Summary

- GMB, one of the labour unions of Centrica, is expected to go on strike early next year after a majority of members voted in favour of industrial action against the company.

- The FTSE 250-listed energy company planned to axe 5,000 jobs and simplify the employment contracts, which GMB members refused to follow.

- The company has accelerated its cost savings with a significant amount of restructuring still underway.

The tensions seem to have escalated between Britain’s largest energy supplier Centrica Plc (LON: CNA) and one of its labour unions. The union has accused Centrica of forcing its employees to accept new employment contracts in a bid to restructure its workforce. As a result, the union has warned for industrial action in January.

GMB, one of the unions that represents more than 9,000 workers, is expected to go on strike as a majority of its members voted in favour of industrial action against the company asking all employees to sign new contracts or get fired.

Also read: Fire and rehire: Employees’ strike likely at Centrica-owned British Gas

New Contract

Centrica introduced new employment contracts as part of a restructuring in 2015. Since then, the union has witnessed nearly 18,000 job cuts. Notably, Centrica has more than 80 separate agreements to tackle various types of employees. Although other unions have accepted the new contracts, GMB has been objecting to the company’s new rules.

The recent entrant of the FTSE 250 index, Centrica intends to simplify the employment contracts for its workforce and has initiated talks with unions in this regard. As a last resort, if the talks with unions are not fruitful, the company could seek to terminate existing contracts and offer fresh terms, which is known as Section 188 notice.

The GMB, on the other hand, has said that it has lost faith in the company as they often threaten job cuts. Axing jobs has been a common phenomenon in the wake of the coronavirus pandemic. In a bid to help the struggling energy company survive the financial disruption, the energy company planned to axe 5,000 jobs.

Moreover, due to the fierce competition in the energy market, Centrica has seen major value erosion and slipped out of the premium FTSE 100 index earlier this year, losing a significant chunk of its market capitalisation. It is worth noting, in the last two years, British Gas has lost about a million customers.

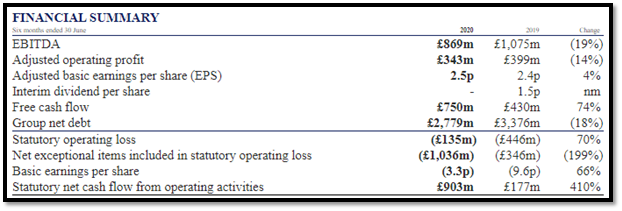

Centrica’s Business Highlights for H1 FY20

(Source: Company’s filings, LSE)

Centrica helps customers to make a swift transition to a lower carbon future and remains a customer-focused energy services company. The company has accelerated its cost savings with a significant amount of restructuring, which is still underway.

The company has shown an improvement in its financial performance in the first half of FY2020, despite the decline in top-line performance. The bottom-line performance has improved but remained in the red for H1. With the easing of lockdown, the group witnessed a recovery in demand for energy services and solutions in the core market.

In the H1 of FY2020 due to lower revenue generated from all business streams, the revenue declined to £10,695 million, which was £11,568 million in H1 FY2019. The EBITDA declined by 19 per cent to £869 million in H1 FY2020 (H1 FY2019: £1,075 million).