Union Jack Oil PLC

Union Jack Oil plc (LSE:UJO) is one of the major oils & gas producers based in the United Kingdom. It is into drilling, development, production and investment in the hydrocarbon sector. The stock of the company is listed on the AIM Market of the London Stock Exchange.

The company firmly believes in the appraisal and exploitation of the assets it currently owns. In addition, the UJOâs management hopes to continue using its expertise in getting new licence interests in the areas where there is the lesser time required to procure the interest and explore drilling-related activities or initializing production from any oil or gas fields that may be discovered.

Recent news

The company has made an announcement that Frazer Lang, who was serving as Non-Executive Director, has resigned from his position in the company, which will take place with immediate effect.

Frazer, who is also serving as an Executive Director of Humber (âHumber Oil & Gas Limitedâ) is leaving to shoulder more responsibilities at Humber Oil & Gas Limited. The company wishes him good luck for future endeavours and thank him for his immense contribution to the company.

The company made an announcement in mid-April, they had conditionally agreed to sell their 7.5% license interest in Holmwood to UKOG (UK Oil & Gas PLC). The sale deed was to be executed by sale and purchase agreement with the principal terms agreed upon, subsequently followed by approval obtained from the Oil and Gas Authority. The company confirmed on 3rd June 2019 the completion of the sale of (7.5 per cent) interest in Holmwood to UKOG.

Post this transaction of £112,500; Union Jack would be able to reap benefits from UKOGâs increased interest in âHolmwoodâ and exposure to UKOGâs Weald Basin assets and other projects. This sale of interest will allow Union Jack to focus on East Midlands, Humber Basin and East Yorkshire areas.

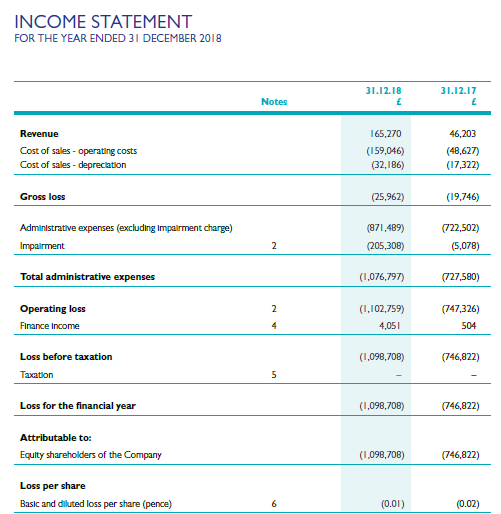

Financial Highlights for Financial Year 2018 (£)

(Annual report, Companyâs website)

The Companyâs financial statement reports revenue of £165,270 in FY2018 against £46,203 in FY2017. This can be attributed to production income from the Keddington oilfield and the Fiskerton Airfield oilfield. The companyâs cash balances are of £2.5 million as on 1 May 2019. As of now, all drilling and testing projects are fully funded by the company. The revenue from production increased by more than 250 per cent. The company remains debt free. The company further expanded the portfolio by specific accretive transactions in Wressle and Biscathorpe. The company possesses an increased level of reserves.

The loss for the year stood at £1,098,708 against £746,822 in FY2017. The directors did not announce dividend this year, same was the case in FY2017. In March 2018, 1,470,588,226 common shares were issued for raising £1,250,000. In October 2018, new common shares (2,647,058,823) were issued for raising £2,250,000. The Intangible assets stood at £3,485,961 in FY2018 against £2,806,278 in FY2017. The Tangible assets stood at £611,139 in FY2018 against £496,859 in FY2017.

Union Jack Oil Plc Share price performance

Daily Chart as at June-11-19, before the market closed (Source: Thomson Reuters)

Â

On June 11, 2019, at the time of writing (before the market closed, at 11:19 AM GMT), Union Jack Oil plc shares were trading at GBX 0.15054, down by 4.41 per cent against the previous day closing price. Stock's 52 weeks High and Low is GBX 0.17 /GBX 0.07. At the time of writing, the share was trading 11.76 per cent lower than the 52w High and 114.28 per cent higher than the 52w low. Stock's average traded volume for 5 days was 222,672,603.40; 30 days â 154,768,343.50 and 90 days â 106,486,046.92. The average traded volume for 5 days was up by 43.87 per cent as compared to the 30 days average traded volume. The outstanding market capitalisation was around £17.05 million.

Â

Canadian Overseas Petroleum Limited

Canadian Overseas Petroleum Limited (COPL) is an oil and gas producer with a proven track record for discovering oil and gas quickly and efficiently. The Company formed a joint venture with Shoreline Energy International Ltd; in line with the Companyâs focus to diversify and find the right asset portfolio balance to generate stable cash flow from secure assets. Both companies hold a 50% interest in the jointly controlled company.

Recent news

The company will be issuing new ordinary shares in two tranches. The company will issue new 429,200,000 shares which will bring proceeds of £429,200. The second trance will include shares amounting £67,800 and will be admitted for official listing.

Financial Highlights for the Financial year 2018 ($, thousand)

(Source: Annual Report, Company Website)

General and administrative costs were $4.9 million for the year ended December 31, 2018 (net of $nil of costs allocated to exploration projects), compared to $4.6 million for the year ended December 31, 2017 (net of $0.2 million of costs allocated to exploration projects). The Pre-licence costs stood at $0.5 million for the year ended December 31, 2018, against $0.4 million in the Financial Year 2017.

In 2017, the Company derecognized its exploration and evaluation assets of $15.6 million; there was no such derecognition recorded in the comparable period of 2018. During the year ended December 31, 2018, the Company recorded a gain on derecognition of a former, 2011/2012 joint venture payable in the amount of $0.7 million; there was no such gain recorded in 2017. Stock-based compensation expense of $0.3 million was recorded in 2017 in relation to stock options granted; there were no stock options granted in 2018. A foreign exchange loss of $0.2 million was recognized for the year ended December 31, 2018 versus foreign exchange gain of $0.4 million in 2017.

The Company recorded a derivative gain of $0.4 million for the Financial Year ended 2017; against nil for the year ended December 2018. The Company reported an interest income of around $11,000 for the financial year ending December 2018, against $9,000 in the financial year ending December 2017.

The loss recognized on the Companyâs investment in ShoreCan was $43,000 for the year ended December 31, 2018, and $76,000 the year ended December 31, 2017.

Consequently, the Companyâs net loss was recorded at $4.9 million for the financial year ending December 2018 as against a net loss of $20.1 million in the Financial year 2017.

By the end of December 2018, the Companyâs cash and cash equivalents stood at $1.9 million, against $4.1 million by the end of December 2017.

Cash used in operations stood at $5.5 million for the financial year ending December 2018 against $4.9 million in the financial year 2017. Cash provided by financing activities stood at $3.4 million for the year ending December 2018 against $6.5 million for the year ending December 2017. Cash used in investing activities stood at $44,000 for the financial year ending December 2018 against $0.3 million for the year ending December 2017.

Canadian Overseas Petroleum Limited Share Price Performance

Daily Chart as at June-11-19, before the market close (Source: Thomson Reuters)

On June 11, 2019, at the time of writing (before the market closed, at 01:32 PM GMT), Canadian Overseas Petroleum Limited shares were trading at GBX 0.1075, up by 2.38 per cent against the previous day closing price. Stock's 52 weeks High and Low is GBX 0.8999 /GBX 0.0863. At the time of writing, the share was trading 88.05 per cent lower than the 52w High and 24.56 per cent higher than the 52w low. Stock's average traded volume for 5 days was 124,368,839.20; 30 days â 101,035,246.33 and 90 days â 69,216,177.90. The average traded volume for 5 days was up by 23.09 per cent as compared to the 30 days average traded volume. The companyâs stock beta was 4.04, reflecting significantly higher volatility as compared to the benchmark index. The outstanding market capitalisation was around £7.39 million.