Summary

- GlaxoSmithKline Plc is among the few spearheading the discovery of a potential vaccine to combat the deadly coronavirus.

- The pharmaceutical company spends a lot of money on research development every year to stay ahead of the competition in the global healthcare industry

- GSK’s strategy is to tap the maximum market opportunities by leveraging upon its robust R&D capabilities while mitigating the potential risk of a rapidly changing environment.

- GSK has remained consistent with its dividend pay-outs, which makes it one of the best dividends paying stocks

The world has underpinned high hopes on the global pharmaceutical industry to find a cure for the coronavirus pandemic, which has weighed heavily on countries with an enormous amount of economic and human cost. GlaxoSmithKline Plc (LON: GSK) is a global healthcare company, which has been among the few spearheading the discovery of a potential vaccine to combat the deadly coronavirus.

GSK & HealthCare Industry

GSK is one of the largest producers and developers of vaccines across the globe. Vaccination programmes are undertaken by almost all the governments across the world to protect the masses from preventable diseases. The importance of these vaccination programs is expected to increase over time as the global population continues to grow. These vaccination programs are often partially or fully funded by the governments.

As per the recent report from Research and Markets, the market size of the global healthcare industry is expected to reach US$11,908.9 billion by 2022, from US$8,452 billion recorded in 2018, growing at a compounded annual growth rate of 8.9 per cent. As the world’s population continues to grow (8.5 billion expected by 2030), with a major component of the ageing population, the healthcare sector seems to have a lot of ground to cover which provides ample headroom of growth for companies like GSK. Moreover, improved quality of life means the availability of better healthcare systems.

Scope and opportunities for GSK

GlaxoSmithKline is most likely to benefit from the vaccination programmes in the future as the pharmaceutical company spends a lot of money on research development every year to stay ahead of the competition in the global healthcare industry.

GSK’s strategy is to tap the maximum market opportunities by leveraging upon its robust R&D capabilities while mitigating the potential risk of a rapidly changing environment. The Company strives to upgrade the old products and improve them to provide an updated offering in the healthcare market. The Company is also open for inorganic growth and continuously looks to grow further by making acquisitions and partnerships.

GSK’s-Recent developments

- GSK in collaboration with Sanofi has initiated Phase 1/2 clinical trial of their Covid-19 vaccine after receiving promising pre-clinical studies. Upon successful completion of this study, the company expects to move into a Phase 3 trial by the end of 2020. The Group had collaborated with Sanofi to find the potential solution for SARS-CoV-2 in April 2020

- Sanofi and GSK had signed agreements to provide millions of doses of adjuvanted COVID-19 vaccine to the UK, EU, US, and Canada

- GSK's BLENREP known for curing patients suffering from patients with relapsed or refractory multiple myeloma received regulatory approval from the US Food and Drug Administration (FDA)

- GSK announced a strategic collaboration agreement with CureVac in July 2020 for development and commercialisation of monoclonal antibodies and up to five mRNA-based vaccines. The agreement would be a strategic collaboration for R&D, manufacturing, development, and commercialisation of mRNA-based vaccines and mAbs (monoclonal antibodies)

Resilient Earnings for Second Quarter

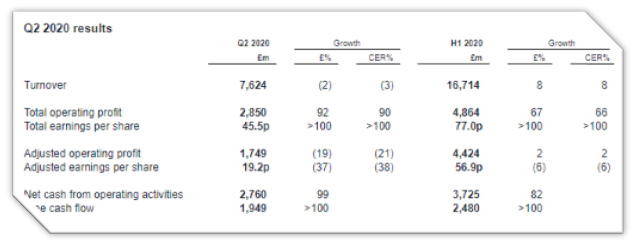

(Source: Company’s filings, LSE)

During the Q2 2020, the company delivered resilient performance. The company received a positive regulatory review for its new speciality pipeline medicines to treat Oncology and HIV and made further progress with the Future Ready programmes and Consumer Healthcare integration.

Over the course of four years (FY15-19), GSK’s statutory revenue grew from £23,923 million to £33,754 million at a CAGR (compounded annual growth rate) of 8.99 per cent. This implies that the company has stable revenue streams despite the challenges in the trading environment. GSK’s stock looks defensive able to survive all kinds of economic cycles.

GSK is also consistent with its dividend pay-outs, which makes it one of the best dividends paying stocks and well suited for income-seeking investors. Although the Reported Group sales fell by 3 per cent to £7.6 billion during the second quarter of 2020, GSK still managed to declare a dividend of 19 pence per share for the period. Notably, GSK’s dividend pay-out ratio stood at 41.80 per cent, which means that it will be distributing 41.80 per cent of its retained earnings to its shareholders. This proves the confidence GSK has in its products portfolio and business operations.

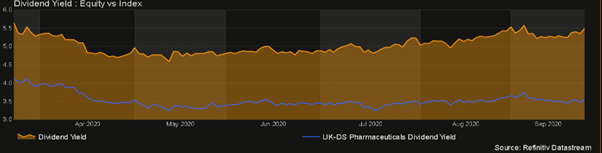

(Source: Refinitiv, Thomson Reuters)

GSK’s annual dividend yield stood at 6.80 per cent, which is higher than the benchmark index. The dividend yield is contra to the stock price; which means that a fall in stock prices would lead to higher Dividend yields. Higher Dividend provides investors with the opportunity to invest in businesses at a lesser price, which means that the stock is priced less than its intrinsic value.

GSK-Stock Dynamics

Talking about intrinsic value, GSK’s Price to Earnings (P/E) multiple stood at 12.3, while the industry’s P/E multiple stood at 27.2, which is twice more than that of GSK. This implies that GSK’s stock is currently trading cheaply and is undervalued.

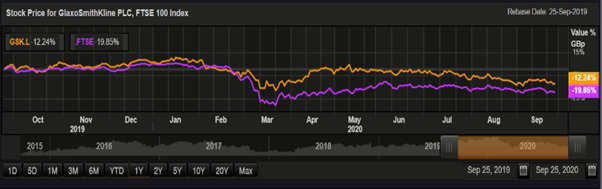

(Source: Refinitiv, Thomson Reuters)

Over the course of the last five years, GSK’s shares have delivered a double-digit price return of 16 per cent. The stock created a new bottom of GBX 1,374.60 during the peak of the heightened crisis. Since then, GSK shares have regained momentum and have delivered a price return of 7.26 per cent as of 25 September 2020 closing.

Comparative chart: GSK vs FTSE 100

(Source: Refinitiv, Thomson Reuters)

The pharmaceutical field requires extensive research and testing, which usually takes a lot of time. The gestation period of the final product is usually long. GSK shares have performed better than the benchmark index in the last five years. On the operational front, the company has several new products under the pipeline in all the three stages: Phase I, Phase II and Phase III, focused on HIV, Anaemia associated with chronic renal disease, and COPD, respectively. This stock can provide the income-seeking investors portfolio a new dimension. Seasoned investors should keep an eye on the recent developments and progressions made by the company this year.