In a bid to help accelerate global efforts to move to a low-carbon economy, LGIM, Britain’s biggest asset manager plans to increase the number of companies it assesses and engages with over climate change

- Legal & General Group is committed to reducing carbon footprint by 2030 from its asset portfolio and aims to improve lives through inclusive capitalism

- It Is really important for global businesses to help in reducing the carbon emissions over the course of the coming decades

A part of UK’s leading insurer, Legal & General Group Plc (LON: LGEN), Legal & General Investment Management (LGIM) aims to increase the number of companies covered by its Climate Impact Pledge by ten times. The Group will be providing climate ratings to various companies which are covered by its Climate Impact Pledge and would disclose them on its website. Britain’s biggest asset manager vote against their boards at the companies’ annual general meetings (AGM’s) and potentially divest their shares from their portfolio; would also publish the names of the worst-performing companies on its website.

Notably, Legal & General Investment Management has more than £1.2 trillion worth of assets under management. It Is really important for global businesses to help in reducing the carbon emissions over the course of the coming decades.

Also read: Brunel Pension Partnership- Financial Services Sector Not Capable Of Addressing Climate Change

In 2016, LGIM decided to help to meet the goals of the 2015 Paris Agreement on climate change and therefore, was committed to engaging with the largest companies across critical sectors of the economy such as the oil and gas, mining, electric utilities, automotive and few others. LGIM is likely to expand its reach beyond these critical sectors to the cement, steel, chemicals, property, transport, technology, and telecom sectors.

The asset manager is likely to develop a comprehensive assessment framework to better understand the strategy of companies for making a transition to a low-carbon economy before engaging directly.

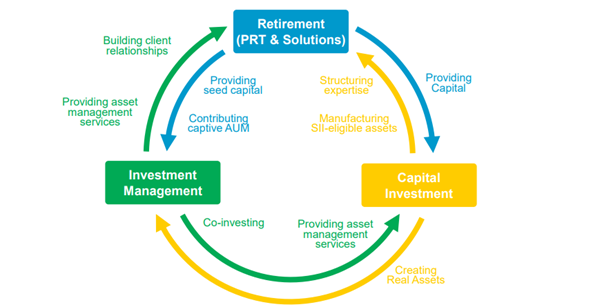

(Source: Company’s presentation, LGEN Business model)

In addition to having set reduction targets aligned with a 1.5 degree Celsius interpretation of the 'Paris' commitment, the company intends to exclude investments in thermal coal and other carbon-intensive projects and periodically measures the carbon intensity of its investment portfolios.

The leading asset manager actively invests in energy-efficient property, renewables, and new science to support de-carbonisation and has implemented additional controls over the acquisition of high carbon investments. Moreover, the house-building business of the company is committed to reducing its carbon footprint from 2030 by delivering a low carbon, energy-efficient homes. The asset manager reduced the carbon emissions of the Group asset portfolio by 6 per cent during 2019.

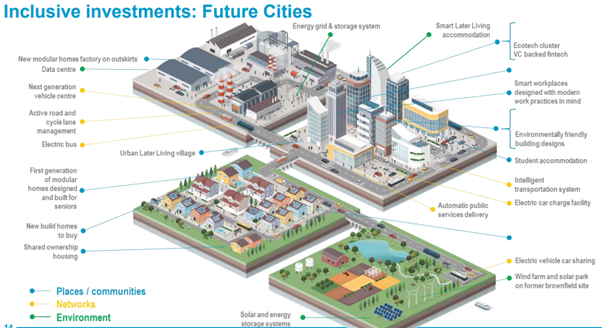

The company has invested nearly £1 billion into the real economy across fifteen UK towns and cities through its Future Cities portfolio, which comprises of climate & energy investments that include renewable infrastructure and clean technology, urban development, science and technology-focused real estate, and data centres.

Also read: PM Johnson Urge Leaders at UN Climate Roundtable to Rebuild A Greener Planet

Legal & General Capital expanded its portfolio further to cover low carbon heat, transport, power generation and made further climate & energy investments during the first half of 2020. Clean energy investments have now reached £1.4 billion across the Legal & General Group.

(Source: Company’s presentation)

The Company believes that the business is well placed to pursue upcoming opportunities during the second half of 2020, well supported by strong competitive positioning in growing and profitable markets.

The Legal & General Retirement Retail (LGRR) segment is on course for delivering growth due to welfare reforms and ageing demographics. Legal & General Insurance expects to emerge stronger from the ongoing coronavirus pandemic. The company remains committed to delivering inclusive Capitalism and intend to be a leader in the post-pandemic economic recovery, extending support to all its stakeholders, and customers.

Also read: The UK is near the bottom of the climate investment ladder in Europe

Over the course of the next five years, the Group intends to write £40 to £50 billion of UK pension de-risking business. In October 2020, Legal & General Reinsurance announced that Fitch Ratings had upgraded the Insurer Financial Strength to ‘AA-’ from ‘A+’, which indicates strong growth potential.

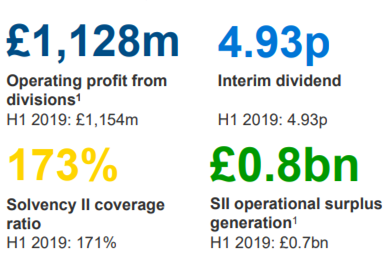

Financial Highlights

(Source: Company’s presentation)

The Company maintained a strong balance sheet, and resilient operating profits, with solvency II coverage ratio of 173 per cent and unutilised credit default reserve of £3.5 billion during the first half of 2020.

Also, the profit was down, due to the unrealised impact of market movements and the formulaic impact of lower interest rates on Legal & General Insurance (LGI) during the first half of 2020. Due to the consistent performance of the growing annuity portfolio, the Legal & General Retirement (LGR) operating profit increased by 10 per cent year-on-year to £721 million during the period (H1 2020). Despite the global turmoil caused by the pandemic, the Company declared an interim dividend per share of 4.93 pence during the first half of 2020, which was in line with the previous year.

Legal & General has recently also emphasised on ethnic diversity and has warned the FTSE 100 listed companies to have at least one BAME (black, Asian or other minority ethnic ) board member by 2022, or else it will vote against those that fail to diversify their leadership teams.

It is not just the carbon-intensive industries which have the onus of reducing the carbon footprint across the world. Other sectors would have to shoulder the responsibility as well and do their bit to make progress towards the desired goal, and also support other businesses in making this transition.