Source: TPROduction, Shutterstock

Summary

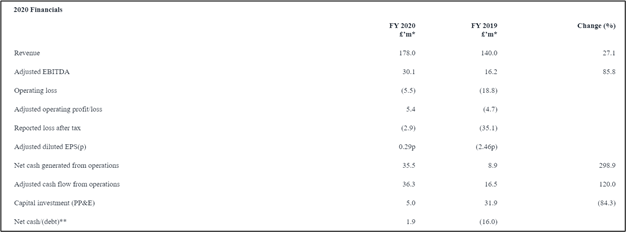

- IQE PLC had declared growth of 27.1% in the revenue to around £178.0 million during FY20.

- IQE had shown growth of 38% in wireless revenue during FY20 due to the deployment of 5G infrastructure in Asia.

- IQE had demonstrated a decline in capital expenditure to around £5.0 million during FY20.

- IQE had managed to narrow down the net losses during FY20.

IQE PLC (LON:IQE) is the LSE listed technology stock. IQE’s shares have generated a return of approximately 116.92% in the last 12 months. It is listed on the FTSE AIM UK 50 Index. IQE was incorporated in 1999.

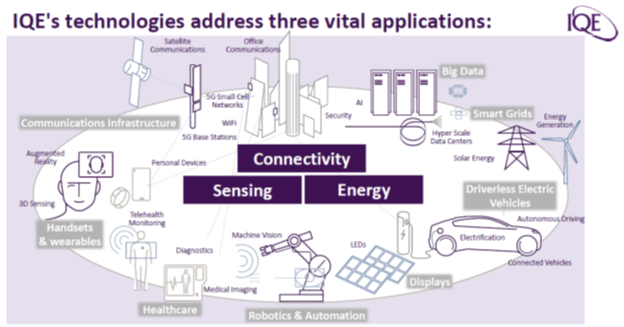

Business Model

IQE PLC is the FTSE AIM UK 50 listed Company, which is engaged in the research and development of engineering consultancy services to the semiconductor industry. The Company had nine manufacturing facilities present in the US, Taiwan, Singapore, and the UK. IQE is headquartered in Cardiff, UK.

(Source: Company result)

Recent News

On 09 March 2021, IQE updated that it has achieved a key milestone for IQDN-VCSEL™ technology for advanced sensing applications on 150 mm GaAs substrates at longer wavelengths. It would enable the Company’s customers to access increased market opportunities.

Financial Highlights (for 52 weeks ended 31 December 2020, as of 25 March 2021)

(Source: Company result)

- IQE had shown revenue growth of 27.1% to £178.0 million during FY20 benefitted from the start of the 5G mega-cycle.

- The wireless revenue grew by 38% during FY20 due to the deployment of 5G infrastructure in Asia.

- The photonics segment had demonstrated a 17% growth from £69.8 million during FY19 to £81.6 million during FY20, driven by the accelerated progress of 3D sensing and other sensing applications.

- Furthermore, IQE had managed to narrow down the net losses during FY20. The net loss remained around negative £2.9 million during FY20, while it was negative £35.1 million for FY19, benefitted from the high operational gearings.

- With regards to the cash movement, the net operating cash inflow remained £35.5 million during FY20 due to resilient trading performance, favorable working capital movement and stringent capital expenditure.

- IQE had demonstrated a decline in capital expenditure to around £5.0 million during FY20 due to the completion of capacity expansion in 2018 and 2019.

- Moreover, the Company had maintained business continuity throughout 2020 despite the emergence of the Covid-19 pandemic.

Share Price Performance Analysis of IQE PLC

(Source: Refinitiv, Thomson Reuters)

IQE’s shares were trading at GBX 63.67 and were down by close to 12.30% against the previous closing price as of 25 March 2021 at 11:51 AM GMT. IQE's 52-week Low and High were GBX 24.62 and GBX 91.94, respectively. IQE PLC had a market capitalization of around £581.62 million.

Business Outlook

The Company had achieved resilient financial performance during 2020, underpinned by the 5G infrastructure developments. Meanwhile, IQE would plan to embed US MBE manufacturing activities by 2024 in North Carolina. Moreover, the Company had received USD 2.5 million in cash during February 2021 from the settlement of an intellectual property legal dispute. IQE would accelerate the progress of Wireless GaAs in Taiwan as it would order three new Aixtron G4 tools during the first quarter of 2021. Furthermore, IQE had anticipated capital expenditure ranging from £20 million to £30 million during FY21 due to the expenditure incurred for three new reactors in Taiwan. IQE estimated revenue and adjusted EBITDA to remain the same during H1 FY21 as that of H1 FY20. The Company would continue to witness a positive trend regarding the demand for 3D sensing, advanced sensing applications and communications products. Overall, the Company is well-positioned to maintain the leadership position in the 5G megacycle in the coming years.