Source: TippaPatt, Shutterstock

Summary

- Food delivery company Deliveroo announced on Monday that it will bring down its float price towards the lower end of its issue price range due to market volatility.

- The new range is between £3.90 and £4.10 per share, which will be valued between £7.6 billion and £7.85 billion.

- The move comes a week after it faced potential IPO rejection from fund managers due to issues over workers’ rights, regulatory issues and others.

Food delivery company Deliveroo announced on Monday that it will lower its float price towards the lower end of its issue price range due to market volatility. The upcoming listing is set to be the largest IPO on the LSE in a decade.

The new range is between £3.90 and £4.10 per share. Deliveroo will now be worth between the £7.6 billion and £7.85 billion range. The company will announce its final issue price on 31 March. The company had previously planned a price range of £3.90 and £4.60 per share, thus being valued up to £8.8 billion.

The move comes after several US-based technology stocks fell below their issue price after floating on the market recently.

Also, few days back, some of the fund managers said they will reject the IPO due to workers’ rights issues, regulatory concerns, share structure and the company’s business model.

The company saw its business soar since last year amid the pandemic as food delivery, and takeaway services saw a huge growth due to lockdown related restrictions.

Also Read: Deliveroo’s hotly anticipated IPO kicks off in London

Copyright © 2021 Kalkine Media Pty Ltd.

We take a look at a few FTSE 100-listed technology stocks with an annual return of over 7 per cent:

- Just Eat Takeaway.Com (LON: JET)

FTSE 100-listed online food delivery company Just Eat Takeaway.Com is a Netherlands based company. It was formed after merging two leading European food delivery companies, Takeaway.com N.V. and Just Eat PLC, which closed in April 2020.

The company reported revenues in FY 2020 rose by 54 per cent to €2.4 billion, from €1.6 billion the year before, boosted by tailwinds during the pandemic. It also announced a loss of up to €151 million in FY 2020 from a combined loss of €115 million the previous year. The company attributed about €102 million of the reported losses in 2020 to its expansion deals.

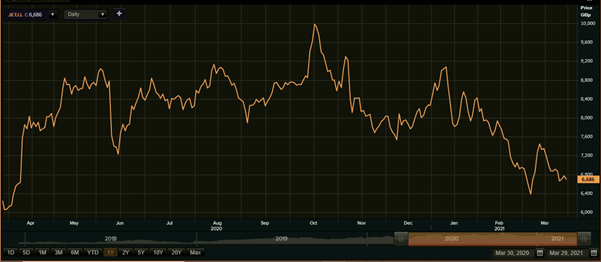

(Source: Refinitiv, Thomson Reuters)

The company had a 1-year return of 7.05 per cent while its market cap stood at £10.077 billion. Its shares were trading at GBX 6,678.00, down by 1.39 per cent, while the FTSE 100, which it is a part of, stood at 6,713.62, down by 0.40 per cent on 29 March at 10:00 AM GMT+1.

Also Read: What next for Just Eat Takeaway.com after it delivers strong growth in revenue

- Aveva Group (LON: AVV)

Another FTSE 100-listed technology major Aveva Group is a UK-based multinational industrial software firm. On 29 March, the company announced the completed acquisition of data management software company OSIsoft in a US$5.0-billion deal to drive digital transformation in the industrial sector.

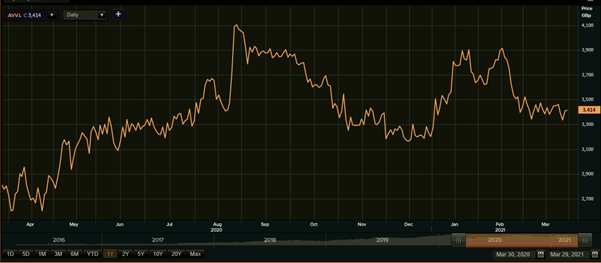

(Source: Refinitiv, Thomson Reuters)

The company had a 1-year return of 21.67 per cent while its market cap stood at £10.254 billion. Its shares were trading at GBX 3,414.00, up by 0.26 per cent on 29 March at 10:03 AM GMT+1.

Also Read: 5 Technology Stocks Under Focus: IQE, KNOS, GAW, AVV, OCDO

.jpg)