Summary

- Midwich Group Plc had anticipated a revenue growth of 4.0% during FY20.

- The Company had announced regarding the acquisition of 80% stake of NMK Group on 14 December 2020.

- The Board had anticipated the adjusted profit before tax of around £14 million during FY20.

- The operating cash conversion was 127% as of 30 June 2020.

Midwich Group Plc (LON:MIDW) is the industrial stock listed on FTSE AIM UK 50 Index. The Company is the specialist audiovisual distributor having its footprints across the UK and Ireland. MIDW’s shares have generated a return of about negative 8.41% in the last 12 months.

The Company will announce its full-year FY20 results on 09 March 2021.

Business Model

The Company is the provider of audiovisual categories such as projectors, printers, digital signage and sizeable format display. The Company serves various industries like retail, residential, education and hospitality. The Company has a customer base of around 20,000 and maintaining a quality relationship with around 500 vendors. The Company was initially known as Jade 320 Limited. Some of the most prominent vendors are shown below -

(Source: Company presentation)

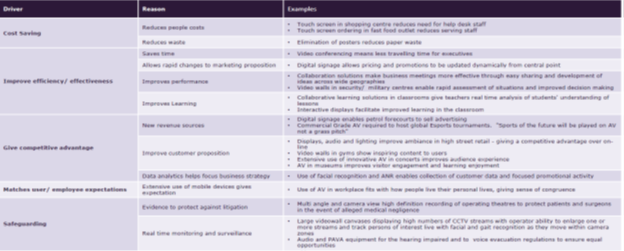

Demand drivers of Audiovisual industry

(Source: Company presentation)

Pre-Closing Trading Update (for FY20 ended 31 December 2020 as on 20 January 2021)

- The Company had anticipated a revenue growth of around 4% at constant currency to over £710 million during FY20.

- The underlying sales excluding acquisition had shown decent improvement during H2 FY20 compared to H1 FY20 as it had reported a decline of 7% year-on-year during H2 FY20 from an equivalent period of the prior year.

- The Board had anticipated reporting adjusted profit before tax of around £14 million during FY20.

- The Group had strengthened its balance sheet by bringing down net debt from £53 million as of 31 December 2019 to £20 million as of 31 December 2020 boosted by strong cash generation during the year.

Acquisition update

On 14 December 2020, the Company had announced regarding the agreement to acquire 80% of the stake in NMK Group. The deal is expected to be completed by early 2021, and the consideration price includes an initial cash transaction of £10.0 million followed by another £4.2 million of cash transaction to take place after six months.

NMK Group is a value-added audiovisualizer distributor based out in UAE and Qatar. The Company had achieved total revenue of AED 104 million and net profit of AED 17.9 million for the financial year ended on 31 December 2019.

On 23 October 2020, the Company had announced that it would no longer be engaged in the distribution of Music Tribe products by its North American business arm Starin Marketing Inc.

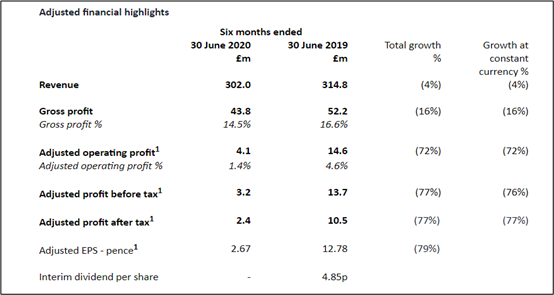

H1 FY20 Financial Highlights (for six months period ended 30 June 2020, as on 08 September 2020)

(Source: Company result)

- The Company’s revenue had plunged by 4.1% to £302 million during H1 FY20 adversely impacted by Covid-19 pandemic results in reduced product demand.

- The organic revenue was plunged by 22.1% during the period.

- The gross margin of the Company was declined by 210 basis point to 14.5% during the period.

- The operating cash conversion remained strong throughout the period as it stood at 127% for H1 FY20 compared to 28% during H1 FY19.

- Regarding the profitability, the adjusted profit before tax was declined by 76.6% to £3.2 million during the period. Similarly, the adjusted earning per share had also dropped to 2.67 pence for the period due to the significant postponement of projects.

- The Company had improved on the leverage part as it had reduced its adjusted net debt to £41.2 million as of 30 June 2020 due to strong cash preservation measures taken by the management.

- The Group had not proposed any interim dividend for the first six months of FY20 and withdrawn FY19 final dividend as well.

- The Company had completed two key acquisition deals during the period, Starin Marketing Inc on 06 February 2020 and Vantage Systems Pty Limited on 20 March 2020.

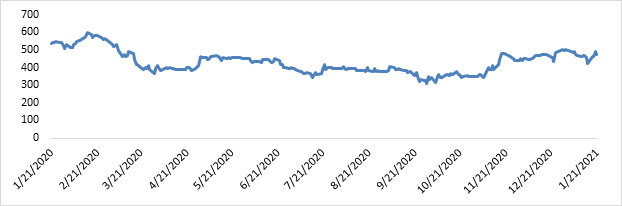

Share Price Performance Analysis of Midwich Group Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of Midwich Group Plc were trading at GBX 472.95 and were down by close to 3.48% against the previous closing price as on 21 January 2021, (before the market close at 08:30 AM GMT). MIDW's 52-week Low and High were GBX 305.00 and GBX 600.00, respectively. Midwich Group Plc had a market capitalization of around £434.16 million.

Business Outlook

The Company had shown resilient financial performance during FY20 and witnessed an increase in its top-line despite operating in a challenging business environment. The Company remained confident regarding its services and well-positioned to capitalize on optimum market demand as per the situation. The Group had taken several key strategic decision throughout the period and completed several restructuring activities. The Company had completed several lucrative acquisitions and gotten rid of various unprofitable business.

The Group had entered two critical markets by completing the acquisition of US-based Starin Marketing in February 2020 and announcement to acquire controlling stake of NMK Group in the Middle East during December 2020. These deals would bring several synergies and would contribute towards revenue growth through geographic integration. The Company had an attractive upcoming acquisition pipeline. The Company was also cautious regarding its business performance to remain affected at least till the first half of 2021.