The iShares Russell 2000 ETF (IWM) has done well recently as demand for American shares jumps. The fund, which tracks the top small-cap stocks in the US, has risen to a high of $193, the highest level since February 10th of this year. It has rise by 11.5% this year, underperforming other mainstream funds like Invesco QQQ and SPDR S&P 500 Fund.

Bitcoin miners lead the rally

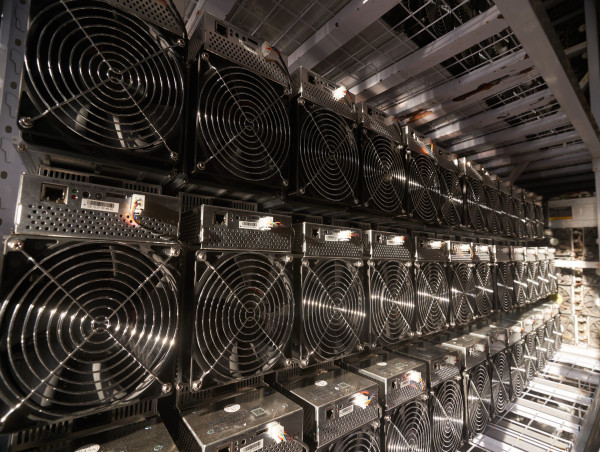

The iShares Russell 2000 ETF has done well, helped by some of the most unwanted companies of 2022. Bitcoin mining companies are some of the top performers, helped by the strong performance of Bitcoin and other cryptocurrencies.

Cipher Mining is the best-performing stock in the Russell 2000 index after it jumped by over 830% this year. Riot Platforms, Bit Digital, and Marathon Digital stocks have also done well after rising by more than 300% this year.

Another top-performing stock in the Russell 2000 index is Carvana, a company that nearly collapsed in 2022. Its stock has surged by 694%, outshining many companies listed in the US.

Other top companies in the index are IonQ, Opendoor Technologies, Redfin, and Upstart among others. On the other hand, the worst performers in the index are Babylon Holdings, Viewray, Dragonfly Energy, and F45 Training among others.

I believe that the iShares Russell 2000 ETF has some more upside in the coming months for two main reasons. First, there is a likelihood that the Fed will pause its interest rate hikes after its July meeting. That’s because, as we wrote here US inflation dropped to 3.0% in June and there is a likelihood that the trend will continue.

Second, technically speaking, I think that stocks have the momentum to keep going upward in the near term. The main risk for stocks is that the ongoing earnings recession could continue for a while.

IWM ETF stock analysis

The daily chart shows that the IWM ETF share price has been in a strong bullish trend in the past few weeks. This week, the fund moved above the important resistance level at $189.38, the highest level on June 14th.

The fund is being supported by the 200-day and 50-day moving averages. The two averages have made a bullish crossover, which is known as a golden cross pattern. Therefore, the fund will likely continue rising as buyers target the next key resistance point at $198.55, the highest level in February.

The post iShares Russell 2000 (IWM) ETF just formed a bullish golden cross appeared first on Invezz.