Summary

- Amigo Holdings Plc has reported a revenue contraction of 36.5% during H1 FY21.

- The Company has witnessed a net loan book reduction of 33.6% to £2 million during H1 FY21.

- The number of customers declined by 21.0% during H1 FY21.

Amigo Holdings Plc (LON:AMGO) is the LSE listed financial services stock. Based on 1-year performance, shares of AMGO have generated a return of -83.20%. Shares of AMGO were up by close to 8.15% from the last closing price (as on 27 November 2020, before the market close at 02:40 PM GMT).

Amigo Holdings Plc is the FTSE All-Share listed company, which is the leading provider of guarantor loans in the UK and offers access to credit to those who are unable to borrow from usual channels because of their weak credit history.

Guarantor Loan Industry Overview

The Guarantor Loan industry is on an evolving phase, and balance on guarantor loan has almost doubled since 2016. The industry has gotten boosted by digital transformation as technology, and the internet has provided access to a wide range of customers. Lenders provide easy approval to those applications which are backed by an acquaintance as a guarantor who is having a good credit history. The critical advantage of guarantor loans is that they can make lending accessible to customers who otherwise would not be able to borrow.

The industry has been adversely impacted by Covid-19 pandemic as most of the lenders have paused their lending activities and provided various payment holidays that led to a decline in its business.

Operational Highlights as reported on 26 November 2020

Covid-19 payment holidays - The Company has given Covid-19 related payment holidays to around 56,000 customers during H1 FY21 ended on 30 September 2020. The Company had approximately 39,000 customers on Covid-19 related payment holidays with over 12,000 customers plans completing and returning to standard payments as of 30 September 2020. The number of active plans had reduced to 22,000 with 29,000 plans ending and returning to standard payments as of 31 October 2020.

Complaints provision - The Company is maintaining complaints provision of £159.1million in its balance sheet as of 30 September 2020 while it was just £7.5 million as of 30 September 2019 due to £93.7million of charge as the consolidated statement of comprehensive income of which £86.9 million occurred in the second quarter. The significant rise has been caused due to the rise in complaint volumes from CMC which has been factored into half-year provision.

The Company had reviewed and reached a decision on all 25,571 of the complaints included within the VReq. The Company is still reviewing 2,517 of those complaints and decision is not taken yet, 2,209 relate to a specific group of complaints where guarantor payment on the loan has been a feature, and 238 relate to complaints where further information is required from third parties.

Impairment charges - The impairment charges as a percentage of revenues has declined from 31.1% in H1 FY20 to 21.1% in H1 FY21 due to significant reduction in new originations. The overall provision has reduced in line with the amortization of the loan book in the absence of any meaningful originations.

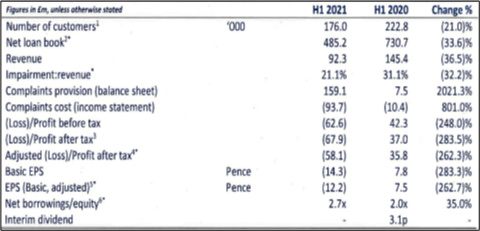

H1 FY21 results (ended 30 September 2020) as reported on 26 November 2020

(Source: Company result)

- The revenue of the Company has declined by 36.5% to £92.3 million during H1 FY21 ended on 30 September 2020 from £145.4 million for H1 FY20 due to temporary halt of lending activities and modification loss arising from Covid-19 related payment holidays.

- The reported loss after tax for H1 FY21 is £67.9 million while it has reported a profit after tax of £37.0 million in H1 FY20.

- Regarding the financial position, the Company had cash of £134.2 million as of 30 September 2020 while it was £27.9 million during H1 FY20.

- The number of customers declined by 21.0% from 222.8 million in H1 FY20 to 176.0 million in H1 FY21.

- The Company has witnessed a net loan book reduction of 33.6% to £485.2 million during H1 FY21.

- The net borrowings/equity ratio has also increased to 2.7x for H1 FY21 from 2.0x in H1 FY20.

- The Company has not declared any interim dividend for H1 FY21.

Recent Developments

On 19 November 2020, the Company provided an update that Michael Bartholomeusz will join the Board as a Non-Executive Director effective from the same day.

On 11 November 2020, the Company provided an update that under the 12-week exemption rule, Mike Corcoran has been appointed a Director of the Company and Chief Financial Officer (CFO), with an immediate effect.

On 10 November 2020, the Company provided an update that Mike Corcoran will join the Board as Chief Financial Officer (CFO) elect, subject to approval by the FCA effective from 01 December 2020.

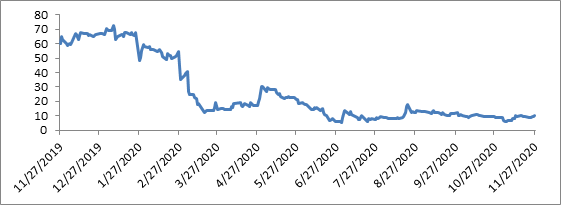

Share Price Performance Analysis of Amigo Holdings Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of Amigo Holdings Plc were trading at GBX 10.08 and were up by close to 8.15% against the previous closing price as on 27 November 2020, (before the market close at 02:40 PM GMT). AMGO's 52-week High and Low were GBX 73.60 and GBX 4.84, respectively. Amigo Holdings Plc had a market capitalization of around £40.83 million.

Business Outlook

The Company has witnessed a pretty challenging period during H1 FY21. However, the Company is quite optimistic regarding its prospects, and they have also started resolving out their legal issues. The Company has appointed a new board to tackle challenging business circumstances lying ahead. The Company has not provided any financial guidance for FY21 yet due to material uncertainties and lack of clarity on the financial impact of Covid-19 pandemic. The Collections from customers stood at 83% of pre-covid levels. The Company has adequate cash on its balance sheet to fund daily operations and has robust liquidity of £160.0 million of cash.