Summary

- Taylor Wimpey Plc is expected to generate an operating profit ranging around £242 million to £292 million in FY20.

- The Company has made £826 million of gross land purchases in H2 FY20 till 01 November 2020.

- The trading business will remain weak in the Spanish market till FY22.

Taylor Wimpey Plc (LON:TW) is the LSE listed construction stock. Shares of TW were down by close to 2.63% from the last closing price (as on 10 November 2020, before the market close at 08:55 AM GMT).

Would Taylor Wimpey Plc get impacted by new restrictions announced by the UK Government?

Taylor Wimpey Plc is the FTSE 100 listed customer-focused homebuilder, operating at a local level from 24 regional businesses across the UK.

Trading updates for FY20 ending on 31 December 2020 as reported on 09 November 2020

Strong Financial performance: The Company is targeting an operating margin of around 21-22% by generating annualized savings in the range of £15 million from FY21. The Company is expecting its operating profit to be ranging around £242 million to £292 million for FY20 and in the range of £359 million to £626 million for FY21. The Company is expecting a strong balance sheet driven by net cash balance ranging between £550 million and £750 million by the end of FY20 ending on 31 December 2020 with subject to timelines of conditional land purchases. The cash balance was £545.7 million as of 31 December 2019. The Company will pay FY20 dividend in FY21 and review special dividend in FY21 to be paid in FY22.

Recovery of the Housing market: On 09 November 2020, the Company has updated that the housing market has seen a good recovery since reopening post Q2 FY20. The industry has witnessed a sharp rise in demand because of various factors such as stamp duty holiday, government schemes for first-time homebuyers and low-interest mortgage rates.

Decent Key Performance Indicators: The Company has strengthened its order book reflecting volumes of around 11,530 homes as of 1 November 2020 in comparison to 10,486 as of 1 November 2019. In terms of value, the order book stood at £3.0 billion as of 01 November 2020 against £2.7 billion as of 01 November 2019 reflecting the Company's capability to manage short term market uncertainty and price. The Company is having a decent sales rate of 0.76 homes per outlet per week in the H2 FY20 as of 1 November 2020. However, it has dropped marginally from the levels of 2019. Cancellation rate remained at normal levels of approximately 20% for FY20 as of 1 November 2020. The Company is currently operating on 239 outlets and has opened 56 new outlets in the year to date in 2020.

No significant impact of new restrictions: The UK Government has encouraged the construction industry and allowed it to operate during the period of announced lockdown. Hence, the Company is fully operational, which is fueling up the demand levels and taking forward sales to meet the increasing demand. The Company has focused on the long term business environment by delivering quality homes, enhancing production capacity, and providing full customer services. Construction Quality Review score has improved in FY20 and reached 4.37 as of 1 November 2020 against 4.13 on 1 November 2019. The NHBC Construction Quality Review is an average score, out of six, achieved during an in-depth annual review of construction quality on a site-specific basis.

Identifying Lucrative opportunities in Land Buying: The Company is making significant investments in the land market since they have completed the fundraising of £510 million on 18 June 2020 and since then, they have agreed to terms and authorized £826 million of gross land purchases, comprising 70 sites and 14,500 plots. The Company has set an attractive medium-term operating margin target of 21-22% and an average return on capital employed of 34% from these acquisitions. The short term landbank is estimated to be at 78,000 plots as of 1 November 2020 (28 June 2020: 77,000) and the strategic land pipeline at 137,000 potential plots as of 1 November 2020 (28 June 2020: 138,000).

Weak trading performance in Spain: The Company has witnessed the significant impact of Covid-19 pandemic in their Spain business due to travel restrictions. The order book stood at 186 homes as of 01 November 2020 against 296 homes in the same period in 2019. The Company is expecting a business situation to get normal by FY22 after the resumption of international travel.

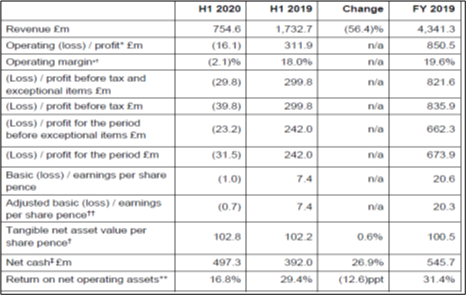

H1 FY20 results (six months ended on 28 June 2020) as reported on 29 July 2020.

(Source: Company result)

Sales during H1 FY20 have declined by 56.4% from £1.732 billion in H1 FY19 to £0.755 billion in H1 FY20. The Company has reported an operating loss of £0.016 billion during H1 FY20 indicating weak trading performance due to Covid-19 pandemic. The operating loss includes £0.039 billion of costs directly relating to the Covid-19 pandemic.

The Company has strengthened its balance sheet during the period by increasing the cash balance by 26.9% from £0.392 billion in H1 FY19 to £0.497 billion in H1 FY20. The Company completed equity fundraising for £0.510 billion on 18 June 2020 to invest in lucrative land opportunities.

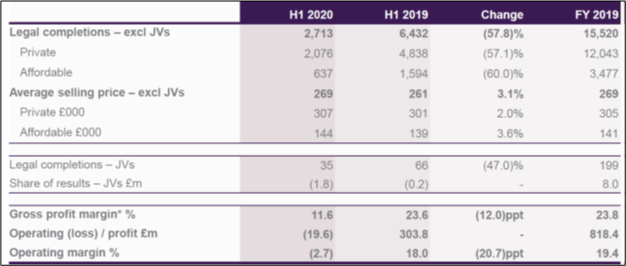

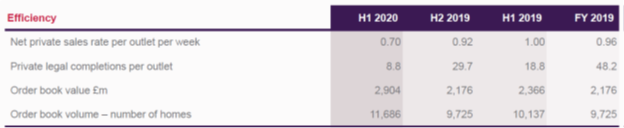

Key Performance Indicators

(Source: Company presentation)

The Company has completed only 2,713 units in H1 FY20 adversely affected by site closure in Q2 FY20 due to Covid-19 pandemic, while it completed 6,432 units in H1 FY19. However, the Company had a healthy order book of 11,686 homes in H1 FY20.

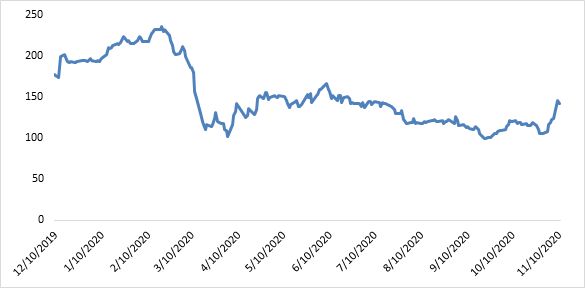

Share Price Performance Analysis of Taylor Wimpey Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of Taylor Wimpey Plc were trading at GBX 142.40 and were down by close to 2.63% against the previous closing price (as on 10 November 2020, before the market close at 08:55 AM GMT). TW's 52-week High and Low were GBX 237.70 and GBX 98.12, respectively. Taylor Wimpey Plc had a market capitalization of around £3.96 billion.

Business Outlook

The Company has recovered significantly from the slump which it has experienced during H1 FY20 and on the path to deliver strong trading performance in the second half of FY20. The housing industry has witnessed a spike in demand due to factors like low-interest rates and stamp duty relief. The Company has expected FY21 completions to be around 85-90% of FY19 levels driven by the healthy order book and resilient customer demand. Besides volume, the Company is also focusing on costing and efficiency to generate profit for the shareholders.

The Company is expected to make an operating profit in FY21 well ahead of expectations assuming market situation remains normal. The Company has also benefited out of various Government schemes introduced for supporting first-time homebuyers.