Summary

- Unite Group expects the rental income to fall by 15% to 20% in 2020/2021 due to the cancellation of bookings following covid-19.

- Approximately 88% of the beds are booked for the academic year 2020/2021.

- Secure Income REIT stated that the whole adjusted rent due for collection between 29 September 2020 and 7 October 2020 amounts to £12.4 million.

- The Company has reduced the contracted rent for Travelodge for 2020 and 2021.

Unite Group (LON:UTG) and Secure Income REIT PLC (LON:SIR) are LSE listed REIT. Based on 1-year performance shares of both UTG and SIR were down by close to 19.73% and 39.38%, respectively (as on 9 October 2020).

Unite Group (LON:UTG) - The current letting remains below the target level

Unite Group is a UK based company that is engaged in the development and management of student accommodation. The Company provides service to around 75,000 students via 177 properties partnered with 45 universities in the UK. The Company acquired Liberty Living in 2019 for £1.4 billion. Unite Group was founded in 1991, and it is listed on the FTSE-250 index.

Trading update as reported on 8 October 2020

Unite Group stated that all its properties are operational for students who are starting academic year 2020/2021. All the sites are operating under the government's guidance, and appropriate safety measures are taken as the students are settling. The Company highlighted that around 88% of the beds at its properties are booked for the academic year 2020/2021; however, it is lower than the occupancy of 98% achieved for the academic year 2019/2020.

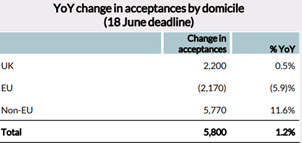

The new lettings have increased after the declaration of A-level results in August 2020, but that is offset by the booking cancellations due to the covid-19. Out of the total sublet, 57% has been achieved through nomination agreements, and 43% are booked directly. The UK students constitute 45% of the direct-let bookings. Unite Group is giving the flexibility to the students to check-in late, which has shortened the average tenancy period to 43 weeks for 2021/2021, and 10% of students have already availed this facility.

The weekly prices have moved up by 1.1% year on year that has translated to a contractual growth of 2.8% for multi-year. The Unite Group took some cost-mitigating measures such as insourcing work and reduction in utility and broadband cost, which are expected to result in a cost-saving of £12 million to £15 million.

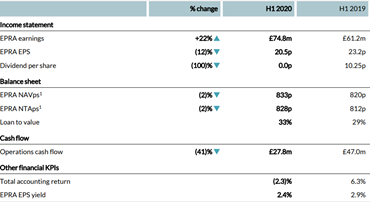

H1 FY20 Financial Highlights

(Source: Company website)

Quarterly fund valuation

As on 30 September 2020, the independent valuation of Unite UK Student Accommodation Fund (USAF) stood at £2,808 million that was up by 0.7% on a like for like basis. The London Student Accommodation Joint Venture (LSAV) was valued at £1,325 million. USAF includes 79 properties in 22 universities that have 30,209 beds. LSAV consists of 12 properties in London and Aston Student Village in Birmingham that have 8,354 beds. The valuation of the properties was positively impacted by the temporary reduction in the stamp duty for residential properties. If the Company removed the impact of the stamp duty, then the value of the properties remain flat for USAF and LSAV. The average yield of USAF and LSAV portfolio was 5.3% and 4.4%, respectively.

Outlook for 2020/2021

(Source: Company website)

Share Price Performance Analysis

1-Year Chart as on October-9-2020 after the market closed (Source: Refinitiv, Thomson Reuters)

Unite Group PLC's shares last traded at GBX 872.5 (as on 9 October 2020). UTG's 52-week High and Low were GBX 1,351.00 and GBX 577.00, respectively. Unite Group had a market capitalization of around £3.47 billion.

Business Outlook

The Company expects the rental income to fall by 15% to 20% in 2020/2021 as compared to 2019/2020, excluding the impact of covid-19. The decline in the rental income would be mainly due to the cancellation. The Company has some visibility over the revenue, as under the nomination agreement the university pays the rent for the bookings. The EPRA earnings per share are expected in the range of 22 pence to 25 pence for FY2020. The current letting of the Company remains below the target occupancy of 90%, but it is discussing with universities for let-out to customers from 2021, which could improve sales. Unite Group expects the performance to be strong in the academic year 2021/2022, which would be supported by an increasing share of the UK's 18-year choosing to go to the university.

Secure Income REIT PLC (LON:SIR) - Investment property value stood at £1958.7 million

Secure Income REIT PLC is a UK based company that operates real estate assets. The Company has 161 properties under its portfolio that have an average unexpired lease term of 20.8 years. The properties include hospitals, hotels and entertainment centres.

Rent collection update as reported on 8 October 2020

Secure Income REIT announced that the whole adjusted rent due for collection between 29 September 2020 and 7 October 2020 amounts to £12.4 million. Due to the pandemic, the Company negotiated rental terms with its tenants. The Company has reduced the rent for Travelodge in 2020 and 2021 that would resume to the original contracted level in 2022. Secure Income received the rent of £1.3 million from Travelodge that was due for the period between 1 October and 7 October 2020, and there is no outstanding rent. Secure Income has agreed for deferment of the rent payment for Merlin leisure assets to September 2021. The rent was due for the quarter ended June 2020 and September 2020.

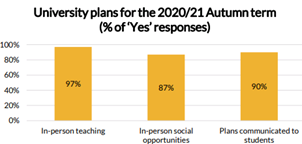

Portfolio overview

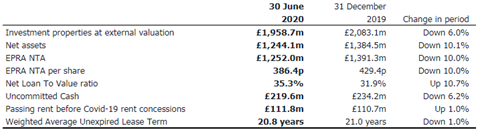

H1 FY2020 results (ended 30 June 2020) as reported on 10 September 2020

(Source: Company website)

As on 30 June 2020, the value of investment properties stood at £1958.7 million, which declined by 6% year on year. The net asset value was £1,244.1 million in H1 FY20 that fell from £1,384.5 million a year ago. In H1 FY20, the passing rent before covid-19 concessions was £111.8 million, which increased by 1% year on year from £110.7 million a year ago. Out of the total passing rent, Leisure rent was £46.9 million, Healthcare was £36.6 million, and Budget hotel rent was £28.3 million. As on 30 June 2020, Secure Income REIT had a net debt of £690.6 million and a net loan to value of 35.3%.

Share Price Performance Analysis

1-Year Chart as on October-9-2020 after the market closed (Source: Refinitiv, Thomson Reuters)

Secure Income REIT PLC's shares last traded at GBX 274.00 (as on 9 October 2020). SIR's 52-week High and Low were GBX 476.00 and GBX 180.00, respectively. Secure Income REIT had a market capitalization of around £879.76 million.

Business Outlook

The majority of the Company's properties are operational; however, the impact of covid-19 on the future business remains highly uncertain. Secure Income REIT stated that the low-interest rate scenario would bring down the saving of the investors against inflation. At this junction, inflation-linked rental income would support the investment case for the Company. It is confident about the strength of the balance sheet to sustain any disruption.