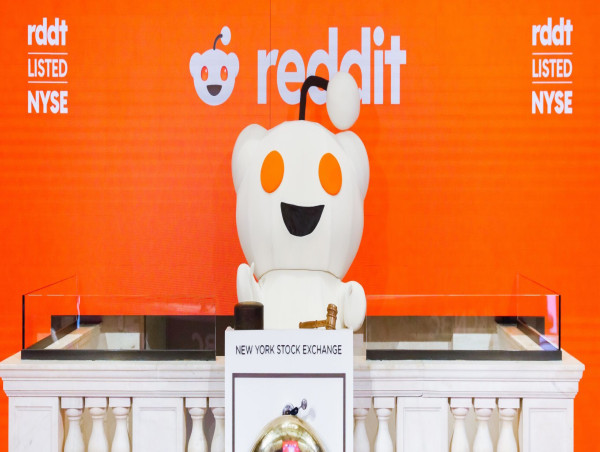

Reddit (RDDT) had a stellar year in 2024, with s staggering 250% surge in its stock price from its first-day close following its debut listing in March.

The trajectory of the stock has caused the 19-year old social media giant to become a darling of Wall Street.

Reddit has 13 buy ratings from analysts as against seven neutral calls and one sell recommendation.

Analysts’ views on RDDT stock and 2025 forecast

Earlier this month, Morgan Stanley upgraded the stock and raised the company’s rating to “overweight” with a price target of $200.

The analysts at the brokerage attributed the move to Reddit’s strong engagement and advertising pipeline being key drivers of its future growth, and said the platform had the potential to outpace its peers in user engagement, time spent, and advertising revenue growth.

With user growth accelerating this year, Reddit has been encouraged to monetised its platform through advertising.

Reddit’s sales are projected to hit $1.28 billion in 2024, a sharp increase from $804 million in 2023 and $668 million in 2022.

Needham analyst Laura Martin recently raised her price target to $190, up from $120, while maintaining Reddit as a “conviction list” stock. In a December 11 client note, Martin wrote:

From our point of view, key areas driving Reddit’s growth in 2025 include higher Reddit search and shopping revenues, and higher international revenues from closing the (average revenue per user) gap vs. US users.

“From a macro perspective, we expect markets and ad demand to be stronger in 2025 vs. 2024, driven by more positive business sentiment,” she added.

While Baird analyst Colin Sebastian is more cautious with a neutral rating, he acknowledges “near-term upside” driven by advertiser interest and platform enhancements.

Sebastian noted that improvements like automation, targeting, and AI-powered tools could unlock greater ad revenue potential.

Challenges and opportunities in search and AI

Reddit’s heavy reliance on Google search traffic has emerged to be a strength.

Reddit Chief Executive Steve Huffman said on a late October analyst call that “Reddit” was the sixth most Googled term of 2024.

However, it is also a vulnerability with Huffman acknowledging that Google and its algorithms can “giveth and taketh away”, implying that the algorithms could impact user traffic unpredictably.

To mitigate this risk, Reddit has announced an AI-powered feature called Reddit Answers aimed at taking people’s search queries directly to Reddit.

Still, Bernstein analyst Mark Shmulik has expressed skepticism, suggesting these investments may not significantly boost margins in the near term.

Rating Reddit underperform, Shmulik said in a note earlier this month, “The (second half 2024) test has been passed, but an expensive stock has investors skipping a grade ahead of us.”

December quarter earnings to test the rally

Investors will closely watch Reddit’s December quarter earnings, expected in February, to gauge the sustainability of its rally.

The company’s October third-quarter results delivered a surprise profit and 68% sales growth, propelling shares up 42% in one day.

Despite its recent pullback, Reddit stock shows resilience.

It closed Friday at $173.52, down 1.8% but still above its 21-day moving average.

According to Investor’s Business Daily’s IBD Stock Checkup, Reddit’s IBD Composite Rating is 96 out of a best-possible 99.

The score combines five separate proprietary ratings into one rating. The best growth stocks have a Composite Rating of 90 or better, and thus Reddit stands out as a growth stock leader.

As Reddit prepares for 2025, investors will look for sustained growth and innovation to justify its premium stock price.

The post RDDT stock 2025 forecast: will the company sustain its IPO momentum? appeared first on Invezz