Highlights

- Bitcoin reached its all-time high of US$68,789.63 on 10 November before closing the year at US$46,306.

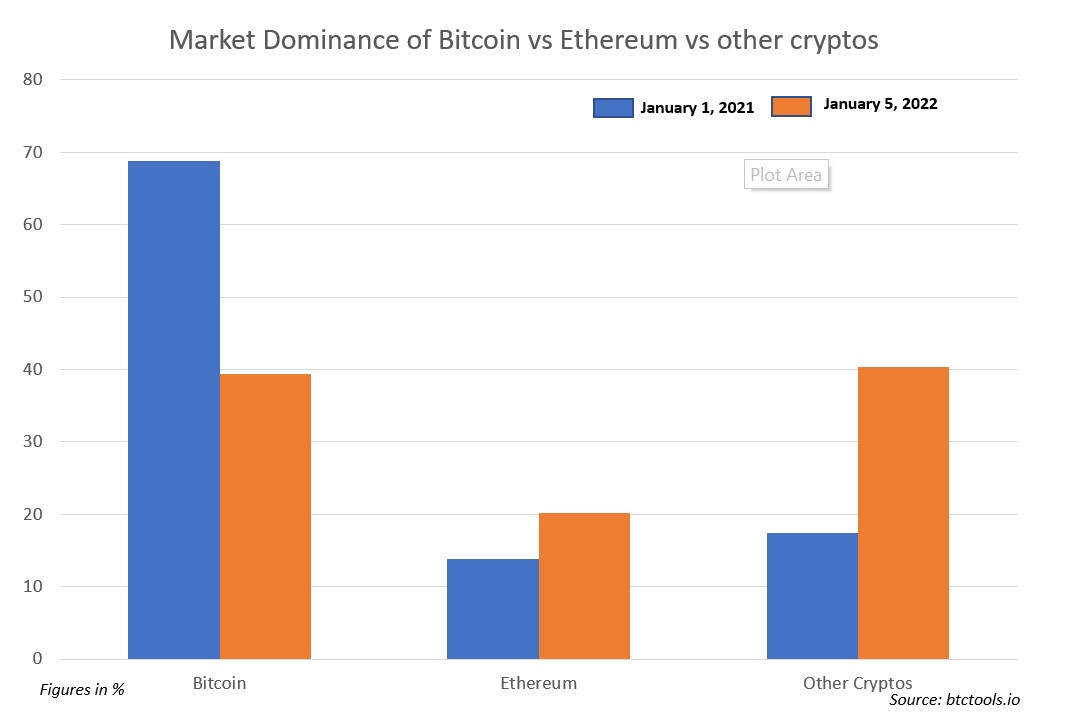

- When 2021 started, Bitcoin had a market dominance of close to 70%. That dominance has fallen 39% in 2021, as per CoinMarketCap.

- As on 5 January, Bitcoin was trading at US$46414, with a volume of $28,176,009,781 over a day. It was up slightly by 0.22% at the time of drafting with a live market cap of US$881,769,816,094

As Bitcoin enters its 13th year in 2022, crypto enthusiasts are watching the leading cryptocurrency with keen eyes. Bitcoin in fact celebrated its birthday recently on 3 January and has grown manifold since its launch in 2009. Despite its mixed run in 2021, Bitcoin still managed to register gains of well over 60%. Its gains came largely came on the back of sustained run, which saw its value treble to US$60000 between December 2020 to April 2021. But then, it was brought to its knees following a period of bearish run, where altcoins gained significant ground over the leading crypto.

Then once again in September-October 2021 it rallied following which, it reached its all-time high of US$68,789.63 on 10 November. It closed the year on a sombre note at US$46,306.45 leaving many experts predicting how the Bitcoin will shape up in its 13th year.

Let’s look at the possibilities of how the leading crypto will perform this year.

Bitcoin sluggish run will continue

Bitcoin’s sluggish run is likely to continue, considering that the market participants are in the accumulation phase. Market participants feel that first important thing for the leading cryptocurrency to reclaim its support of US$48,670. But for now, it has been meeting resistance and they feel that the trend could continue for January month as well.

Image source: Trading view

As on 5 January, Bitcoin was trading at US$46,414, with a volume of US $28,176,009,781 over a day. It was slightly up by 0.22% at the time of drafting with a live market cap of US$881,769,816,094.

Experts predict that Bitcoin will take some time to move out of the bearish phase and would need to be wary of another market crash like last year.

.png)

©2022 Kalkine Media®

Bitcoin’s dominance will continue to decrease

One thing that was pretty evident in 2021 was the drastic reduction of Bitcoin’s market dominance. When 2021 started, it had a market dominance of close to 70%. That dominance has fallen 39% as per CoinMarketCap.

©2022 Kalkine Media®

On the contrary, Ethereum has gained momentum in 2021. It was placed just at 13.89% at the start of 2021 and now has seen a significant rise in its market dominance and has moved up to 20.13%.

The Bitcoin’s dominance has slowed down largely due its volatility factor at the same time due to the eruption of the smart contract platforms like Ether, Cardano, Solana etc. More and more projects are being built on these platforms, giving them a bigger share of the market.

Bitcoin as a legal form of tender

More and more countries are looking to adopt Bitcoin as a legal form of tender. South American countries such as Paraguay, Brazil etc. and African countries are in favour of Bitcoin as a legal form of tender. In fact, many even of these nations even had favoured it when El Salvador adopted it. So, it won’t be wrong to assume that Bitcoin could well be used as a medium of exchange in countries.

Will Bitcoin hit US$100,000?

Well, that’s what the market wants at the moment, but experts are predicting that may be possible in the second half of the year. Leading Bloomberg analyst Mick McGlone feels that BTC can touch that figure in 2022 and that could be a reality.

Meanwhile, there are other sceptics as well who feel that if the bearish run continues, BTC could sink to as low as US$10,000. Sussex University professor Carol Alexander felt that Bitcoin could tank to US$10,000 in 2022, virtually wiping out all of its gains in the past year and a half.

Conclusion

All in all, Bitcoin’s path in its 13th year will not certainly be a bed of roses. It will definitely have it moments, but it will also be huge bumps in the road. But 2022 could well be defined by the regulations that could have a significant impact on Bitcoin and other cryptocurrencies too changing the whole crypto market.