Highlights

Darktrace reported revenue of $281.34 million for the year ended 30 June 2021, representing a year-on-year increase of 41.3% compared to $199.07 million in FY2020.

Vela announced an investment of £750,000 for Northcoders’ IPO funding round.

The technology sector encompasses businesses engaged in the sales of products, services and solutions in software, IT, cloud computing, hardware, artificial intelligence (AI), and other related industries. Tech stocks may often serve as a leading indicator for the economy and stock market.

The growing pace of digital transformation across enterprises is driving the adoption of advanced technology solutions that not only improve efficiency and productivity, but also offer security. Rising remote working trends and the growing need to access organisational data over unsecured networks have accelerated this trend.

(Data source: Refinitiv)

Here we take a detailed look at two tech stocks you can buy in September.

Darktrace Plc (LON: DARK)

Darktrace is a technology company that specialises in AI cybersecurity solutions. The company reported a 45.3% year-on-year growth in customer base in FY2021 compared to the previous year.

In May 2021, Darktrace debuted on the London Stock Exchange (LSE) and raised funding of £171.0 million ($237.4 million). A part of this funding was used to expand its workforce at the R&D centre in Cambridge.

Darktrace reported revenue of $281.34 million for the year ended 30 June 2021, representing a year-on-year increase of 41.3% compared to $199.07 million in FY2020. Its EBITDA for the period was $2.79 million and an adjusted EBITDA of $29.7 million for the year, an improvement of $20.8 million year-on-year.

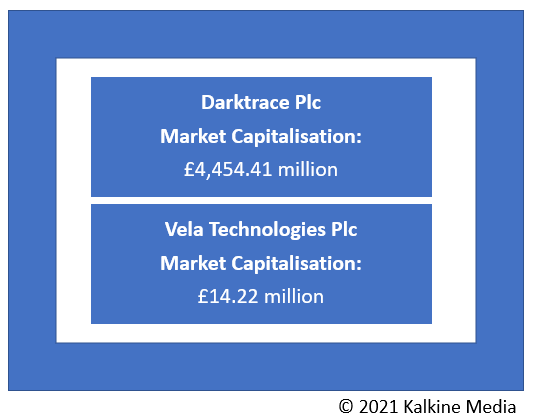

The shares of the company closed at GBX 731.00, up by 14.49% on Wednesday 15 September 2021. The market cap of the company stood at £4,454.41 million.

Vela Technologies (LON: VELA)

Vela Technologies is an AIM-listed company that invests in new disruptive technology businesses. In July 2021, Vela announced an investment of £750,000 for Northcoders’ IPO funding round. Recently, Vela was informed by St George Street Capital that post the receipt of the final results of the ARCADIA Phase II clinical trial, St George Street will commence commercial discussions with licensees for further clinical trials of the SGS002.

At the end of the financial year on 3 March 2021, Vela Technologies accounted for £9k cash (31 March 2019: £23k). Its overall loss for the year stood at £1,412k compared to £1,554k loss in 2019.

The shares of the company closed at GBX 0.09 on Wednesday, 15 September 2021. The market cap of the company stood at £14.22 million.

Conclusion

The pandemic imposed huge demand for tech solutions to meet the growing requirements. Many tech companies stepped up operations to address the demand. The pandemic thus yielded positive results for the tech industry. Investors keen on diversifying their investments are adding tech stocks to their portfolios to make the most of the growth prospects from the industry.

.jpg)