Summary

- Reach Plc had reported a decline of 10.2% in its total revenue during the fourth quarter ended on 27 December 2020.

- The Company had completed the remaining 50% acquisition of the Independent Star Limited on 24 November 2020.

- The Company forecasted its underlying operating profit for FY20 to be in the range from £130 million to £135 million.

- The Company had crossed the milestone of 5 million online customers registrations during December 2020.

Reach Plc (LON:RCH) is the FTSE All-Share listed media stock. The Company is the UK’s largest commercial national and regional news publisher with a leading portfolio in Ireland. The Company had 5 million registered customers base across the UK and Ireland. Based on its 1-year performance, shares of RCH have generated a return of about 44.16%.

The Company will announce its full-year FY20 results ending 27 December 2020 on 01 March 2021.

Business Model

The Company is engaged in developing unique content which is distributed through newspapers, magazines and digital platforms. Reach is the largest commercial publisher in the UK having over nine national and over 110 regional newsbrands targeting 47.8 million people in a month. The Company had two broader segments for reporting its revenue – Print Segment and Digital Segment.

- Print Segment – It comprises of circulation revenue and advertising revenue. The circulation revenue accounted for about 68% of total print revenue.

- Digital segment – It comprises of the combined display and transactional revenue streams which are predominantly directly driven by page views.

(Source: Company presentation)

Pre Closing FY20 Trading Update (as on 08 January 2021)

- The Company had forecasted its underlying operating profit for FY20 to the range from £130 million to £135 million driven by the sparkling digital performance.

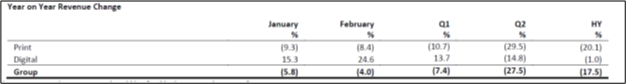

- The digital revenue year-on-year growth of the Company was improved to 24.9% during Q4 FY20, while it was surged by 13.4% for Q3 FY20.

- The decline in total revenues was also improved to 10.2% during Q4 FY20, compared to 14.8% decline for Q3 FY20.

- The Company had crossed the milestone of 5 million online customers registrations during December 2020.

Recent News

On 11 December 2020, the Company had appointed Dr Julie Humphreys as the Head of Diversity and Inclusion.

Trading Update (for the period from 29 June 2020 to 22 November 2020, as on 27 November 2020)

- The Company had achieved strong digital revenue growth of 16.2% for the five months period ended on 22 November 2020. The total revenue slipped by 13.9% over the period due to the contribution of decline in print revenue of 19.6% for the five months period ended on 22 November 2020.

- The operating margin during H2 FY20 anticipated being higher than H1 FY20 due to efficient cost management and digital transformation programme.

- The Company had retained its scale of the audience with 42.1 million unique visitors on its website.

- The addition of Irish Stars had taken the count of newspapers in Ireland to eight.

- On 24 November 2020, the Company updated that it had completed the acquisition of the remaining 50% of Independent Star Limited. This transaction will enable the Company to grab the position as one of the biggest publishers of national and regional news brands across Ireland.

H1 FY20 results (ended 28 June 2020) as reported on 28 September 2020

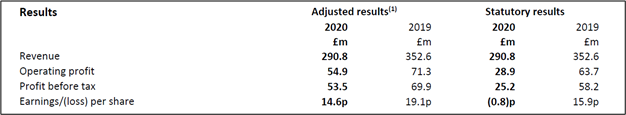

(Source: Company result)

- The adjusted revenue of the Company had reduced by 17.5% to £290.8 million during H1 FY20 ended on 28 June 2020 from £352.6 million achieved in H1 FY19. The like-for-like drop in revenue was 6.3% during H1 FY19.

- The Company had managed to deliver an operating profit of £54.9 million with an adjusted operating margin in the range of 18.9% for the 26 weeks period ended on 28 June 2020 driven by the management action taken for efficient cost management.

- Similarly, the adjusted profit before tax was £53.5 million during H1 FY20.

- The underlying basic earning per share also dropped to 14.6 pence per share during H1 FY20.

- Regarding its financial position, the Company had a closing cash balance of £41.9 million as of 28 June 2020.

- The Company had generated strong cash flow from operations of £47.9 million as of 28 June 2020 reflecting proactive steps taken to preserve cash.

- The Company had declared an interim dividend of 2.63 pence per share with subject to shareholders approval. However, the Board had suspended the cash dividends due to Covid-19 uncertainties and would decide to resume it subject to specific market conditions.

(Source: Company result)

- The print revenue was declined by 20.1% to £241 million with circulation revenue demonstrated a decline of 11.5% while the advertising revenue fell by 31.9% because of substantial impact on the print advertising volumes. The circulation revenue contributes 68% of total print revenues.

- The digital revenue dropped marginally by 1% to £48.2 million during the period. The average monthly worldwide page views grew by 45% year-on-year with mobile page views shown a 55% growth and desktop page view show an increase of 13% for the period.

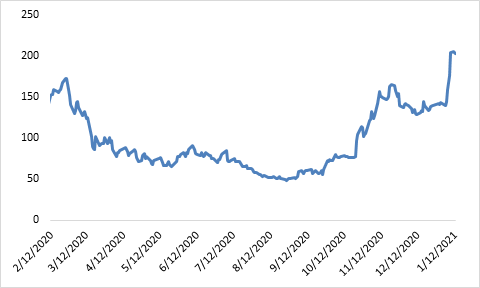

Share Price Performance Analysis of Reach Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of Reach Plc were trading at GBX 203.44 and were down by close to 0.76% against the previous closing price as on 12 January 2021, (before the market close at 09:00 AM GMT). RCH's 52-week High and Low were GBX 230.50 and GBX 47.95, respectively. Reach Plc had a market capitalization of around £639.74 million.

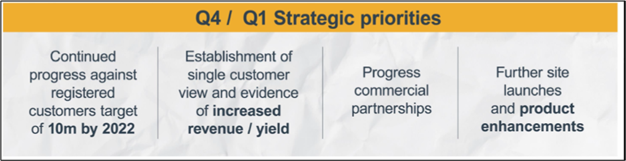

Business Outlook

The Company would continue to work on its reputation as the UK's leading news publisher and would launch new sites covering Bedfordshire and Buckinghamshire during January 2021. The Company is on track to achieve 10 million registrations by the end of 2022. The Company expects trends towards digital growth, and resilient circulation will maintain its momentum in the near future.

(Source: Company presentation)