Highlights

- Redde Northgate is one of the leading integrated mobility solutions platform offering automotive services to businesses and customers across the United Kingdom, Spain, and Ireland.

- The company help its customers with vehicle rental services, repair and maintenance services, accident and incident management services, vehicle disposal and other ancillary services.

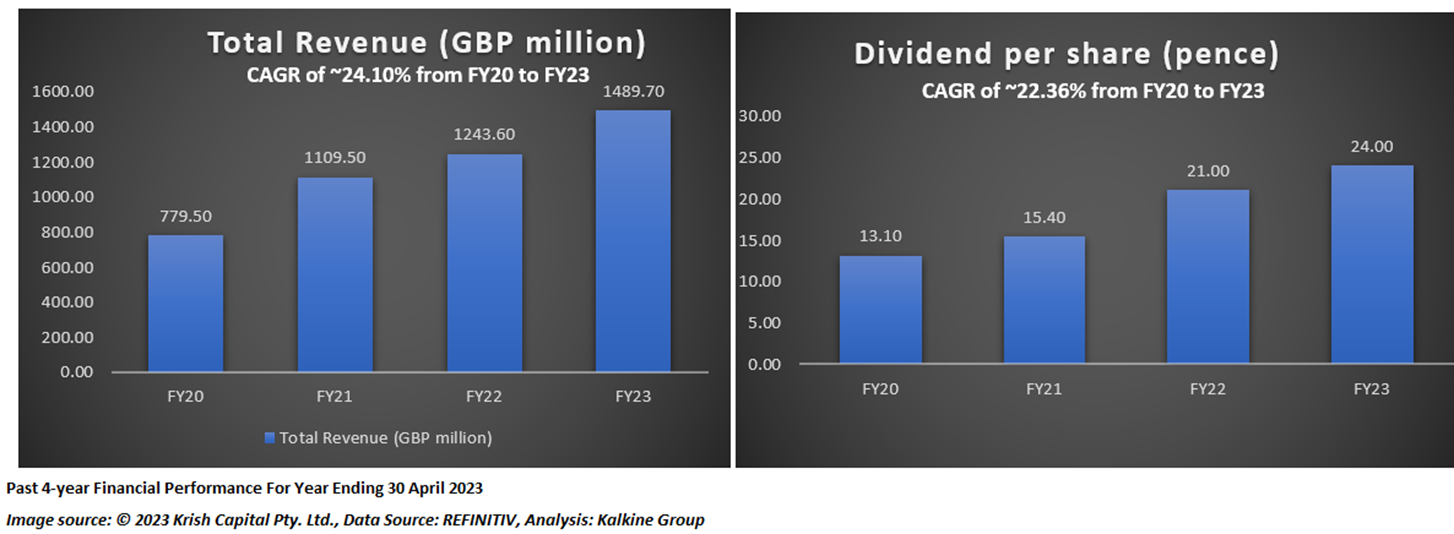

- REDD posted 19.8% YoY growth in total revenue from GBP 1,243.60 million in FY22 to GBP 1,489.70 million in FY23.

- For FY23, the company’s total dividend per share jumped 14.3% YoY.

FTSE 250 index listed Redde Northgate PLC (LSE:REDD) is one of the leading integrated mobility solutions platform offering automotive services to businesses and customers across the United Kingdom, Spain, and Ireland. The company operates more than 130,000 vehicles from over 175 sites to help its customers with vehicle rental services, repair and maintenance services, accident and incident management services, vehicle disposal and other ancillary services.

For its service excellence and efficiency, the firm has won several recognitions at the global level. It has received the Rental Company of the Year 2022 Award at Fleet News Awards. It was declared as the winner of Best Long Term Van Rental Over Three Months at the Business Motoring and Business Van Awards 2023.

REDD’s performance in FY23

During fiscal year 2023, the company posted 19.8% year-on-year growth in total revenue from GBP 1,243.60 million in FY22 to GBP 1,489.70 million in FY23, while its reported profit before taxation saw an YoY increase of approximately 34.7%. At the end of FY23, the group fleet rose by 3% YoY to over 130,000 vehicles due to growth in Spain and replacement vehicles for insurance. Also, REDD’s reported profit before tax has grown by approximately 34.7% YoY during the year.

Redde Northgate’s total dividend per share jumped 14.3% YoY during the year. It has declared to pay a final dividend of 16.5 pence per share in September 2023 with 31 August 2023 as its ex-dividend date.

EDD’s future course of action

Demonstrating the growing appeal of the platform, REDD is building a strong pipeline of new businesses. Recently, the firm signed a multi-service outsourcing agreement with a new leasing company. Also, REDD has accelerated its value-added services during FY23 with 10% YoY growth in telematics units to 10,000 and 150% YoY increase in cross platform - Northgate UK&I accident management services customer.

Top 10 shareholders

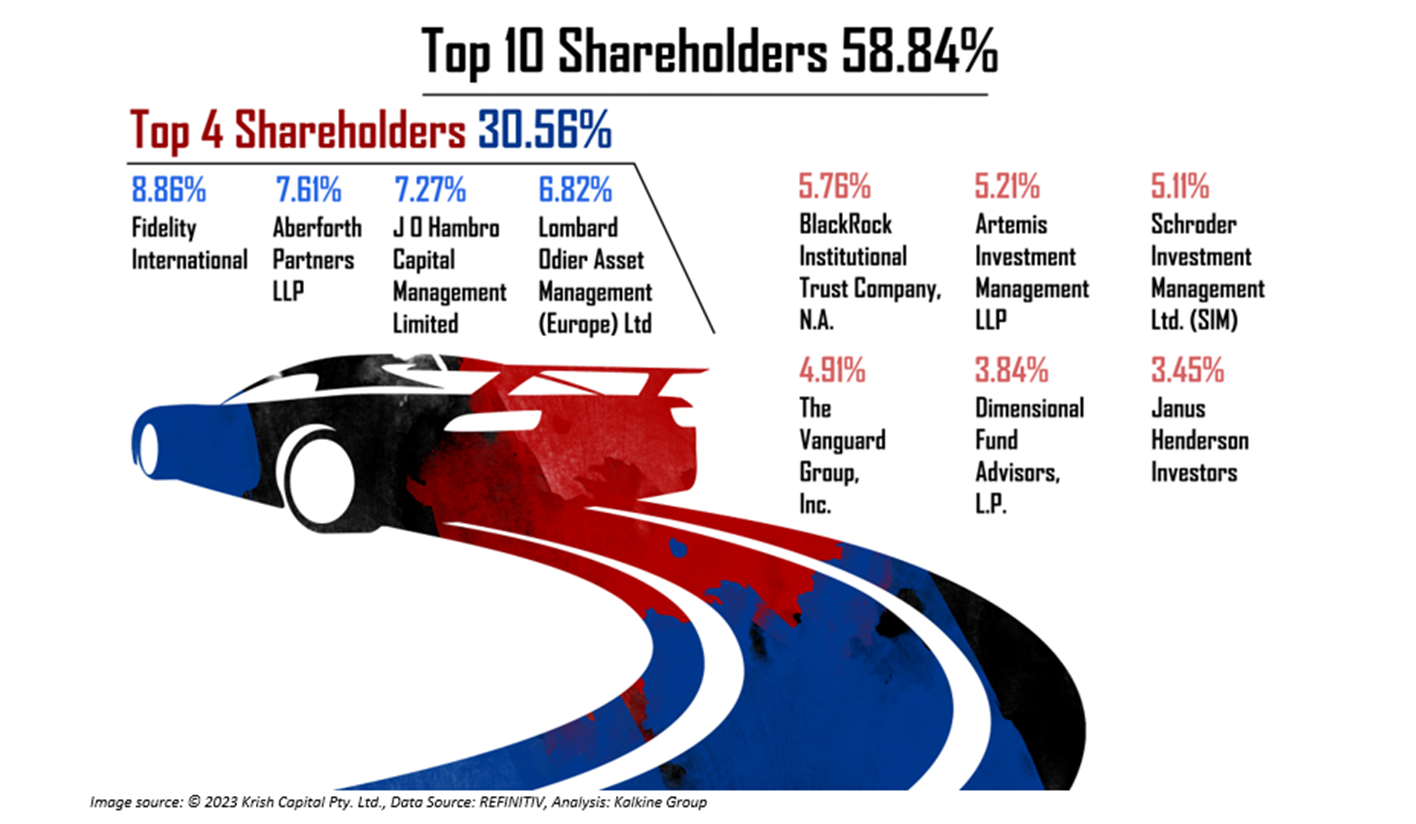

Around 58.84% of the total shareholdings of the company are held by its top ten shareholders. While Fidelity International owns the maximum number of shares with approximately 8.86% shareholding, Aberforth Partners LLP holds 7.61% shareholding in the firm.

Stock Price Performance

Stock Price Performance

There has been an increase of about 1.17% in the REDD’s stock price in the past one month. It has dropped by over 17.72% over the last six months. The stock’s 52-week low and 52-week high stands at GBX 276.50 and GBX 438.00, respectively as on 7th August 2023.