The Covid-19 outbreak has compelled everyone to re-think about their future strategy, be it business or the individual; everyone is looking to make their future more secure than ever. While businesses are looking to find means to survive and thrive, individuals are concentrating on insurance, which has resulted in a sudden rise in demand for global life and health insurance. Here we are going to discuss a company which is not only a market leader in the health and life insurance but strategically placed to harness the growing demand with high levels of recurring premium coupled with high retention rates and high-quality revenue sources.

Prudential Plc – Focus on Value Unlocking

|

CMP (GBP) |

MCap (£m) |

P/E (TTM) |

YTD Return (%) |

Div. Yield (ADY) |

|

1,135.00 |

30,328.93 |

29.97 |

-22.47 |

2.09% |

(As on 4 Sept 2020)

Prudential Plc, an Asia-led portfolio of businesses focused on structural growth markets which focus on strategic investment in long-term opportunities and capabilities to drive future growth and value for its stakeholders. The company has around 20 million customers and is listed on stock exchanges in Hong Kong, Singapore and New York apart from the London Stock Exchange, where it trades with a ticker symbol “PRU”.

The company presently has four major verticals viz:

- Prudential Corporation Asia, the company, provides financial security to a vast majority of the population, ranking top three in nine Asian markets through 600,000 agents and over 18,000 bank branches and further broadening its presence in the life and asset management markets. Since 2013, Prudential has committed over $9 billion of capital to support growth in Asia, including around $5 billion of inorganic investments to broaden the distribution reach and to strengthen the digital capability.

- Eastspring Investments with a focus on Asia, it is a global asset manager offering innovative investment solutions to meet the financial needs of clients. The company, with over 25 years of operating history has around USD 241 billion asset under management.

- Prudential Africa- Through this vertical, the group is bringing value-added insurance solutions to customers in eight countries in Africa, including Ghana, Kenya, Uganda, Zambia and Nigeria.

- Jackson National Life Insurance Company, the US affiliate of the company is an indirect subsidiary. It is one of the top annuity providers of the US. The company which for more than 50 years has been helping Americans pursue financial freedom for life, is basically a group of four companies, Jackson National Life Insurance Company® which offers products, tools, and support designed to help for retirement with purpose. Jackson National Life Insurance Company of New York, it offers products and outstanding service to help in pursuing financial freedom. Jackson National Asset Management, LLC®, provides investment advisory, fund accounting and administration services for the Funds and separate accounts. PPM America, Inc., it’s a client-focused investment manager, providing investment solutions across markets, including fixed income, public and private equity, and commercial real estate.

Company’s intention to fully separate Jackson

The board of the Prudential Plc, to focus on its high-growth Asia and Africa businesses, has decided to separate Jackson from the Group. Initially, there will be a minority IPO during the first half of 2021 followed by full divestment over time. Jackson is expected to be solely listed in the US, while the company continue with its primary listings in both London and Hong Kong and secondary listings in Singapore and the US. If market conditions are not supportive of an IPO, the Group may opt for a demerger of the Group's stake in Jackson to its existing shareholders for the separation.

Once Jackson gets separated, the company would be fully transformed into a group focusing on the structural opportunities of Asia and Africa.

Till recently, there has been a lot of concern raised over Jackson’s, but the management has prudently handled the situation with Jackson’s robust hedging program. If we have a glance at the latest earnings of the company (Half-year 2020) Jackson, which is the long-term business in the US, reported a 33 per cent decline to US$ 688 million as compared to US$ 1,026 million in Half-year 2019 on actual exchange rate.

Jackson's dynamic hedging programme- As on 30 Jun 2020, the embedded value of long-term business on Interest rates and consequential effects - 1 per cent increase, stood at US$1,362 million as compared to US$ 798 million at 31 Dec 2019. For a 0.5 per cent decrease in interest rates, the increase in expected benefit costs has been more than offset by the hedging protection held to manage such a risk.

(Jackson hedges the GMWB and GMDB guarantees through the use of equity options and futures contracts, with an expected long-term future hedging cost allowed for within the EEV value of in-force business to reflect the equity options and futures expected to be held based on the Group's current dynamic hedging programme and consideration of past practice.)

Resilient first half performance despite a challenging new business sales environment

The Covid-19 pandemic has significantly increased the volatility of equity markets, consequently impacting the financial markets. The Group’s gross premiums earned from the continuing operations for the half-year 2020, declined by 5.88 per cent to $19,842 million from $21,081 million of the same period in 2019. Adjusted operating profit, declined modestly by 2 per cent (CER basis) to $2,541 million from $2,619 million.

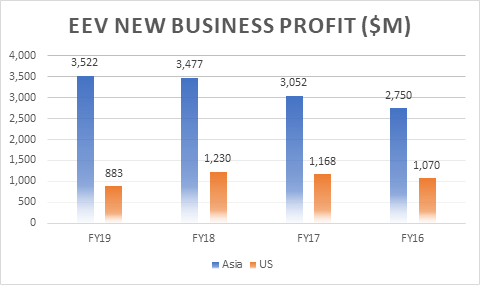

Asia business continued performing well, with half-year adjusted operating profit surging by 14 per cent to $1.7 billion, nine Asia markets reported double-digit adjusted operating profit growth for the period. Once the Jackson business is divested, it would transform it into a Group purely targeting the structural opportunities of Asia and Africa. Excluding Hong Kong, the new business profits, were lower by only 6 per cent, while four markets, including China, even reported growth in new business profits.

(Data Source- Company Release)

(EEV -European Embedded Value)

The company declared its first interim dividend for the year 2020 of 5.37 US cents per ordinary share. (Shareholders holding shares on the UK will receive their dividend payments in pounds sterling unless they elect otherwise.) The dividend announced represents the one-third of the present expectation for the 2020 full-year dividend under the Group's new dividend policy, and as per the management, dividends are expected to grow largely in line with the growth in Asia operating free surplus generation net of right-sized central cost.

Insurance Industry likely To Witness Huge Growth in the coming five years

The insurance industry has been considered one of the vital components of the economy with the quantum of premium it collects. Till the beginning of the year when the pandemic’s reach had not been that widespread and economies were showing the growth momentum, trend in gross premiums had shown uptick for the inclusive and thriving sector; however, the outbreak of the Covid-19 has changed the complete economic scenario, with nearly all the industries getting devastated and insurance industry also getting embroiled in it.

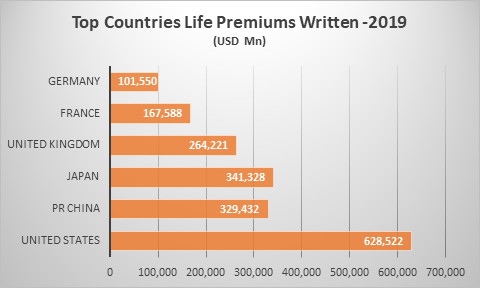

The UK is one of the most developed nations of the world, and the insurance industry here plays a significant role with its market status being the largest in Europe and the fourth-largest insurance market in the world.

The COVID-19 pandemic is expected to reduce life premiums by 4.5 percentage points in 2020 and 2021, resulting in a 1.5 per cent decrease from 2020 to 2021, according to Swiss Re. In the non-life sector, premiums are anticipated to slow by 1.1 percentage points, which in turn would result in 1.6 per cent increase in 2021 from 2020.

(Data Source- Insurance Information Institute Release)

Company’s Growth Factors

- Prudential Plc, in the 10 years to the end of last year, has delivered double-digit compound annual growth rates in new business profits, IFRS operating profits, and operating free surplus and embedded value. Even, the first half of 2020 despite a tough condition were comparatively resilient, with the company posting high levels of recurring premium coupled with high retention rates and high-quality revenue sources. Diversification and stable earnings source remained the major factor, and the $1.7 billion of operating profits was generated by a broad spread of markets operating at scale, with seven businesses contributing more than $100 million of earnings in the period. On the same time, the 70 per cent of the new businesses were from health and protection, with high levels of recurring premium.

- The group has been expanding its reach of the distribution and products in order to cater for a full spectrum of household incomes and has also been entering new distribution segments like the SME market and has developed Sharia-compliant products to cater the Malaysia and Indonesia market. With the Covid-19 making deep-rooted impact, the group has increased its virtual capabilities and presently can sell 90 per cent of the products virtually.

- With the intended separation of Jackson, the group would be able to focus on growth, with a view to achieving sustained double-digit advancement in embedded value per share. The proceeds would be used to increase financial flexibility for further investment in the group’s Asia and Africa business. This would be supported by growth rates of new business profit, which are expected to substantially exceed GDP growth in the markets in which the group operates.

- The group has a strong and sustainable business model. Its competent preparation and execution ability can be gauged with the fact that it was able to raise $1 billion of Group debt in three days of global marketing. The company has been continuously building resilience and developing the capabilities that will support future growth.