Highlights

- Lucid Group, Inc. (NASDAQ:LCID) delivered the first lot of vehicles in October and has over 17,000 reservations across all models as of date.

- Rivian Automotive, Inc. (NASDAQ:RIVN) has designated Amazon Web Services (AWS) as its preferred cloud partner.

- Electrameccanica Vehicles Corp. Ltd. (NASDAQ:SOLO) has delivered 42 Solos, the EV makers flagship vehicle, to clients in November.

The electric vehicle industry is getting a big push because of the fight against climate change. The industry makes electric cars, SUVs, and commercial vehicles like vans and trucks.

It also manufactures EV parts, provides services, and upkeeps the charging networks. President Biden has set a national target for EVs to make up at least half of all new vehicles sold in the US by 2030. Here, we discuss five EV companies catching investors’ attention.

Also Read: Five hot healthcare stocks to watch as Omicron threat looms

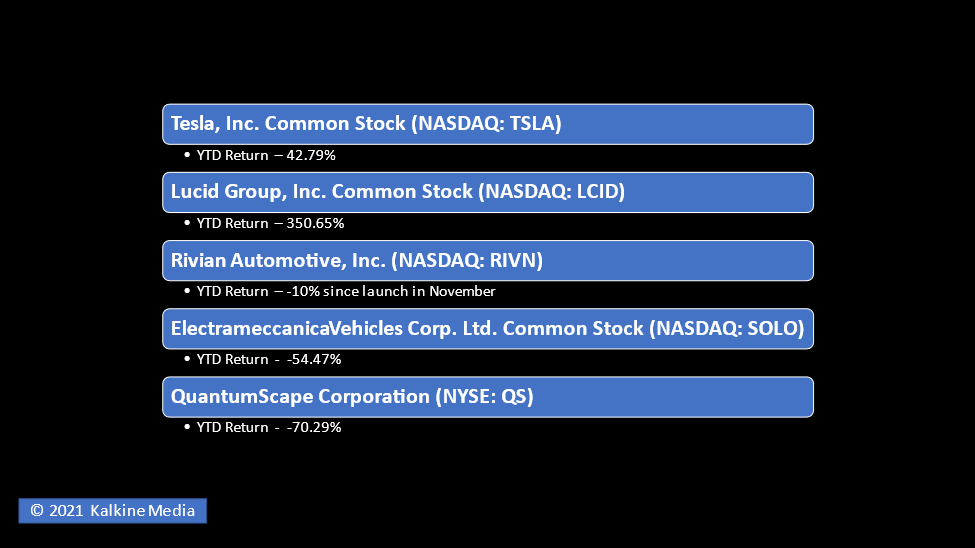

Tesla, Inc. (NASDAQ:TSLA)

The Palo Alto, California-based Tesla has been in the news lately after the SEC started a probe over whistleblower claim that its solar panels have fire risk not notified to shareholders.

Founded in 2003, the company sells luxury electric sedans, SUVs, solar panels, solar roofs, batteries, etc. It delivered roughly 500,000 units in 2020. In 2021, it has produced 624,582 cars and delivered 627,572 vehicles through Q3, 2021.

The company had recently crossed the market cap of US$1 trillion. It is currently valued at US$984 billion. Its P/E ratio is 317.01, and beta is 2.04.

Tesla earned revenue of US$13.76 billion in the September quarter of 2021 compared to US$8.77 billion in the same quarter of 2020. The net income per share diluted for the September quarter of 2021 was US$1.44. It was US$0.27 in the same period of 2020.

The stock closed at US$1014.97 on December 3, 2021.

Also Read: Five metaverse cryptos that are making news

Also Read: Seven hot dividend stocks to watch in 2022

Lucid Group, Inc. (NASDAQ:LCID)

Lucid announced on Monday that Bank of America would be its new lending partner. Lucid customers can now apply to Bank of America for online financing needs.

Lucid started commercial production of Lucid Air, its first vehicle, in September 2021.

It delivered the first lot of vehicles in October and has over 17,000 reservations across all models to date. It plans to continue developing new vehicle models for future releases.

The Newark, California-headquartered Lucid develops next-generation EV technologies and vehicles. The vertically integrated company designs, engineers, and builds EVs, EV powertrains, and battery systems. Its current market capitalization is US$71.77 billion.

The automaker posted revenue of US$232,000 for the quarter ended September 30, 2021, compared to US$334,000 in the corresponding period of 2020. The net loss was US$524 million in the September quarter of 2021 against US$161 million in the same quarter of 2020.

The stock closed at US$47.27 on December 3, 2021.

Also Read: Top metal and mining stocks to explore in 2022

Rivian Automotive, Inc. (NASDAQ:RIVN)

The Irvine, California-based Rivian manufactures electric vehicles and accessories.

The company delivered its first vehicle R1T, in September this year. It delivered 11 of the 12 R1T vehicles it produced in September. Its primary revenue source was R1Ts in November.

On December 2, Rivian announced Amazon Web Services, Inc. (AWS) as its preferred cloud partner. Rivian plans to apply AWS’s computing, analytics, containers, and machine learning to enhance the performance of its EVs. Its current market capitalization is US$97.59 billion.

The stock closed at US$104.67 on December 3, 2021.

Also Read: Five key US economic sectors to keep an eye on in 2022

Also Read: Seven hot penny stocks to watch in December

Electrameccanica Vehicles Corp. Ltd. (NASDAQ:SOLO)

On Monday, the company announced that it had delivered 42 SOLOs, the EV maker’s flagship brand, to clients in November.

The stock jumped on the news. It was trading at US$2.76, up 5.75%, at 12:59 pm ET. The company has produced 182 SOLOs since August 2020, and it delivered 21 EVs in October this year.

The British Columbia, Canada-based company manufactures EVs. Its flagship brand is the single-seat SOLO. This three-wheeled EV aims to make commuting easy.

The company’s operating loss was US$17.2 million in the September quarter of 2021 compared to an operating loss of US$6.5 million in the same period a year ago.

Its cash and equivalents were US$228.8 million as of September 30, 2021, while the same was US$129.5 million as of December 31, 2020. Its stock closed at US$2.61 on December 3, 2021.

Also Read: Fresh Grapes (VINE) IPO to open on Dec 14: How to buy the stock?

QuantumScape Corporation (NYSE:QS)

The San Jose, California-headquartered company develops solid-state, next-generation lithium-metal batteries used in electric vehicles (EVs).

For the September quarter of 2021, the company booked a net income of US$15.35 million compared to a net loss of US$376 million in the same quarter of 2020. The net income per share diluted was US$(0.13) compared to US$(1.57) in the September quarter of 2020.

Founded in 2010, the company has a current market capitalization of US$10.5 billion. Its stock closed at US$24.55 on December 3, 2021.

Also Read: Top artificial Intelligence (AI) stocks to watch in December

Why are these EV stocks worth watching in 2022 ?

Bottomline

The EV sector is expected to witness robust investment over the next few years, thanks to the government push for clean energy vehicles to fight climate change. Investors, however, should evaluate the companies carefully before investing in stocks.

_06_30_2023_10_37_44_979056.jpg)