Summary

- OneSavings Bank's net loan book increased by 2 percent year on year and it reported a profit after tax of £119.2 million in H1 FY2020.

- The Bank provided a mortgage payment holiday to approximately 26,000 mortgage accounts.

- Provident Financial reported revenue of £445.6 million in H1 FY2020.

- The Company incurred an impairment charge of £207.7 million and reported a loss of £23.1 million in H1 FY2020.

OneSavings Bank PLC (LON:OSB) & Provident Financial PLC (LON:PFG) are two FTSE 250 listed financial services stock. As on 30 June 2020, gross loan to the customers for OSB was £10,937.2 million and for PFG was £2,822.9 million. Based on 1-year performance, shares of OSB and PFG were down by about 9.85 percent and 35.13 percent, respectively. Shares of OSB were down by nearly 1.00 percent and shares of PFG were up by about 0.08 percent, respectively from previous closing price (as on 28 August 2020, before the market close at 12:10 PM GMT+1).

OneSavings Bank PLC (LON:OSB) - Underlying return on equity was 18 percent in H1 FY2020

OneSavings Bank PLC is a UK based financial group that is engaged in lending and retail saving business. The Group operates retail saving business through brands such as Kent Reliance and Charter Savings Banks. It has a securitization platform for the issuance of residential mortgage-backed securities. OneSavings Bank is listed on the FTSE-250 index.

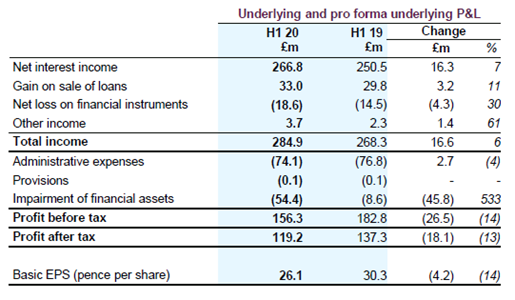

H1 FY2020 results (ended 30 June 2020) as reported on 27 August 2020

(Source: Group website)

In H1 FY20, based on the statutory reporting, the gross new lending increased by 29 percent year on year to £2.1 billion. The net loan book was £18.5 billion in H1 FY20, which increased by 2 percent year on year from £18.2 billion in H1 FY19. The profit before tax was £156.3 million, which declined by 14 percent year on year from £182.8 million in H1 FY19. It incurred an impairment charge of £54.4 million, mainly related to covid-19. The profit after tax was £119.2 million in H1 FY20. The interest margin declined to 2.50 percent in H1 FY20 from 2.70 percent in H1 FY19 that was mainly due to the changing asset mix and the Group's intention to maintain higher liquidity in H1 FY20. The cost to income ratio improved to 26 percent in H1 FY20 from 29 percent a year ago. The cost to income ratio is the administrative expense to the total income. The underlying return on equity declined to 18 percent in H1 FY20 from 24 percent in H1 FY19. As on 30 June 2020, the Group provided mortgage payment holiday to approximately 26,000 mortgage accounts that were about 28 percent of the total loan book value. OneSavings Bank categorizes the lending business under OneSavings Bank PLC (OSB) and Charter Court Financial Services Group PLC and CCFS. OSB and CCFS were combined in October 2019. As on 30 June 2020, the gross loans and advances to customers for OSB was £10,937.2 million and for CCFS was £7,674.3 million.

Share Price Performance Analysis

1-Year Chart as on August-28-2020, before the market close (Source: Refinitiv, Thomson Reuters)

OneSavings Bank PLC's shares were trading at GBX 298.40 and were down by close to 1.00 percent against the previous closing price (as on 28 August 2020, before the market close at 12:10 PM GMT+1). OSB's 52-week High and Low were GBX 461.00 and GBX 155.30, respectively. OneSavings Bank had a market capitalization of around £1.34 billion.

Business Outlook

The Group expects the net loan book to grow by double-digit in FY20, excluding the asset sales impact. For the full year, it expects the net interest margin would be flat, and the underlying cost to income ratio would be higher as compared to H1 FY20. The board is currently reviewing full consolidation of OSB and CCFS with regards to locations and suppliers.

Provident Financial PLC (LON:PFG) – No interim dividend declared in H1 FY20

Provident Financial PLC is a UK based financial group that provides personal credit products to the non-standard credit market. The Group owns businesses such as Vanquis Bank, Provident home credit, Satsuma loan and Moneybarn. It serves close to 2.3 million customers, and it is included on the FTSE 250 index.

H1 FY2020 results (ended 30 June 2020) as reported on 26 August 2020

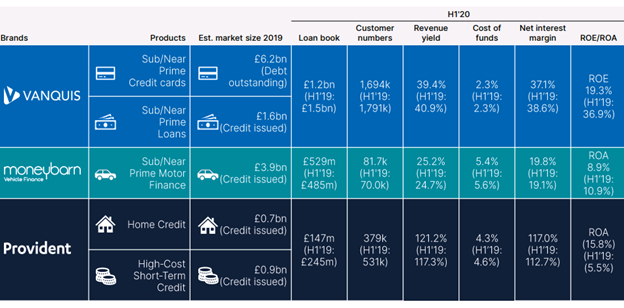

In H1 FY20, the Group reported revenue of £445.6 million that was below £501.5 million reported in H1 FY19. The revenue yield declined to 44.3 percent in H1 FY20 from 47.7 percent in H1 FY19 that was mainly impacted due to the covid-19. The net interest margin declined to £409.6 million in H1 FY20 from £465.0 million a year ago. Net interest margin was 40.9 percent in H1 FY20 lower than 44.3 percent in H1 FY19. An adjusted profit before tax and impairment was £207.7 million, which declined by 15.7 percent year on year from £246.3 million in H1 FY19. Provident Financial incurred an impairment charge of £240.3 million in H1 FY20. The loss for the reported period was £23.1 million, and loss per share was 9.1 pence in H1 FY20. As on 30 June 2020, the Group had liquidity of £1.2 billion that includes nearly £1.0 billion funds with Vanquis bank. The Group plans to repay funds it has received under the government's job retention scheme. It did not declare the interim dividend and highlighted that dividend payment would be resumed when economic conditions are back to normal.

Performance by business division in H1 FY2020

(Source: Company website)

Vanquis Bank reported profit before tax of £11.8 million in H1 FY20 that was lower than the previous year following the decline in customer spends and covid-19 related impairments. The new customer bookings were 147,000 in H1 FY20 that was 190,000 in H1 FY19. The new customer bookings have picked up recently to 50 percent of the pre-covid level. Approximately 2 percent of the total customers took payment holiday, and the amount was 4 percent of the outstanding balance. Moneybarn generated profit before tax of £2.4 million in H1 FY20. Consumer Credit Division (CCD) reported a loss before tax of £37.6 million in H1 FY20.

Share Price Performance Analysis

1-Year Chart as on August-28-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Provident Financial PLC's shares were trading at GBX 245.40 and were up by close to 0.08 percent against the previous closing price (as on 28 August 2020, before the market close at 12:10 PM GMT+1). PFG's 52-week High and Low were GBX 492.17 and GBX 126.87, respectively. Provident Financial had a market capitalization of around £621.87 million.

Business Outlook

The Company has witnessed improvement in customer spend and consumer demand in July and August which should support the business in the third quarter. Moneybarn business performance was strong in July 2020 as 4,500 deals were written despite tighter conditions. The Company targets return on equity in the range of 20 percent to 25 percent over medium-term. The main target in H1 FY20 and 2021 is to carry out prudent lending as the Company lends to customers for whom mainstream lending is inaccessible.