The Schwab US Dividend Equity ETF (SCHD) is one of Wall Street’s most popular dividend funds, thanks to its high dividend yield, payout growth, and strong performance since its inception.

SCHD is a popular dividend fund

This year alone, the fund has attracted over $4.7 billion in inflows, bringing its total assets to over $64 billion.

SCHD has jumped by over 16% this year and is hovering near its all-time high, a notable thing since it does not have many popular technology names. Instead, it is made up of some traditional tech names that are less popular than the likes of NVIDIA, Microsoft, and Alphabet.

Some of the top tech names in the fund are Texas Instrument and Insperity. Tech stocks account for just 8.79% of the fund.

Still, the fund’s total return in the past five years has been 88%, making it one of the best-performing dividend players in the industry. Still, some investors question whether it is a real dividend fund since it yields just 3.39%.

If you are concerned about its low yield, this article looks at two high-yielding funds that have a long track record of beating the SCHD ETF and even the popular Vanguard S&P 500 (VOO) and the SPDR S&P 500 ETF (SPY).

Read more: Love the SCHD ETF? USA is a great 10% yielding alternative

Cornerstone Strategic Value Fund | CLM

First, we need to note that SCHD and CLM are different types of funds. SCHD is an ETF that invests in companies that track the Dow Jones US Dividend 100 Index. It has 103 companies, most of which are in the financials, healthcare, consumer staples, and industrials.

The CLM fund, however, is a closed-end fund that invests in 278 companies across multiple sectors. CEF and ETFs are different types of assets in that the former allows the use of leverage to maximize returns. Also, CEFs are more expensive than ETFs. In this case, the CLM fund has an expense ratio of 2.01%, while the SCHD charges 0.060%.

The CLM is a classic dividend fund, thanks to its forward dividend yield of 16.1%. This means that a $10,000 investment will generate a gross return of $1,600. With the stock return included, the fund will have higher returns.

The CLM has invested in companies across most sectors in the US economy. Most of its investments are in the technology sector, and include names like Apple, Microsoft, NVIDIA, and Alphabet.

The other second biggest constituent are closed-end funds, which account for 15.6% of the fund. In this, the biggest constituent is the Gabelli Dividend & Income Trust.

CLM has also invested in financials, healthcare, communication services, and consumer discretionary.

At a quick glance, the fund has had a horrible return in the past five years as it has dropped by 27%, while the SCHD has risen by 58%. The same trend has happened this year as it has risen by 11.2%, while the SCHD has risen by 13.5%.

However, with dividends included, the CLM fund’s performance in the last five years was 84% compared to SCHD’s 88%.

Read more: SCHD: Blue chip SWAN ETF braces for 2 key crucial events

Cornerstone Total Return Fund | CRF

The Cornerstone Total Return Fund is another high-yielding closed-end fund that has done well over time.

Established in 1973, the fund has had strong performance over time. At press time, the fund was trading at a 22.6% premium to its net asset value (NAV).

The biggest part of the fund is the technology sector, which accounts for 24.3% of its holdings. This includes companies like Apple, Microsoft, NVIDIA, Alphabet, and Amazon.

The other big constituent is closed-end funds like the Gabelli Dividend & Income Trust, Eaton Vance Tax-Advantaged Dividend Income Fund, and Nuveen Nasdaq 100 Dynamic Overwrite Fund.

By investing in the CRF fund, you also indirectly invest in many other companies. For example, the Gabelli Dividend & Income fund has invested in companies like American Express, Mastercard, JPMorgan, and Microsoft. This makes it a more diversified fund than the SCHD.

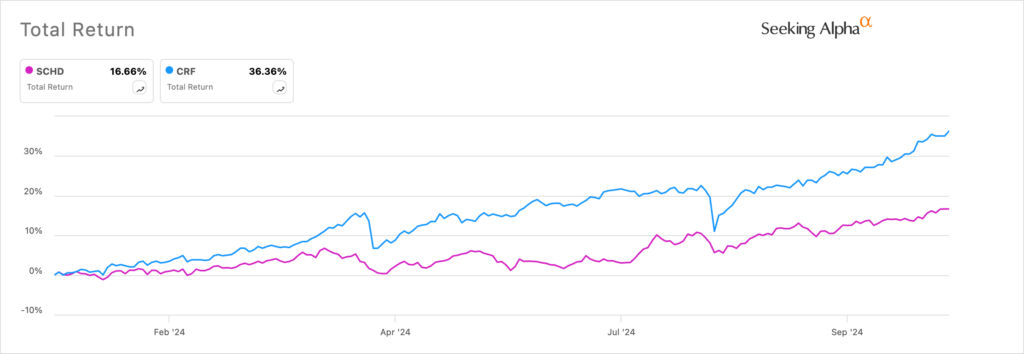

The CRF Fund has done better than the SCHD and the CLM over time. Its total return in the past five years stood at 97.84% compared to SCHD’s 88%. It has risen by over 36% this year compared to SCHD’s 16.6%.

The post Love the SCHD ETF? CLM and CRF are better yielding alternatives appeared first on Invezz