Summary

- LoopUp Group generated revenue of £31.9 million, which grew by 43 percent year on year in H1 FY20.

- The growth in revenue was driven by work from home migration due to the covid-19.

- Trackwise Design's revenue grew from £1.54 million in H1 FY19 to £2.38 million in H1 FY20. The acquisition of Stevenage Circuits Ltd drove the performance.

- Stevenage Circuits Ltd added £1.22 million to the total revenue in H1 FY20.

LoopUp Group PLC (LON:LOOP) and Trackwise Designs PLC (LON:TWD) are FTSE listed technology stocks. It is noteworthy that LOOP has generated a return of nearly 301.07 percent in the last one year and its shares surged by around 8.18 percent on 23 September 2020 when the Company reported improved H1 FY20 earnings. Shares of LOOP were down by about 1.30 percent, whereas shares of TWD were up by close to 0.23 percent (as on 28 September 2020, before the market close at 12:55 PM GMT+1).

LoopUp Group PLC (LON:LOOP) - Clients switched to subscription-based contracts

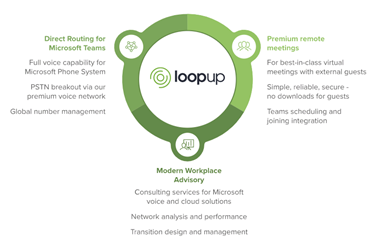

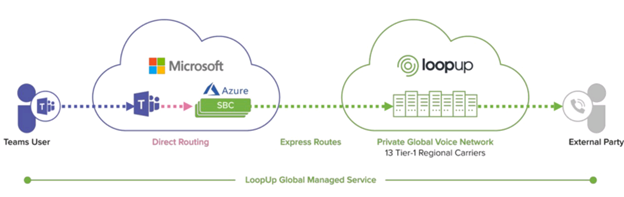

LoopUp Group PLC is a UK based cloud communication and remote meeting solution provider. The Company provides solutions that interconnect cloud with Microsoft Teams using direct routing and provides in-bound and out-bound calls.

Business Model of LoopUp Group

(Source: Company website)

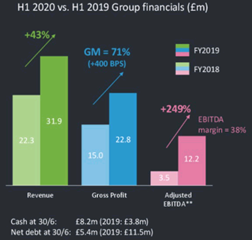

H1 FY2020 results (ended 30 June 2020) as reported on 23 September 2020

(Source: Company website)

The performance of the Company was positively impacted due to the work from home migration amid the health crisis. In H1 FY20, the revenue stood at £31.9 million, which increased by 43 percent year on year from £22.4 million in H1 FY19. The gross profit was £22.8 million that reflected a gross margin of 71.4 percent in H1 FY20. The adjusted EBITDA improved from £3.5 million in H1 FY19 to £12.2 million in H1 FY20. The operating profit was £7.8 million, and adjusted earnings per share were 13.9 pence in H1 FY20. As on 31 August 2020, LoopUp had cash of £10.6 million and net debt of £3.0 million.

Operational Highlights

The demand for the core Loop products increased in H1 FY20, the Professional Services (PS) increased by 90 percent to 335 minutes. The net revenue retention was up by 132 percent that includes churn, growth and shrinkage. The Company won new clients during the reported period, and it gained positive business momentum due to the covid-19. LoopUp has better revenue visibility as many clients have switched from pay-as-you-go to subscription-based contract, and the average committed term period is 24 months. The Company has a strong pipeline with 219 potential contracts with a value close to £50 million.

LoopUp cloud voice via Microsoft Teams direct routing

(Source: Company website)

Share Price Performance Analysis

1-Year Chart as on September-28-2020, before the market close (Source: Refinitiv, Thomson Reuters)

LoopUp Group PLC's shares were trading at GBX 224.60 and were down by close to 1.30 percent against the previous closing price (as on 28 September 2020, before the market close at 12:55 PM GMT+1). LOOP's 52-week High and Low were GBX 250.00 and GBX 39.00, respectively. LoopUp Group had a market capitalization of around £127.34 million.

Business Outlook

The Company highlighted the the outlook of the trading activity would remain highly uncertain, but it is confident about its business model. LoopUp product is the signature product of the Company, and that combined with direct routing is expected to do well. The increased usage of the Microsoft Teams is highly value accretive for the Company's future performance. It would drive growth and generate substantial shareholder returns.

Trackwise Designs PLC (LON:TWD) - Signed a deal for IHT technology with a UK based EV manufacturer

Trackwise Designs PLC is a UK based company that designs and manufactures specialist products using the printed circuit technology. The products of the Company include Improved Harness Technology™ (IHT) and Advanced PCBs that have a wide range of applications in telecommunication, defence and automobile industry and they are exported to the US, Australia, Europe and China. Trackwise Designs have a manufacturing facility in Tewkesbury and Stevenage.

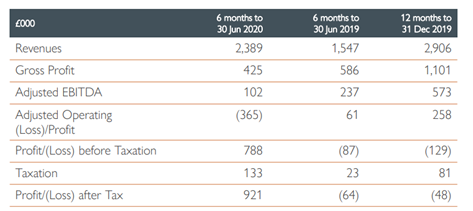

H1 FY2020 results (ended 30 June 2020) as reported on 23 September 2020

(Source: Company website)

Trackwise Designs reported revenue of £2.38 million in H1 FY20, which increased from £1.54 million a year ago. Despite the impact of the pandemic, the Company had a resilient performance due to the acquisition of Stevenage Circuits Ltd (SCL) in April 2020. The operating loss was £0.47 million in H1 FY20, which widened from operating loss of £0.05 million in H1 FY19. The Company reported a profit after tax of £0.92 million in H1 FY20 following the goodwill from the acquisition of SCL of £1.54 million. The goodwill was acknowledged as the Company stated that it acquired SCL's asset at a discounted price. The earnings per share were 4.89 pence in H1 FY20. As on 30 June 2020, Trackwise Designs had net cash of £1.56 million.

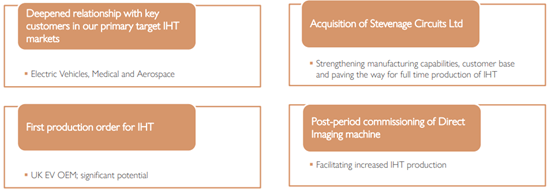

Operational Highlights

(Source: Company website)

The Company's main growth driver is its IHT technology, which uses a patented process to make a multi-layer flexible printing circuit of unlimited length and one of its key applications is to remove the wire harness. The IHT customers and opportunities grew to 82 by the end of H1 FY20 from 57 a year ago. In February 2020, Trackwise Designs announced the order from UK based EV OEM for flex PCBs and in September 2020 it got a follow on order for three years that could be valued around £38 million.

Acquisition of Stevenage Circuits Ltd

In April 2020, Trackwise Designs completed the acquisition of Stevenage Circuits Ltd and it was funded through the placement of new shares. The addition has strengthened the manufacturing facility of the Company, and increased the customer base. SCL contributed £1.22 million to the total revenue post-acquisition.

Share Price Performance Analysis

1-Year Chart as on September-28-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Trackwise Designs PLC's shares were trading at GBX 172.90 and were up by close to 0.23 percent against the previous closing price (as on 28 September 2020, before the market close at 12:55 PM GMT+1). TWD's 52-week High and Low were GBX 179.00 and GBX 58.60, respectively. Trackwise Designs had a market capitalization of around £38.15 million.

Business Outlook

The new orders were delayed, and the commissioning of machines was postponed due to the pandemic in H1 FY20. The addition of SCL has strengthened the Company's portfolio, and new contracts are won that would generate revenue in the H2 FY20. The Company is confident over the deal for IHT technology with a UK based electric vehicle manufacturer. Trackwise Designs considers Electric Vehicle, Medical and Aerospace as the target market for the Company, and it would focus on growing presence in these markets. It expects that the improving IHT pipeline and growing Advanced PCB business would be key revenue drivers in FY21.