Source: Freedomz, Shutterstock

Summary

- UK banking giant Natwest Group is planning to rebrand its retail business by focusing to better compete with fintech companies and boost its revenues.

- The bank plans introduce several new initiatives such as longer banking hours, low investment products and other measures to attract customers

UK-based state-owned bank Natwest Group (LON:NWG) on Wednesday 24 March announced plans to overhaul its retail business in order to compete against fintech companies and boost revenues amid low interest rates.

The bank, previously known as the Royal Bank of Scotland, aims to have longer banking hours to cater to customers with more flexible work models, offer video access, in-app phone call facilities as part of its new retail strategy.

Natwest also plans to introduce new low-risk investment products for less affluent savers, and plans to boost efforts to attract younger customers for building brand loyalty. The bank plans to share further details with the public later this year.

The news comes a week after the UK treasury sold up to £1.1 billion worth of NatWest shares, thereby reducing its stake to 59.8 per cent. The government sold 591 million shares priced at 190.5 pence per share. The banking group was previously bailed out over 10 years ago during the financial crisis.

(Source: Refinitiv, Thomson Reuters)

Natwest’s shares were trading at GBX 194.55, down by 0.57 per cent on 24 March at )9:37 AM GMT+1, while the broader index FTSE 100, which it is a part of, stood at 6,682.52, down by 0.25 per cent for the same period.

Here we take a look at 3 other high performing FTSE 100 listed banking stocks with a 5-year average dividend yield of over 2.5 per cent:

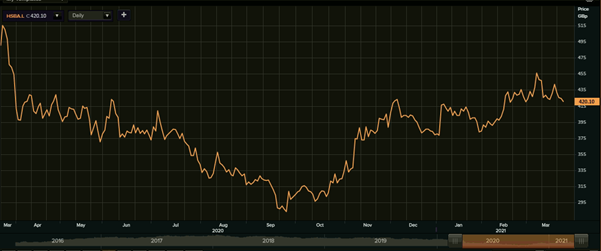

- HSBC Holdings PLC (LON: HSBA)

FTSE 100-listed banking giant HSBC Holdings announced on Wednesday (24 March) the launch of a mobile banking service targeted towards small business enterprises (SME). The new mobile app named HSBC Kinetic was developed after receiving feedback from 3,000 owners of SMEs and can be used with major accounting softwares such as Xero, Sage and more.

(Source: Refinitiv, Thomson Reuters)

HSBC Holdings’ shares were trading at GBX 420.10, down by 0.93 per cent on 24 March at 09:48 AM GMT+1, while the UK financial services sector index stood at 10,657.57, down by 8.53 per cent for the same period.

The company’s market cap was at £ 86.434 billion, while its year to date return was 10.26 per cent. Its five-year average dividend yield stood at 5.1 per cent.

Also Read: What led HSBC to resume dividend pay-outs despite a drop in profits

- Barclays PLC (LON: BARC)

FTSE 100-listed banking major Barclays announced setting up two private banks in France and Italy, offering advisory services and discretionary products targeted to family offices and high net worth individuals on 22 March.

The news comes after HSBC was reported to be in the process of selling its French operations recently. Barclays had earlier sold its French retail business to UK-based private equity company AnaCap Financial Partners in September 2017.

(Source: Refinitiv, Thomson Reuters)

Barclays’ shares were trading at GBX 182.28, up by 1.01 per cent on 24 March at 09:58 AM GMT+1. The company’s market cap was at £31.418 billion, while its year to date return was 23.70 per cent. Its five-year average dividend yield stood at 2.7 per cent.

Also Watch: Did Barclays results push FTSE 100 lower? | UK Market Updates

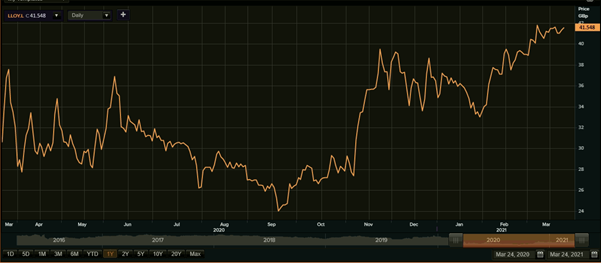

- Lloyds Banking Group PLC (LON: LLOY)

Lloyd Bank is another leading bank in the UK and is a part of the FTSE 100 index. The banking group announced earlier this month its plans to enter into the private residential to-let industry and operate as a landlord.

The group’s new initiative Project Generation aims to identify new stream of income in order to offset the low interest rates set by the central bank. Several European banks are eyeing if outcome of this initiative, as they are facing similar challenges in the sector.

(Source: Refinitiv, Thomson Reuters)

The company’s shares were trading at GBX 41.54, up by 0.39 per cent on 24 March at 10:10 AM GMT+1. The company’s market cap was at £29.293 billion, while its year to date return was 13.90 per cent. Its five-year average dividend yield stood at 3.9 per cent.

Also Read: Lloyds bank resumes dividend payments despite a large plunge in profits