315. The company reported a net loss of US$75,089.

Sociedad Quimica y Minera S.A. (NYSE:SQM)

Sociedad Quimica y Minera S.A. is a chemical company that supplies lithium, iodine, and industrial chemicals. Lithium is used for battery production.

Its stock traded at US$44.19 at 10.10 am ET on July 8, down by 2.65 percent over the previous closing price. Its stock prices decreased by 13.52 percent YTD and increased by 56.70 percent YoY. Its market capitalization is US$11.5 billion.

Also read: Top small-cap tech stocks to explore in July

Its P/E ratio is 61.89, and the forward P/E 1 Year is 37.55. Earnings per share are US$0.71. Beta is 0.86. Annualized dividend is US$0.625. And the current yield is 1.36%. The 52 weeks highest stock price is US$60.74, and the lowest is US$27.02. The share volume is 75,230.

It reported a net income of US$68 million in Q1, 2021, which ended on March 31, up from US$45 million YoY. It reported revenue of US$528.5 million. Earnings per share were US$0.26.

Piedmont Lithium Inc. (Nasdaq:PLL)

Piedmont Lithium Inc. manufacturers battery-grade lithium, battery storage required for electric vehicles.

Its stock traded at US$67.745 at 10.29 am ET on July 8, down by 0.25 percent over the previous closing price. Its stock prices increased by 136.45 percent YTD and increased by 987 percent YoY. Its market capitalization is US$1 billion.

The forward P/E 1 Year is -109.95. Beta is 0.31. The 52 weeks highest stock price is US$88.97, and the lowest is US$5.80. The share volume is 85,325.

Also read: 8 healthcare stocks to explore in July

Johnson Controls International (NYSE:JCI)

Johnson Controls International develops battery technologies for electric cars and electronic systems.

Its stock traded at US$68.85 at 11.20 am ET on July 8, down by 0.02 percent over the previous closing price. Its stock prices increased by 49 percent YTD and 101.61 percent YoY. Its market capitalization is US$49 billion.

Its P/E ratio is 46.91. Forward P/E 1 Year is 26.44. Earnings per share are US$1.46. Beta is 1.12. The current yield is 1.58%. Annualized dividend is US$1.08. The 52 weeks highest stock price is US$69.70, and the lowest is US$33.31. Share volume is 1,332,779.

It reported earnings per share US$0.48 in Q2, 2021. Operating activities provided cash of US$0.6 billion and a free cash flow of US$0.5 billion.

Please note: The above constitutes a preliminary view, and any interest in stocks/cryptocurrencies should be evaluated further from an investment point of view.