Highlights:

- CEO Americo Lemos steps down as IQE refocuses on strategic priorities and operational efficiency.

- Mark Cubitt becomes executive chair, while CFO Jutta Meier takes on interim CEO responsibilities.

- Leadership aims to prioritize cash generation, asset optimization, and a Taiwan IPO to enhance growth.

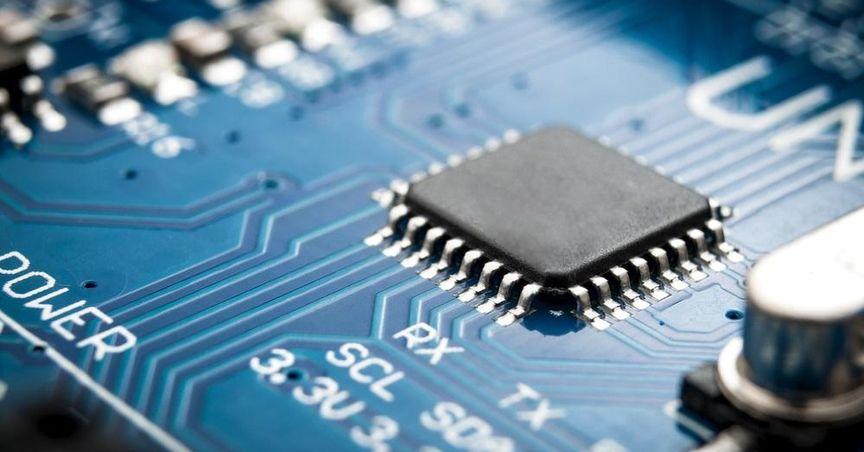

IQE PLC (LSE:IQE), the semiconductor wafer specialist, has announced significant leadership changes, signaling a strategic pivot focused on core growth initiatives and operational optimization. CEO Americo Lemos has left the company effective immediately, following a recent performance warning that led to a notable drop in share price. The leadership transition sees Mark Cubitt, who joined IQE’s board earlier this month as chair-elect, stepping into the role of executive chair. Meanwhile, Jutta Meier, CFO since January 2024 and a former Intel Corporation executive, will take on the role of interim CEO alongside her existing responsibilities as IQE initiates its search for a permanent leader.

Phil Smith, who has served as IQE’s chair since 2019, will also transition into a non-executive director role, supporting the company through the leadership change and broader strategic focus. Smith expressed confidence in the new structure, stating, "In Mark and Jutta, we have two excellent individuals with the necessary sector and leadership skills to capture that growth in partnership with our customers, employees, and broader stakeholders."

The leadership team is set to focus on strategic goals that include advancing IQE’s core pipeline, improving cash generation, and enhancing asset utilization. This includes a planned initial public offering (IPO) of IQE’s Taiwan operations, an effort aimed at unlocking embedded value and strengthening IQE’s global positioning in the semiconductor sector. Management is also expected to explore opportunities to optimize IQE’s asset base, reallocating resources to align more closely with IQE’s primary areas of expertise within the fast-evolving semiconductor industry.

IQE has faced recent challenges as market volatility impacted performance expectations. However, this reshaping of its leadership signals a renewed commitment to aligning operational efficiencies with growth-focused strategies, particularly in markets showing strong potential for semiconductor technologies. The company believes that these adjustments will drive stronger customer partnerships and long-term shareholder value as it adapts to market demands and explores growth opportunities in Taiwan and beyond.

As IQE moves forward under this interim leadership, it will remain focused on near-term execution and developing longer-term value from its global operations, while positioning itself to meet the increasing demand for advanced semiconductor materials and technologies.