Summary

- Barclays reported £1.1 billion in pre-tax profits during the third quarter of 2020

- The impairment charges in the second half of 2020 are expected to be lower than the first half, and in 2021 be lesser than in 2020.

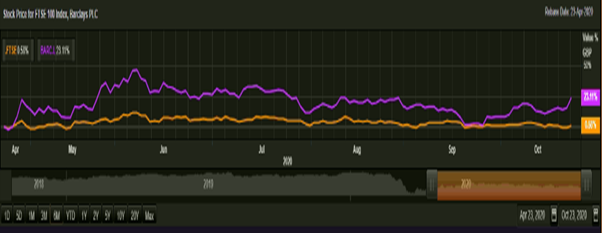

- Barclays despite giving a negative return has outperformed the benchmark index in the last six months

Riding on profits due to positive consumer businesses, FTSE 100 listed lender Barclays Plc (LON: BARC) reported much better Q3 earnings beating forecasts for income, profits and loss provisions. On Friday, despite economic fallouts, the share prices shot up by nearly 7 per cent on London Stock Exchange. But the lender downgraded its outlook for the UK economy moving forward.

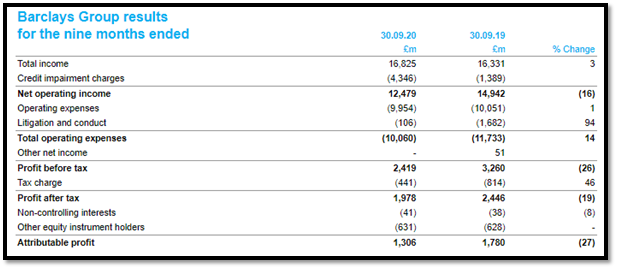

(Source: Company’s filings, LSE)

Barclays reported £1.1 billion in pre-tax profits during the Q3, which ended in September. The Group’s operating expenses declined by 1 per cent, which helped in improving the cost to income ratio to 59 per cent in Q3 FY20 YTD (Q3 FY19 YTD: 62 per cent).

In terms of Q3 performance, CET1 ratio improved by 40 basis points against Q3 FY19 and stood at 14.6 per cent, mainly due to lower RWAs (risk weighted assets).

Also read: UK Banks Looking to Increase Lending Rates on Credit Cards

Due to the catastrophe caused by the coronavirus pandemic which led to the deterioration in macroeconomic variables and increase in unemployment in the US and UK, the lender has increased its impairment charges to £4.3 billion in Q3 YTD. It was £1.4 billion in the corresponding quarter last fiscal. The impairment charges in the second half of 2020 are expected to be lower than the first half of 2020. Similarly, impairments in 2021 are likely to be lower than in 2020.

The diversified income streams of Corporate and Investment Bank (CIB) division offset the income challenges faced by Barclays UK and Consumer, Cards and Payments (CC&P) divisions. Therefore, Q3 YTD income increased by 3 per cent year-on-year. Barclays net interest margin remained steady at 2.5 per cent.

However, given the lower interest rates prevalent in the economy, which can impact the earnings along with other macroeconomic headwinds, the second half of 2020 could continue to be challenging. Though the revenue streams from the Consumer, Cards and Payments (CC&P) segment has picked up steam.

The banking and financial sector had been under stress due to the coronavirus pandemic. The sector has been issuing loans and advances under the support schemes launched by the British government, while more and more institutions are trying to reduce costs as the prevailing conditions are expected to extend over the UK for some more time.

Barclays Stock Performance

(FTSE 100 vs Barclays; Source: Refinitiv, Thomson Reuters)

In terms of stock price performance, Barclays has outperformed the benchmark index; has delivered a positive return of nearly 23.51 per cent in the past six months, whereas the FTSE 100 has given a return of merely 3.59 per cent.

Barclays shares last traded at GBX 112.16 on 26 October, up by 0.51 per cent (09:59 AM GMT+1) from the previous day’s closing price. Barclay’s total market capitalisation stood at £19,355.58 million. Barclays has lost a significant value of market cap during the last one year, as its shares fell by nearly 34 per cent in value.

Banks changed approach while lending

As mortgage demands are rising by the day in the post lockdown housing market, lenders are struggling to cater to the heightened demand. Therefore, banks have decided to increase the interest rates on home loan products. Banks are also struggling with their limited capacity of processing applications as not all industries support remote working culture.

The Chancellor of the Exchequer, Rishi Sunak announced stamp duty holiday for properties up to £50 thousand that offers purchasers a tax saving of up to £15,000. This resulted in a V-shaped recovery in the real estate market, which has led to a spike in the number of mortgage applications. Homebuyers are rushing to seal the deal before the holiday ends, which is on 31 March 2021.

According to a recent report by the Bank of England (BoE), UK lenders are expecting an increase in unsecured credit and other credit instruments in the fourth quarter of 2020. Due to the heightened crisis, consumer credit has decreased, and interest rates are at an all-time low, which has severely impacted the overall banking sector. Besides, the credit moratoriums are being imposed by FCA on state-backed loans facilitated by specific lenders.

Another set of risks emerge from the changing landscape of banking in the form of peer-to-peer lenders (P2P). Fintech firms could eat away the market share of conventional banks in the sphere of lending unsecured loans facilitated through just a few taps on the mobile application.

Another set of risks emerge from the changing landscape of banking in the form of peer-to-peer lenders (P2P). Fintech firms could eat away the market share of conventional banks in the sphere of lending unsecured loans facilitated through just a few taps on the mobile application.

Also read: Negative interest rates in the UK?

Bank of England has also asked the banks to be prepared for negative interest rates in the near future. We have seen interest rates as low as 0.1 per cent. To give a boost to the transactions in the local economy, the Bank of England might consider implementing negative interest rates, if the downturn persists. Japan, Switzerland, and Denmark are some of the countries which have adopted this regime. However, this cannot assure a fruitful way to come out of recession.

The real assessment of impairment charges by the banks is just a tentative number while the reality might differ as the situation might further worsen with the second lockdown. It is imperative for the banks to take a prudent approach and optimise their cost structure as the uncertainties due to coronavirus and Brexit still looms over the British economy.