200 Mn people in the world are living with coronary artery diseases (CAD) and this number is predicted to expand further with changing lifestyle patterns and increasing prevalence of obesity. In 2022, 4.9% of adults (20.1 Mn people) were diagnosed with CAD in US while Australia saw 11.8 Mn admissions. This increasing burden of the disease is fueling the market for stents and DEBs.

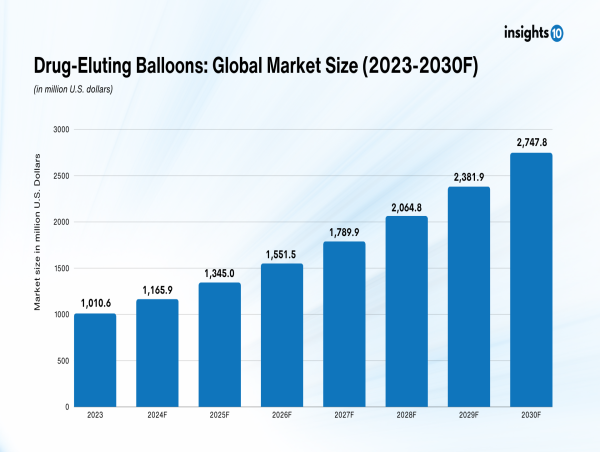

Insights10’s report & analysis on the ‘Global Drug-Eluting Balloons Market’ suggests that Drug-Eluting Balloons and stent markets are fiercely competitive, with companies striving to maintain existing connections while expanding into new markets. Players like Medtronic, Becton, Dickinson and Company (BD), Boston Scientific Corporation are dominating the market.

North America has the largest market share in the Drug-Eluting Balloons market, owing to its growing use to treat peripheral and coronary artery diseases. However, the Asia Pacific region is expected to experience rapid growth in the market as the demand for minimally invasive procedures in China is rising along with an increase in its patient population. Similarly, in India, the soaring demand for advanced treatments in cardiovascular disease and a high prevalence of peripheral artery disease among the elderly is projected to propel the market. US, China, Germany, UK, and India together account for 57.7% of the market share of DEBs.

Insights10's repository contains detailed reports and analysis for Drug-Eluting Balloons Market in many geographies such as North American region like US and Canada, APAC region including China, India, Japan, Australia, South Korea, Indonesia, Hong Kong, Vietnam, Philippines, Singapore, Malaysia, and Thailand, European countries such as Netherlands, Romania, Poland, and Belgium, African regions like Egypt, South Africa, Nigeria, and Kenya, Latin American countries like Brazil and Mexico, and Middle Eastern region including UAE, Saudi Arabia, and Turkey.

A significant share of the market's growth in each of the geographies is attributable to government subsidies. For instance, the Centre for Disease Control and Prevention (CDC) in the US supports heart disease and stroke prevention in all 50 states and the District of Columbia and provided $1.26 Bn as fund under the CDC’s Preventing the Leading Causes of Disease, Disability, and Death program. Similarly, Brazil’s government assists in the treatment of chronic illnesses, including coronary artery disease (CAD) through the Sistema Único de Saúde (SUS) – the public health system in Brazil. In 2021, the Brazilian government’s health expenditure stood at $27.4 Bn and in 2022, Brazilian Health Regulatory Agency approved 9,700 medical devices for marketing in the country.

Moreover, modern technology is revolutionizing the field of cardiovascular intervention, aiming to enhance the efficiency of previous designs of balloon catheters and stents through the improvement of the composition, structure, and design. Bare-metal stent (BMS), a metal scaffold, is placed in the artery to keep it open, while drug-eluting stent (DES) is coated with a drug that is gradually released over time to prevent the artery from re-closing. Compared to BMS, new-generation DES minimizes the incidence of target vessel revascularization and stent thrombosis, and is thus more in demand for the treatment of patients with acute myocardial infarction. These technological breakthroughs contribute to the market's rise.

With the increase in per capita expenditure of countries on health, increasing awareness of angioplasty, government support, and improved clinical efficiency of these medical products, the market for stents and DEBs is projected to expand in the coming years.

About Insights10

Insights10 is a healthcare-focused market research platform with an objective of supporting data-driven decisions and delivering actionable insights for healthcare and life science organizations. Insights10 platform provides syndicated and customized research reports in healthcare and allied industries such as pharmaceuticals, diseases/therapies, medical devices, digital health, healthcare services, OTC and nutraceuticals, etc. Insights10 currently provides 30,000+ different reports on different topics at a global as well as country specific level, making it one of the largest collections of syndicated research reports in the Life sciences and Healthcare sector available across the world.

Purav Gandhi

Healthark Wellness Solutions LLP

+91 91600 01292

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

![]()