Summary

- Marshalls generated revenue of £210.5 million in H1 FY2020, which declined by 24.8 percent year on year.

- The sales of the Public sector & Commercial end market and Domestic end market fell, whereas International business grew in H1 FY2020.

- Polypipe Group generated revenue of £173.6 million in H1 FY2020, which fell by 28.1 percent year on year. The business performance was impacted due to closedown of the building activity in April and May 2020.

- The business activity has recovered slightly in July and August 2020 after the construction activity resumed.

The UK construction output grew by 17.6 percent in July 2020 as reported by the Office for National Statistics. Marshalls PLC (LON:MSLH) & Polypipe Group PLC (LON:PLP) are two construction & materials stocks listed on the FTSE-250 index. Shares of MSLH were down by close to 4.89 percent, whereas shares of PLP were up by around 5.15 percent from their last closing price (as on 15 September 2020, before the market close at 1:30 PM GMT+1).

Marshalls PLC (LON:MSLH) - Incurred restructuring cost of £17.6 million in H1 FY2020

Marshalls PLC is a UK based group that is engaged in external landscaping, interior design, paving and flooring products business. The Group offers products such as garden paving, driveways, garden paths, kerbs & edging, garden walling and artificial grass. Marshalls is included in the FTSE 250 index.

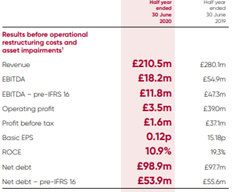

H1 FY2020 results (ended 30 June 2020) as reported on 15 September 2020

(Source: Group website)

Marshalls' H1 FY20 revenue stood at £210.5 million, which fell from £280.1 million generated in H1 FY19. EBITDA declined from £54.9 million in H1 FY19 to £18.2 million in H1 FY20. The Group reported an operating profit of £11.8 million and profit before tax of £1.6 million in H1 FY20. The earnings per share fell from 15.18 pence per share in H1 FY19 to 0.12 pence per share. As on 31 August 2020, Marshalls had net debt of £60.8 million. It generated a return on capital employed (ROCE) of 10.9 percent for 12 months ended 30 June 2020. The Group incurred restructuring cost of £17.6 million in H1 FY20 that included the closure of manufacturing facilities in Falkirk, Llan and Livingston. Marshalls received furlough support of £9.4 million, and it plans to return the money to the government soon.

Performance by End Market in H1 FY2020

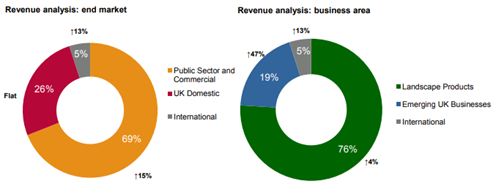

Based on the segment category, Public sector & Commercial end market constituted 64 percent of the total group sales, whereas Domestic end market and International business contributed 28 percent and 8 percent, respectively to the entire group sales. In H1 FY20, the revenue of the Public sector & Commercial end market declined by 28 percent year on year. The sales of Domestic end market fell by 24 percent year on year in H1 FY20, but the sales have slightly improved from May 2020 as the demand for DIY projects grew. The International business sales increased by 15 percent year on year in H1 FY20, which was supported by the strong performance of Marshalls' Belgium business.

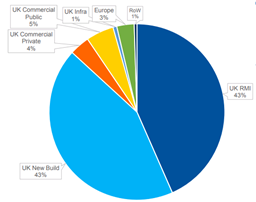

Segment Analysis by End Market and Business Area in FY2019

(Source: Group website)

Share Price Performance Analysis

1-Year Chart as on September-15-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Marshalls PLC's shares were trading at GBX 640.10 and were down by close to 4.89 percent against the previous closing price (as on 15 September 2020, before the market close at 1:30 PM GMT+1). MSLH's 52-week High and Low were GBX 876.00 and GBX 505.00, respectively. Marshalls had a market capitalization of around £1.35 billion.

Business Outlook

Marshalls highlighted a slight uptick in the business activity in July and August 2020. The Group targets road, rail and water management projects in the Infrastructure sector as they have huge growth potential. In the Domestic end market, the demand for the housebuilding segment remains highly uncertain as the people have somewhat shifted to don't move and don't improve mindset. The Group has completed its restructuring programme and expects it would improve operational efficiency.

Polypipe Group PLC (LON:PLP) - Raised new equity of £120 million in May 2020

Polypipe Group PLC is a UK based construction material group, and provides drainage, plumbing, and heating solutions. The Group has 19 facilities across the UK, Italy and the Middle East. Polypipe Group is listed on FTSE-250 index.

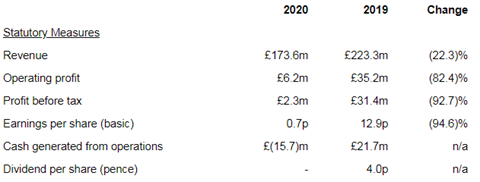

H1 FY2020 results (ended 30 June 2020) as reported on 15 September 2020

(Source: Group website)

In H1 FY20, Polypipe Group reported revenue of £173.6 million, which fell by 22.3 percent year on year from £223.3 million in H1 FY19. The operating profit stood at £6.2 million, which was down by 82.4 percent year on year from £35.2 million in H1 FY19. The Group generated profit after tax of £2.3 million and earnings per share of 0.7 pence per share in H1 FY20. The cash outflow from operations was £15.7 million in H1 FY20 against cash inflow of £21.7 million in H1 FY19. The pandemic impacted the trading activity, and in April 2020 the revenue was down by 66 percent when compared to the same period last year. The business performance has improved since the start of H2 FY20 as revenue in July and August 2020 was down by 6 percent and 3 percent as compared to the same period in 2019. Polypipe Group would not pay the interim dividend, and the decision over the payment of the final dividend for FY20 would be taken in May 2021, which would be subject to improvement in the business performance. The capital expenditure was £8.5 million in H1 FY20 and as on 30 June 2020, Polypipe Group had net debt of £71.2 million. In May 2020, the Group raised £120 million through equity issue.

Performance by Business Segment in H1 FY2020

Residential Systems generated revenue of £92.8 million in H1 FY20, which fell by 28.1 percent year on year from £129.0 million in H1 FY19. The segment generated an underlying operating profit of £7.4 million in H1 FY20. The business performance of Residential Systems was impacted due to low volume sales and as the new build market remained closed in April and May 2020. Commercial & Infrastructure Systems earned revenue of £80.8 million in H1 FY20, which declined by 14.3 percent year on year. Commercial & Infrastructure Systems reported an underlying operating profit of £3.1 million. The division continued to supply plumbing and repair materials to contractors for essential repair works during the lockdown.

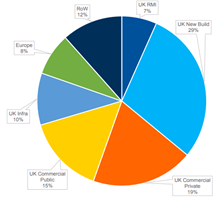

Demand Drivers of Residential Systems and Commercial & Infrastructure Systems in 2019

Residential Systems Commercial & Infrastructure Systems

Share Price Performance Analysis(Source: Group website)

1-Year Chart as on September-15-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Polypipe Group PLC's shares were trading at GBX 429.00 and were up by close to 5.15 percent against the previous closing price (as on 15 September 2020, before the market close at 1:30 PM GMT+1). PLP's 52-week High and Low were GBX 620.00 and GBX 372.00, respectively. Polypipe Group had a market capitalization of around £930.10 million.

Business Outlook

The construction and housing market in the UK has started to recover slightly after the building and construction resumed. The business performance of Polypipe Group witnessed an uptick in July and August 2020 that was above management's expectation. It has experienced growing enquiries for ventilation systems as people look to mitigate the covid-19 risks. The volatility in the macroeconomic conditions and fall in consumer spending is likely to impact the construction market in 2021. However, the Group is confident about the government's infrastructure investment that would support the building materials sector. The medium-term driver of the construction sector is the shortage of housing and carbon-zero construction.