Summary

- 3i Group Insiders have been quite active in the market and have bought nearly £60 million of shares in last twelve months.

- Simon Borrows, CEO and Executive Director of 3i Group, bought £59 million worth of shares in last one year.

Last few months have been very eventful for 3i Group Insiders. The biggest purchase was made by its CEO Simon Borrows, as reported by some media outlets.

Purchase and selling of shares by company top executives who are deemed insiders is considered to be legal. It is a widespread phenomenon that company’s insiders are keen on taking positions in a company anticipating its solid future. The price point at which an insider is willing to buy shares is very significant. Even if they buy at a higher price point, the consensus is that the share price might go up.

Also read: How Are the Business Prospects Shaping up for 2 LSE Stocks: 3i Infrastructure & Creo Medical Group?

Notably, the insiders have bought nearly shares worth £60 million in the last one year. In the last quarter, Simon Borrows, CEO & Executive Director of 3i Group (LON: III), bought shares worth £59 million.

In the present scenario, market is quite transparent, and the details of these transactions are disclosed to the market by the company. As a commonly viewed practice, transactions done by insiders should not be followed blindly as the real reason behind such transactions cannot be ascertained. However, these transactions should be kept in mind while optimising one’s portfolio.

Impact on 3i Group shares

Shares of 3i Group hit their 52-week low when the initial lockdown was announced in March 2020. Since then, the shares of the UK-based investment company rose by nearly 92 per cent to close at GBX 1,147 on Friday, 12 February.

Copyright © 2021 Kalkine Media Pty Ltd.

(Source: Company’s filings, LSE)

In the Q3 of FY2021 ended 31 December 2020, 3i Group delivered solid performance. The company recorded 3.4 per cent increase in its NAV per share to 936 pence quarter-on-quarter. Despite the pandemic-led disruption, the company recorded good sales, EBITDA and cash generation in the nine-month period ended 31 December.

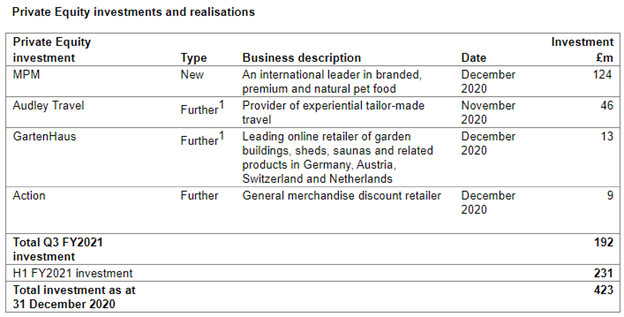

The company’s portfolio delivered robust performance as it constitutes of e-commerce, healthcare, and consumer services sectors. The investment company completed several acquisitions and private equity investments during the period.

The company has paid a dividend of 17.5 pence per share: first FY2021 dividend amounting to £169 million in January. Shares of 3i Group traded at GBX 1,168 on 15 February 2021 at GMT 08:34 AM+1.

The insiders also tend to sell their holdings in anticipation of weak performance. However, these actions by the insiders could spill some volatility in the company’s stock. In addition, there might be some instances were buying and selling transactions of insiders might impact analysts’ and fund managers’ investment strategies.