Highlights:

- Definition and Execution: A held order is a type of stock market order that must be executed immediately at the best available price, without delay or discretion from the broker.

- Types of Held Orders: It includes market orders that execute at the current price and held limit orders, which execute only if a stock is available at a specific price in sufficient quantity.

- Importance in Trading: Held orders are crucial for ensuring quick execution, reducing slippage, and maintaining market liquidity, especially for traders who prioritize speed over price flexibility.

Introduction to Held Orders

In the fast-paced world of stock trading, timing is often as critical as price. A held order is a specific type of instruction given to a broker or electronic trading platform that must be executed immediately and without hesitation. Unlike discretionary orders, where the broker has some flexibility in execution, a held order requires prompt action, ensuring that the investor's trade is completed as soon as possible.

Held orders are commonly used in high-frequency trading, institutional investing, and day trading, where even the slightest delay can impact profitability. These orders play a key role in maintaining market efficiency, price stability, and liquidity.

How Held Orders Work

A held order can take two main forms:

- Market Held Order

A market held order requires execution at the best available price at the moment it reaches the market. This means:

- If an investor places a buy order, it will execute at the lowest available ask price.

- If an investor places a sell order, it will execute at the highest available bid price.

The goal is to prioritize speed over price control, making it ideal for traders who need immediate execution.

- Held Limit Order

A held limit order is executed only if the stock can be bought or sold at a specific price and in a sufficient quantity. Unlike a traditional limit order that allows some discretion in execution timing, a held limit order requires immediate action if the conditions are met.

For example:

- An investor places a held limit buy order at $50 for 1,000 shares of a stock.

- If 1,000 shares are available at $50, the order must be executed immediately.

- If only 500 shares are available, the order may be partially filled or rejected based on the brokerage's execution rules.

Why Traders Use Held Orders

Held orders serve several key functions in the financial markets, making them attractive to certain types of investors and traders:

Speed and Certainty of Execution

- Held orders ensure immediate trade execution, which is crucial in volatile markets where prices can change rapidly.

- Reduced Slippage

- Since the order executes instantly, there is less risk of price fluctuations affecting the trade.

- Liquidity Enhancement

- Held orders help maintain continuous buying and selling activity, improving market efficiency.

- Better Execution in High-Frequency Trading (HFT)

- Algorithmic traders and institutions often use held orders to quickly capitalize on short-term price discrepancies.

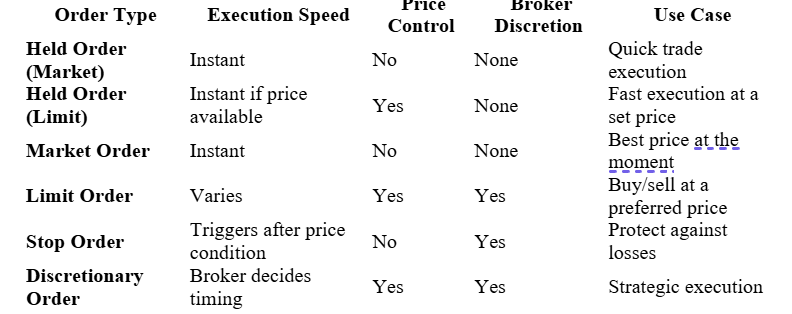

Held Orders vs. Other Order Types

To better understand the role of held orders, it is useful to compare them with other commonly used trading orders:

Risks and Limitations of Held Orders

While held orders provide immediate execution, they also come with potential downsides:

No Price Guarantee (Market Held Orders)

- Since execution happens instantly, investors may not get their preferred price—especially in fast-moving markets.

- Partial Fills (Held Limit Orders)

- If a held limit order does not have enough shares available at the designated price, the order may only be partially filled or not executed at all.

- Not Suitable for Large Orders

- Large-volume traders may prefer iceberg orders or algorithms to break trades into smaller portions, rather than executing everything at once.

Real-World Applications of Held Orders

- High-Frequency Trading (HFT)

In algorithmic trading, speed is everything. Many HFT firms use held orders to execute trades in fractions of a second, ensuring they capture price movements before competitors.

- Institutional Trading

Investment banks, hedge funds, and pension funds may use held orders to quickly adjust their portfolios in response to market events.

- Day Trading

Retail traders who focus on short-term price movements often use held orders to get in and out of positions rapidly.

- Market Making

Market makers—firms that provide continuous buy and sell quotes—rely on held orders to maintain liquidity in stocks, ETFs, and other securities.

How Market Conditions Affect Held Orders

Held orders behave differently depending on market conditions:

During High Volatility

- Prices may change dramatically between placing and executing an order, increasing the risk of poor fills.

- During Low Liquidity Periods

- Some held orders may not get fully executed if there aren’t enough buyers or sellers at the required price.

- After Major News Announcements

- Markets react quickly to economic reports, earnings releases, and geopolitical events, making held orders useful for immediate reaction trading.

Regulatory Aspects of Held Orders

Financial regulators, such as the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), have established rules to ensure fair execution practices for held orders. These include:

- Best Execution Rule – Brokers must execute trades at the best possible price.

- Order Protection Rule (Reg NMS) – Ensures that orders are routed to markets offering the best prices.

Conclusion

Held orders are essential tools for traders and institutions needing fast, reliable trade execution. Whether used in high-frequency trading, day trading, or institutional investing, these orders help maintain market liquidity, efficiency, and price stability.

While they offer advantages such as immediate execution and reduced slippage, they also come with risks like price uncertainty and potential partial fills. Understanding how and when to use held orders can help traders optimize their strategies and navigate market fluctuations effectively.

_02_27_2025_05_37_37_023706.jpg)