Highlights

- Acquisition of Havieron gold-copper project and Telfer mine positions Greatland Gold as a major operator in the Paterson region.

- Initial production estimates from Telfer and Havieron outline robust outputs at competitive costs, with significant opportunities for mine life extension.

- AU$100 million funding secured, with pathways established for fully funding Havieron development.

Greatland Gold plc (LSE:GGP) has finalized the acquisition of a 70% stake in the Havieron gold-copper project and full ownership of the Telfer gold-copper mine from Newmont Corporation. The transformative deal consolidates Greatland’s position as a leading player in Australia’s Paterson region and is expected to generate substantial shareholder value.

Strategic Value of the Acquisition

The acquisition integrates Telfer’s existing infrastructure with the Havieron project, creating a seamless and optimized mining operation. Telfer, an operational gold-copper mine, offers immediate cash flow opportunities, with an estimated 11.5Mt of high-grade ore stockpiles available for near-term production. Additional stockpiles of 20Mt provide further potential for cost-effective processing.

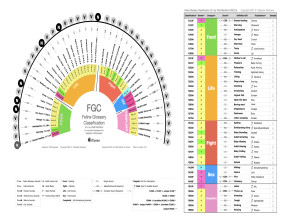

Havieron, a globally significant gold-copper project, boasts a Mineral Resource of 8.4Moz gold equivalent. The project’s base case, as detailed in an independently reviewed report, outlines a 20-year mine life with an annual production average of 258koz gold equivalent at globally competitive costs of $818/oz.

Workforce and Operational Continuity

Greatland has successfully transitioned 435 Telfer employees, ensuring continuity of operations and retaining critical expertise. The company plans to optimize operations through a Telfer-wide resource review, with an updated Mineral Resource estimate expected by March 2025. This will include drill testing for high-priority extensions to the mine life.

Funding Secured for Growth

To support its operations, Greatland has secured a AU$100 million syndicated debt facility, including a revolving working capital facility. Additionally, the company has a non-binding letter of support for AU$750 million to develop Havieron. Combined with cash flow from Telfer, Greatland expects a clear and non-dilutive funding pathway for Havieron’s development.

Newmont's Role and Deferred Consideration

Newmont Corporation, now Greatland’s largest shareholder with a 20.4% stake, has committed to a 12-month voluntary lock-in and a further 12-month orderly market agreement. Up to $100 million of the acquisition cost is deferred until Havieron achieves commercial production, reflecting Newmont’s confidence in Greatland’s stewardship.