Highlights

- Non-Fungible Tokens are digital assets that are cryptographically represented and exist on a blockchain.

- In 2021, the NFT market was about US$12.6 billion, as compared to US$162.4 million in early 2021.

- NFTs are unregulated, which leads to a lot of uncertainty about its legal status.

Non-Fungible Tokens (NFTs) continue to take the crypto world to the next level with companies to celebrities everyone thinking to launch their exclusive NFTs. NFTs have the potential to make real money and its market may surpass the crypto market in near future, as per experts.

Non-Fungible Tokens are digital assets that are cryptographically represented and exist on a blockchain. It can be traded like any other commodity, products and services and represent the ownership of real-world items such as artwork, real estate, music, and videos.

In 2021, the NFT market has grown into a major part of crypto market, with the total market size of over US$12.6 billion, as compared to US$162.4 million in early 2021. During the year, most NFTs were created and traded using Ethereum blockchain technology, with a gas fees of around US$98.69 for minting a single NFT.

© 2022 Kalkine Media®

Currently, NFTs are unregulated, which points a finger at a very crucial question about its legality. Further, major trading platforms have the ability to invalidate and blacklist NFT, so a NFT collector should know their rights and remedies in such cases.

Holding NFTs allow you to own a specific copy or version of an item that NFT represents. It does not represent ownership of its physical form.

Investors usually make profit out of the NFTs by buying it on low price and selling them on secondary marketplaces, such as OpenSea. But little did they know that there are various ways to generate an income from NFTs than selling them at a higher price.

Also Read: Top 4 NFTs to watch out for in 2022

How to make money with NFTs

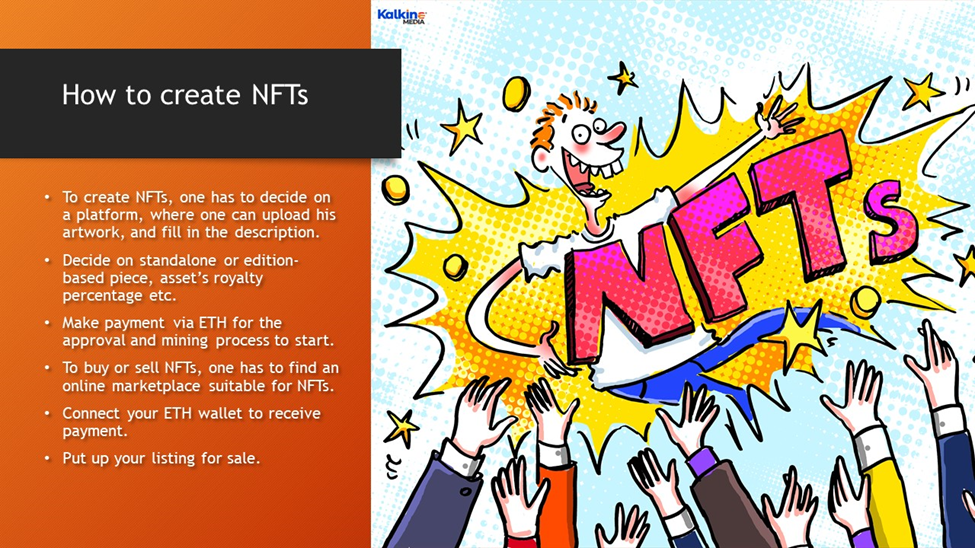

- Create and sell your digital work of art

If you are an artist, you may consider selling your NFT artwork, which is the most valuable NFTs ever created. In March 2021, Christie’s, one of the most renowned auction houses sold Beeple’s NFT artwork for US $69.3 million.

- Licensed NFT collectibles

If you already sell physical collectibles like trading cards you may consider selling them in digital form at a much higher price. Sports cards are the most popular type of licensed NFT collectibles and recently NBA has launched its NFT cards collection. Soon other organizations may launch their NFT cards.

The difference between NFT and physical trading cards are that physical cards can be easily damaged, but NFT cards are securely stored on the blockchain and never lose their quality.

© 2022 Kalkine Media®

- Play-to-earn games

Play-to-earn game is a new model in decentralized games and could very well be the future if BFT technology. These games are based on the blockchain technology and allows players to play and own and trade their in-game assets such as coins, virtual land, character, and weapons as NFTs on crypto market. If the gaming and blockchain ecosystems decide to sell in-game assets as NFTs, it will lead to tremendous boom in NFT market.

Also Read: South Korea to issue NFTs for presidential elections fundraise

- Rent out NFTs

If you have invested in NFTs you may earn passive income by renting them out. Some card trading games rent out NFT cards to players to help them in winning. Both the parties first must enter smart contract, and they have freedom to set their own terms such as lease rate and preferred duration.

- NFT Royalties

The NFT creator can receive passive income even after selling their NFT holdings to collectors as the technology in which NFT is based allow creator to set terms that impose royalty fees even when NFTs are traded on the secondary market. They can earn a share of NFT sale price.

For example, if the royalty fees are set at 5%, the original creator will get 5% of the total sale price every time the NFT is resold. The fees must be set by creators while minting the NFTs and smart contract governs the entire process, which makes the entire process is fully automated.

- Stake NFTs

Staking is the process of depositing or locking away digital assets into a DeFi protocol smart contract to generate income. Some platforms require you to buy native NFTs to earn staking token, while some support an extensive range of NFTs such as NFTX, Splinterlands, and Kira Network.

The part of the rewards earned by the stakers is denominated in governance tokens that offer them voting rights over the future development of their ecosystems. Stakers may also reinvest coins generated from staking into other revenue generating protocols.