Summary

- Augmentum Fintech Plc's NAV per share increased by 6.50 pence in FY20.

- Company has announced the fundraising of £28 million.

- Vast Resources Plc raised £1.75 million through the placement of new shares.

- Port delivery of copper concentrate of 350-400 tonnes expected in early November.

Augmentum Fintech Plc (LON:AUGM) and Vast Resources Plc (LON:VAST) are LSE listed stocks in the financial services industry and the mining industry, respectively. Shares of AUGM & VAST were down by 0.40% and 0.31%, respectively from the last closing price (as on 27 October 2020, before the market close at 8:15 AM GMT).

Are Augmentum Fintech Plc's investments lucrative?

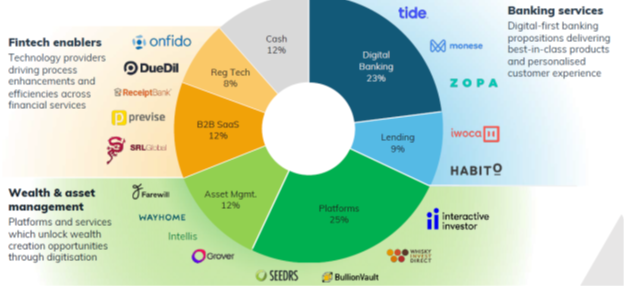

Augmentum Fintech Plc is the FTSE All-Share listed company, a leading venture capital investor that invests in fast-growing fintech businesses focusing in the UK and Europe. The Company has a robust, diversified portfolio of 18 private fintech companies across various verticals.

(Source: Company Presentation)

Upcoming Event - The Company expects to publish its interim results for the period to 30 September 2020 in early December 2020.

Recent Developments

As per the update released on 26 October 2020, the Company has provided an update on the performance of their portfolio companies for the half-year period ended on 30 September 2020. The portfolio companies witnessed a strong performance in the current volatile environment.

Interactive Investor constitutes 16.1% of NAV in H1 revenues of the Company, and it increased by 62% year-on-year. The number of customers acquired in the first two quarters of 2020 has exceeded the total number of acquired in the entire 2019. In September 2020, Tide, representing 10.50% of the Company's portfolio, was awarded a £25 million Banking Competition Remedies (BCR) Pool E grant. Monese (7.5% of NAV) has signed a strategic partnership with Mastercard to deliver better local banking services.

The Company has announced that it would raise close to £28 million through the placement of shares at 120 pence per new share. The proceeds from the issuance will be used to fund portfolio investment opportunities identified in relevance to the Company's objective. The fundraising will be closed on 29 October 2020.

Seedrs, representing 1.2% of the Company's portfolio, is going to merge with Crowdcube, and it would create one of the world's largest private equity firm. Tide, holding 11.5% of the Company's portfolio, received a £25 million grant from the RBS Alternative Remedies Package to challenge the main street banks, in partnership with ClearBank.

FY20 results (ended 31 March 2020) as reported on 16 July 2020

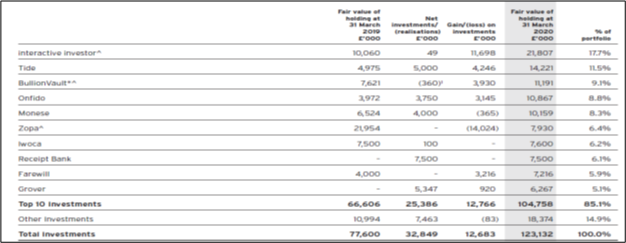

In FY20, gains on investment grew by 4.1% year-on-year to £12.68 million. The return for the year fell by 22% to £7.80 million in FY20 against £10.02 million in FY19. The Company had cash of £15.11 million at the end of FY20.

The Company has shown an increase of 6.5 pence year on year in their NAV per share as on 31 March 2020 and IRR on the invested capital is 18% since inception. The performance of top 10 investments as on 31 March 2020 from the portfolio is shown below -

(Source: Company Presentation)

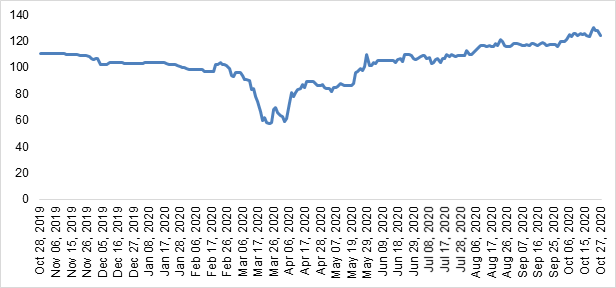

Share Price Performance Analysis of Augmentum Fintech Plc

(Source: Refinitiv, chart created by Kalkine Group)

Shares of Augmentum Fintech Plc were trading at GBX 124.00 and were down by close to 0.40% against the previous closing price (as on 27 October 2020, before the market close at 08:15 AM GMT). AUGM's 52-week High and Low were GBX 131.50 and GBX 55.00, respectively. Augmentum Fintech Plc had a market capitalization of around £146.66 million.

Business Outlook

In FY20, the Company has invested in 3 portfolio companies, taking the count of its portfolio investments to 18. The Company is investing in high-performance European fintech business. The current investment climate will provide opportunities for 'special situation' investments. The Company has already identified several lucrative investment opportunities and subsequently, raised £28 million in October 2020 to fund those investments.

Will Vast Resources Plc capitalize on its upcoming projects?

Vast Resources Plc is the AIM-listed mining company having mines in Romania and Zimbabwe. In Romania, the portfolio includes an 80% interest in the Baita Plai Polymetallic Mine and owns the Manaila Polymetallic Mine. In Zimbabwe, the Company's focus is on the commencement of the joint venture mining agreement on the Chiadzwa Community Concession Block of the Chiadzwa Diamond Fields.

(Source: Company website)

Recent Developments

- On 26 October 2020, the Company reported that renewal of Manaila mining license in Romania had been granted for a period of 5 years to 29 October 2025.

- The Company has updated regarding the first port delivery of 350-400 tonnes of copper concentrate from Baita Plai Polymetallic Mine in Romania. The deal with Mercuria will take place in early November 2020. The JORC reserve and resource report for the Baita Plai Project is expected to be received by the end of October.

- Regarding the asset-backed debt financing deal, the Company has confirmed the independent technical consultants have completed the required site visit, and the independent environmental consultants have confirmed to undertake site visit at Baita Plai in October 2020. The Company, along with the international banking institution, will finalize the term sheet by November 2020 and seek the final approvals by December 2020. The Company has raised close to £1.75 million before costs through the placement of 1.09 million ordinary shares at 0.16 pence. The fund would be used for additional working capital requirements.

- On 22 September 2020, the Company announced that Mark Mabhudhu, Executive Director of the Company's Diamond Division, would step down from his current role as he has accepted an offer to join the Government-owned Zimbabwe Consolidated Diamond Company (ZCDC) as Chief Executive Officer starting immediately.

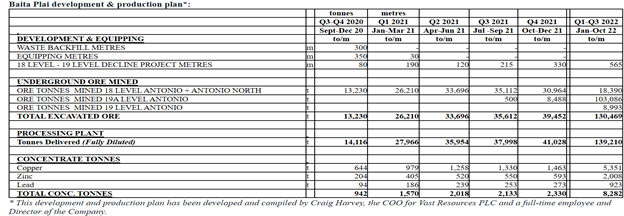

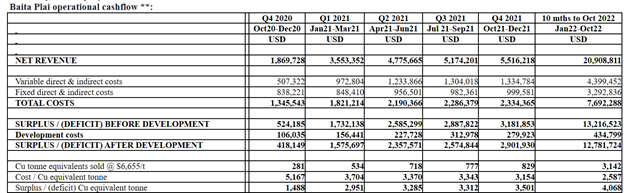

Baita Plai development and production plan

(Source: Company website)

(Source: Company website)

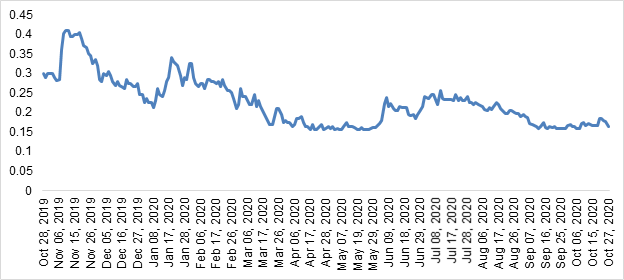

Share Price Performance Analysis of Vast Resources Plc

(Source: Refinitiv, chart created by Kalkine Group)

Shares of Vast Resources Plc were trading at GBX 0.1630 and were down by 0.31% against the previous closing price (as on 27 October 2020, before the market close at 08:15 AM GMT). VAST's 52-week High and Low were GBX 0.47 and GBX 0.13, respectively. Vast Resources Plc had a market capitalization of around £21.81 million.

Business Outlook

The Company has not reported the revenues from the last 18 months. Baita Plai mine has resumed its production, and the first consignment is expected to deliver by next month. The Company has also planned to fundraise to meet its working capital requirements. The October production and sales target will meet the expectation as announced in the project production and associated operational cash flow forecasts.