Source: Oil and Gas Photographer, Shutterstock

Summary

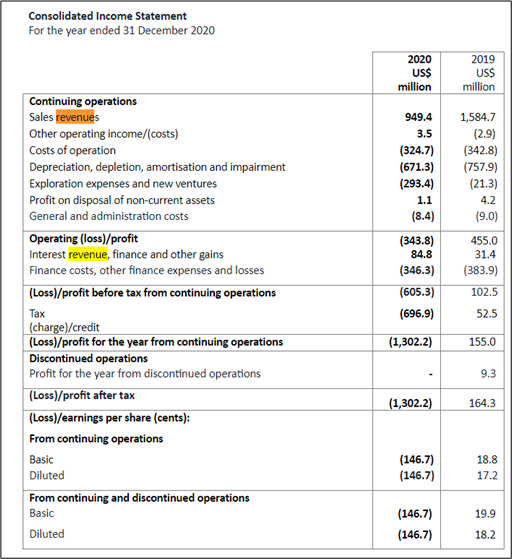

- Premier Oil PLC had reported a revenue of USD 949.4 million during FY20 ended 31 December 2020.

- The shares will be trading as Harbour Energy PLC from 01 April 2021.

- The Company had reported a loss after tax of negative USD 1.30 billion during FY20.

- PMO had a net debt of USD 2.08 billion as of 31 December 2020.

Premier Oil PLC (LON:PMO) is the LSE listed energy stock. PMO’s shares have generated a return of approximately 102.94% in the last 12 months. It is listed on the FTSE All-Share Index. The Company was incorporated in 2002.

Business Model

Premier Oil PLC is an Oil & Gas exploration and production company having its focus on the North Sea, the Falkland Islands and Latin America.

(Source: Company presentation)

Existing facilities & Development projects

(Source: Company presentation)

Recent News

On 23 February 2021, PMO updated that all necessary anti-trust approvals regarding the Chrysaor merger have been received. Moreover, PMO expected this transaction to get completed by 31 March 2021, and shares will be trading as Harbour Energy PLC from 01 April 2021. The merger will create the largest oil & gas Company listed on the London Stock Exchange.

FY20 Financial and Operational Highlights (for the twelve months to 31 December 2020, as of 18 March 2021)

(Source: Company result)

- PMO had reported revenue of USD 949.4 million during FY20, while it was USD 1,584.7 million during FY19. The decline was due to lower realized oil price during the period.

- PMO had reported an operating cost of USD 12.2 per boe (barrel of oil equivalent) during FY20, and it had incurred a total capital expenditure of USD 315 million during the period.

- On the profitability front, the Company had reported a loss after tax of negative USD 1.30 billion during FY20, while it had achieved a profit after tax of USD 164.3 million during FY19.

- PMO had managed to generate an operating cash flow of USD 630.0 million during the period, with a net cash outflow of USD 90 million.

- Furthermore, PMO had a net debt of USD 2.08 billion as of 31 December 2020, while it was USD 1.99 billion as of 31 December 2019.

- The full-year production remained around 61.4 kboepd (thousand barrels of oil equivalent per day) during the period. The UK production stood around 40.6 kboepd.

- The average realized oil price was USD 42.1 per barrel during the period.

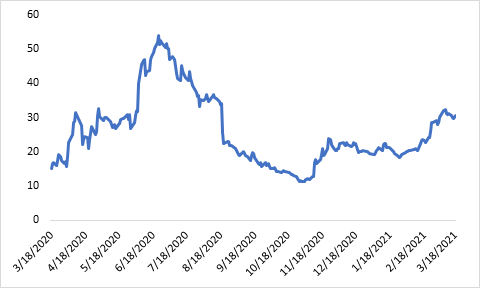

Share Price Performance Analysis of Premier Oil PLC

(Source: Refinitiv, chart created by Kalkine group)

Shares of Premier Oil PLC were trading at GBX 30.85 and were up by close to 3.36% against the previous closing price as of 18 March 2021 (before the market close at 10:29 AM GMT). PMO's 52-week Low and High were GBX 10.77 and GBX 55.14, respectively. Premier Oil PLC had a market capitalization of around £274.77 million.

Business Outlook

The Company is looking forward to completing the merger transaction with Chrysaor during the first quarter of the financial year 2021. Moreover, the proposed merger will create the largest independent oil and gas company listed on LSE, with significant international growth opportunities and a strong balance sheet. PMO had anticipated net debt of USD 2.9 billion for the combined entity upon the completion of the merger. Furthermore, the Company would deliver the first gas from the Tolomount project during Q2 FY21. Meanwhile, PMO would execute the two-well appraisal program of the Tuna field in Indonesia.

Moreover, PMO had provided proper financial guidance for FY21. The Company anticipated its operating cost of USD 15 per boe, while the capital expenditure is anticipated to be approximately USD 300 million during FY21. Furthermore, Chrysaor had estimated its capital expenditure to be ranging between USD 750 million and USD 850 million during FY21. Overall, the Company has an attractive portfolio of pre-development projects, which would accelerate the future growth potential.

.jpg)