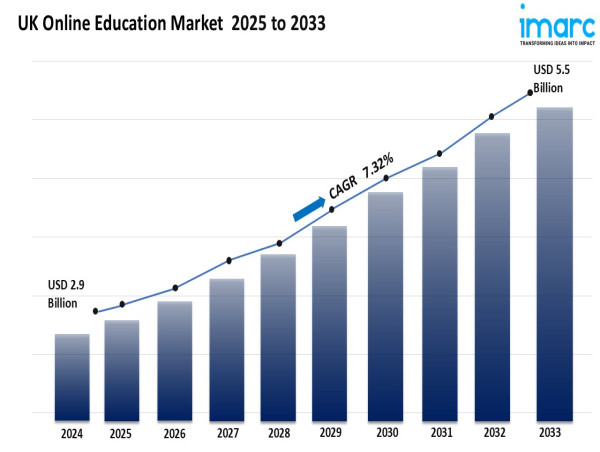

The UK online education market size reached USD 2.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.5 Billion by 2033.

UNITED KINGDOM, UNITED KINGDOM, UNITED KINGDOM, June 25, 2025 /EINPresswire.com/ -- UK Online Education Market Overview

Market Size in 2024: USD 2.9 Billion

Market Forecast in 2033: USD 5.5 Billion

Market Growth Rate (2025-2033): 7.32%

The UK online education market size reached USD 2.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.32% during 2025-2033.

UK Online Education Market Trends and Drivers:

The UK online education market is growing fast. Virtual transformation changes how new learners apply, engage, and absorb knowledge. A key driver of this momentum is the nation’s high net penetration. This makes it easy to access remote learning, whether in cities or rural areas. Students, teachers, and experts are embracing flexible learning solutions. More systems now provide live classes, recorded lectures, and interactive modules. This creates a dynamic online learning experience. More businesses want scalable solutions. So, cellular e-learning and quick content delivery are becoming popular. Smartphones, tablets, and fast networks are changing education. It’s no longer tied to a specific place. Now, you can learn anytime and anywhere.

Businesses are now focusing on school apps. These apps can be customized, tracked, and used remotely. Meanwhile, government agencies support virtual learning and inclusive education methods. This plan shows the UK’s commitment to virtual schooling as a key part of long-term economic growth. Providers are taking advantage of this trend. They offer services that mix content curation, analytics, and real-time support. Tech like cloud computing, AI, and digital classrooms makes learning fun and responsive. So, academic institutions in the United Kingdom are using these improvements. They want to enhance how they deliver the curriculum. They also seek to make education more accessible and draw in a diverse group of students.

The UK online schooling market thrives due to a few key factors. First, there is strong support from institutions. Second, creative EdTech startups are emerging. Finally, a culture of ongoing learning fuels growth. The education sector remains a top force, especially in higher education and K–12. Hybrid models are changing traditional teaching methods. At the same time, more personal gamers are joining in. This brings lower prices, tailored solutions, and better engagement for learners. The UK is becoming a center for modern academic shipping. Coverage frameworks enable virtual inclusion. Partnerships between public and private sectors boost infrastructure. The marketplace is expanding. This growth comes from changing user needs. It also stems from tech readiness and a focus on quality education for everyone

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/uk-online-education-market/requestsample

UK Online Education Market Industry Segmentation:

Type Insights:

• Academic

o Higher Education

o Vocational Training

o K-12 Education

• Corporate

o Large Enterprises

o SMBs

• Government

Provider Insights:

• Content

• Services

Technology Insights:

• Mobile E-learning

• Rapid E-learning

• Virtual classroom

• Others

End-User Insights:

• Higher Education Institutions

• K-12 Schools

Regional Insights:

• London

• South East

• North West

• East of England

• South West

• Scotland

• West Midlands

• Yorkshire and The Humber

• East Midlands

• Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=24934&flag=C

Key highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• COVID-19 Impact on the Market

• Porter’s Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Browse Other Report

UK higher education market size

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Elena Anderson

IMARC Services Private Limited

+1 631-791-1145

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()