Summary

- Marshalls incurred restructuring costs of £17.6 million that included the closure of manufacturing facilities in Falkirk, Llan, and Livingston during the first half of 2020

- Restructuring would help in improving efficiencies across verticals and also help in cost reduction by approximately £12 million in a given year

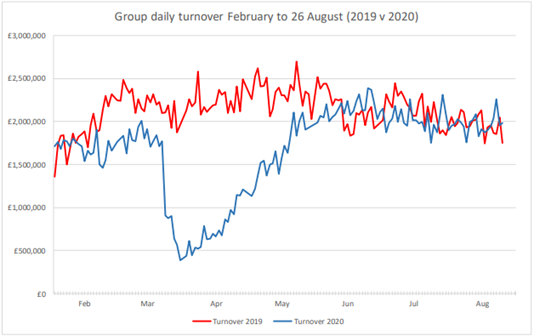

- Company’s trading has gained momentum in July and August 2020

The UK construction output was up by 17.6 per cent in July 2020 as reported by the Office for National Statistics, however, was far below the February 2020 (pre-pandemic) levels. Most of the construction activity has resumed across UK in July 2020 with new safety protocols in place.

Due to the onslaught of the coronavirus pandemic, most of the infrastructure projects were stalled. The business owners were looking to implement measures that ensure liquidity in order to remain afloat during the unprecedented crisis.

FTSE 250 listed construction & materials company, Marshalls Plc (LON: MSLH) opted for restructuring to survive the unprecedented crisis. The company believed that the restructuring could help in improving the overall operational efficiency and reducing fixed costs to some extent.

Do read: Construction Industry Revives in the UK; Are The Stocks Following Suit?

Everything comes at a cost and so does restructuring. The restructuring costs seem to have weighed heavily on the profits of the company. However, the company believes that it is well placed to deliver a strong recovery amid the challenging environment.

Restructuring plan

The company announced a series of restructuring proposals covering all parts the business in May that included closures of selective sites along with changes in shift patterns. The group had also proposed structural changes in its support functions. Nearly 15 per cent of the workforce has been impacted due to restructuring. Marshalls Plc incurred a restructuring costs of £17.6 million that included the closure of manufacturing facilities in Falkirk, Llan, and Livingston during the first half of 2020.

The completion of operational restructuring exercise has resulted in the closure of certain manufacturing sites and overhead reductions for the company. The restructuring programme is now complete as deemed by the company and the cost of restructuring has been charged to the income statement of the current period (H1 FY2020). The group expects that the restructuring would help in improving efficiencies across verticals and also help in cost reduction by approximately £12 million per annum. However, the reported loss before taxation for the period (H1 FY2020) stood at £16 million after adjusting for operational restructuring costs and asset impairments.

Financial results

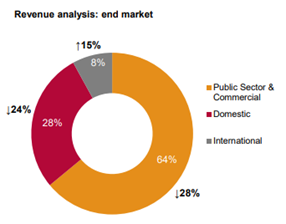

Marshalls' revenue fell from £280.1 million in H1 2019 to £210.5 million during the first half of 2020, a plunge of nearly 25 per cent. Marshall witnessed a decline of 28 per cent in revenue from the public sector & commercial end segment during the first half of 2020. The revenue in the domestic end segment was down by 24 percent year on year during the first half of 2020. However, as the demand for DIY projects picked up, the sales have slightly improved during May 2020. Notably, the revenue from international business segment was up by 15 per cent year on year during the H1 2020 period because of strong performance in company’s Belgium business.

Financial Results for Marshalls Plc (January – June 2020)

(Source: Company’s presentation)

During the unprecedented crisis, the group has taken several measures to ensure liquidity and controlling costs. Apart from capital expenditure restricted only to essential items, all sorts of discretionary expenditure including recruitment has been halted. Moreover, the top management has decided to undergo a reduction in pay. The board did not announce any interim dividend for the current year.

(Source: Company’s presentation)

The three important segments contributing revenue streams to company are public sector & commercial end market, domestic end market, and international business. As evident from the chart, the company’s turnover (2020) depicts a ‘V’ shaped recovery. While market demand and business confidence remained uncertain, the above trading performance showed a steady increase in June 2020, continuing into July 2020, as markets start recovering from the initial impact of COVID-19.

(Source: Company’s presentation)

On a pre-IFRS 16 basis, the company’s net debt stood at £53.9 million for H1 2020; was at similar levels in comparison to previous year (H1 2019: £55.6 million). To remain afloat during the unprecedented crisis, the company availed CCFF facility of £200 million along with an additional short-term revolving credit bank facility of £90 million. The company has a flexible capital structure along with a strong balance sheet.

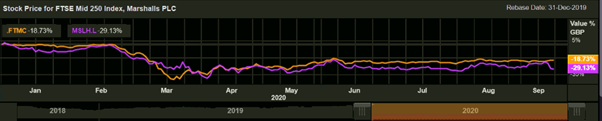

During the unprecedented crisis, Marshalls shares created a new bottom of GBX 519.50 on 6 April 2020. Since then the shares have delivered a price return of nearly 18 per cent.

(Source: Refinitiv, Thomson Reuters)

On YTD basis, the stock has performed poorly in comparison to the benchmark index (FTSE 250). Marshalls Plc’s shares were trading at GBX 609 on 16 September 2020 (before the market close at 9:48 AM GMT+1), marginally down by 0.57 per cent against the last day closing price.

Actions taken by Marshalls to post a strong recovery

CPA has forecasted a growth of 18 per cent in the construction output for 2021. A slight uptick can be seen in trading performance for the month of June, July, and August 2020. Marshalls has been emphasising upon road, rail, and water management projects in the infrastructure sector. The group seems to build upon increased efficiencies post restructuring and create value for all its stakeholders. The demand in the housebuilding segment and DIY items is likely to be stable as people are investing in their new work/ living spaces. Moreover, the new bank facilities and the restructuring programme have served to further strengthen the group’s capabilities. Also, Marshalls is well-positioned to manage the ongoing impact of coronavirus and future growth opportunities. Brexit might pose some risks for the company with regards to its supply chain.