Summary

- The British retail sales recovered as sales volume increased by 13.9 percent month on month in June 2020.

- The Brent was up by 0.07 percent, and it was trading at USD 43.31 per barrel (on 24 July 2020, before the market close at 2:50 PM GMT+1).

- Egdon Resources raised £0.5 million through the issue of new shares at 2 pence per share.

- Egdon Resources entered an agreement to resolve the dispute related to PEDL253.

- Empire Metals Limited increased stake to 70 percent in Munni Munni Palladium Project in Australia.

- Empire Metals Limited raised £0.6 million through placement and subscription of new shares.

Given the above-market conditions, we would review two stocks - Egdon Resources PLC (LON:EDR) & Empire Metals Limited (LON:EEE). Egdon Resources is an energy stock, whereas Empire Metals is a basic materials stock. EDR and EEE were up by about 2.43 percent and 15.69 percent, respectively (on 24 July 2020, before the market close at 2:50 PM GMT+1). Let's walk through their financial and operational updates to understand the stock better.

Egdon Resources PLC (LON:EDR)

Egdon Resources PLC is a UK based company engaged in oil and gas exploration with 44 licenses in proven oil & gas producing basins. The Company has unconventional gas initially in place of (GIIP) of 51 trillion cubic feet of gas (TCF). The Company is listed on the FTSE AIM All-Share index.

Recent Developments

- On 24 June 2020, the Egdon Resources entered an agreement with Humber Oil & Gas limited to resolve the dispute related to PEDL253. Post-deal, the Egdon Resources, owns 35.8 percent operated interest in PEDL253. Gross NPV(10) of £55.6 million is estimated at the site.

- As reported on 27 April 2020, the Company issued new shares in two tranches. The Company issued 20.7 million shares in equity tranche 1 and 4.2 million shares in equity tranche 2, and both were issued at 2 pence per share. The Company raised gross proceeds of £0.5 million from the new share issue.

H1 FY2020 results (ended 31 January 2020) as reported on 21 April 2020

The Company produced 178 barrels of oil equivalent per day (boepd), which increased from 164 bpoed. The oil and gas revenue declined to £0.67 million in H1 FY20 from £1.21 million in H1 FY19 due to weak energy prices. The loss before impairment was £1.04 million, and the overall loss was £3.23 million. As on 31 January 2020, the Company had cash of £0.78 million with net current assets and net assets of £0.37 million and £27.81 million, respectively. During the period, the Company entered into a farm-out agreement with Shell UK for P1929 and P2304 projects. Egdon Resources received planning consent for Wressle oil field development and acknowledged confirmation of hydrocarbon resource in Gainsborough Trough. The Company performed an economic assessment of Wressle oil field and recognized a breakeven price of USD 17.62 per barrel. The breakeven price for Biscathorpe project was estimated at USD 18.07 per barrel.

Interim Results for Six Months FY2020

(Source: Company Website)

Share Price Performance Analysis

Egdon Resources PLC's shares last traded at GBX 2.06 (as on 24 July 2020, before the market close at 2:50 PM GMT+1). Stock 52-week High and Low were GBX 6.95 and GBX 1.50, respectively. The Company had a market capitalization of £6.40 million.

Business Outlook

The Company has maintained full-year oil production guidance of 130-140 bpoed. In H2 FY20, the Company plans to develop Wressle oil field for production. The completion of farm-out with Shell for Endeavor and Resolution projects also remains a major objective along with marine 3D seismic survey acquisition. The Company is also considering an option for drilling North Kelsey-1 in 2021. The UK government-imposed moratorium on shale gas hydraulic fracturing; however, post lifting of the moratorium the plan is to start drilling and testing of Spring Road-2 well.

Empire Metals Limited (LON:EEE) - Received confirmation for two deposits in the Bolnisi Project area

Empire Metals Limited is engaged in the exploration and development of gold and copper mining projects. The Company has an interest in projects such as Kvemo Bolnisi East, Greater Kvemo Bolnisi, Tsitel Sopeli, Dambludi, Tamarisi and Balichi. The Company has operations in the UK, Austria and Georgia. In Georgia, the Company operates in JV with Caucasian Mining Group. The Company is incorporated in the British Virgin Islands, and it is included in the FTSE AIM All-Share index.

Recent Developments

- On 20 July 2020, the Company entered an agreement with Artemis Resources Limited to acquire a 58.6 percent stake in Munni Munni Pty Ltd. The Company now owns 70 percent interest in Munni Munni Palladium Project. Platina Resources Limited holds the remaining stake. Munni Munni project is situated in West Pilbara, Australia. The mining lease and project license covers a tenement area of 64 square kilometres. The project is expected to have 2.9 gramme per tonne of platinum group element and gold.

- On 30 June 2020, the drilling programme update at Munni Munni was provided under which the drilling of 12 drill holes was completed for 1,928 metres. Artemis Resources Limited condected the drilling at the project.

- On 28 February 2020, the Company raised £0.6 million through placement and subscription of 60 million shares at 1 pence per share. The funds would be used to maintain activities at the two new assets in Georgia.

FY2019 Annual results (ended 31 December 2019) as reported on 30 June 2020

The Company experienced a delay in permission for exploration of Bolnisi project in Georgia. In FY19, the reported loss narrowed to £0.6 million from £8.7 million a year ago. Empire Metals had cash of £0.3 million. In January 2020, the Company's JV Georgian Copper & Gold JSC received confirmation of tenure for two deposit area, namely Kvemo Bonisi East and Dambludi from National Agency of Mines.

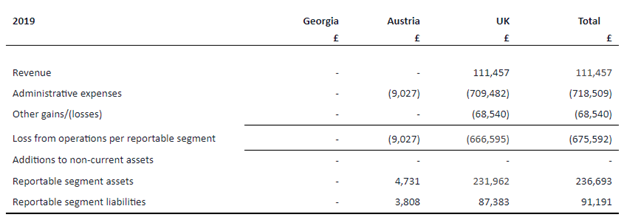

Geographical Segment Breakup for FY2019

(Source: Company Website)

Share Price Performance Analysis

Empire Metals PLC's shares last traded at GBX 2.40 (as on 24 July 2020, before the market close at 2:50 PM GMT+1). Stock 52-week High and Low were GBX 4.50 and GBX 0.72, respectively. The Company had a market capitalization of £4.07 million.

Business Outlook

The Company is optimistic about the future of the Company after significant developments such as fundraising, acquisition of controlling interest in Munni Munni project. The Company would continue to focus on growth and exploration of assets along with expanding and diversifying the portfolio.