Summary

- Moneysupermarket.com Group reported revenue of £183.2 million in H1 FY2020.

- Moneysupermarket.com reported insurance revenue of £89.0 million in H1 FY2020.

- Moneysupermarket.com expects H2 FY2020 to be challenging.

- FDM Group's reported revenue increased by 5 percent year on year in H1 FY2020.

- FDM Group added 28 new clients in H1 FY2020.

- FDM Group's Mountie utilization was 95 percent in H1 FY2020.

Moneysupermarket.com Group PLC (LON:MONY) & FDM Group Holdings PLC (LON:FDM) are two LSE stocks listed on the FTSE 250 index. MONY and FDM had a market capitalization of close to £1.62 billion and £1.13 billion, respectively. Based on year to date return, shares of MONY and FDM were down by about 2.0 percent and 1.3 percent, respectively. Shares of MONY were up by around 0.40 percent, whereas shares of FDM were down by about 1.1 percent from their previous closing price (as on 26 August 2020, before the market close at 10:30 AM GMT+1).

Moneysupermarket.com Group PLC (LON:MONY) – Announced the interim dividend of 3.1 pence per share

Moneysupermarket.com Group PLC is a UK based group that operates price comparison websites. It has brands such as Moneysupermarket, Moneysaving expert and Travelsupermarket under its portfolio. The Group receives a fixed marketing fee for the sale of listed products from the website. Moneysupermarket.com Group is listed on the FTSE 250 index.

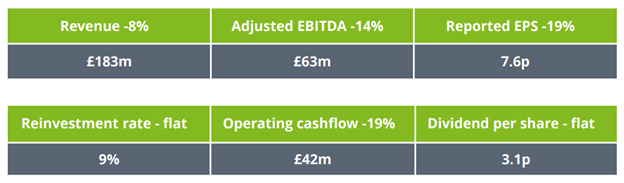

H1 FY2020 results (ended 30 June 2020) as reported on 28 July 2020

(Source: Group website)

In H1 FY20, the Group reported revenue of £183.2 million, which declined by 8 percent year on year from £199.4 million in H1 FY19. The Group generated 80 percent of the revenue from Direct to site & Partnerships segment, and 20 percent of the revenue from Non-brand paid SEM segment. The adjusted EBITDA declined by 14 percent year on year to £62.8 million in H1 FY20 from £72.9 million in H1 FY19. The operating profit was £52.7 million in H1 FY20 that declined by 14 percent year on year. The Group reported a net profit of £40.6 million and earnings per share of 7.9 pence in H1 FY20. The Group invested £17.0 million in technology in H1 FY20, of which £5.0 million was invested in technology capital and £12.0 million in technology operating costs. The Group announced the interim dividend of 3.1 pence per share that would be paid in September 2020. As on 30 June 2020, Moneysupermarket.com had cash of £12.5 million.

Performance by business activity in H1 FY2020

The insurance revenue was £89.0 million in H1 FY20, which declined by 7 percent year on year. The insurance revenue was impacted due to the lockdown as travel was banned and auto dealerships were closed. Money Services reported revenue of £37.0 million that was down by 22 percent year on year due to enhanced lending criteria and fall in consumer demand. Home Services reported revenue of £38.0 million, which increased by 11 percent year on year due to increased customer savings along with lower wholesale energy prices.

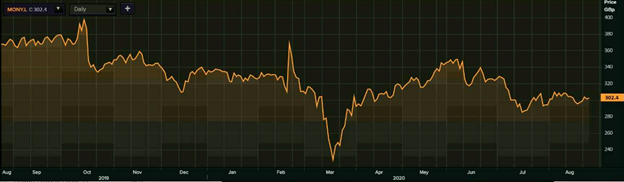

Share Price Performance Analysis

1-Year Chart as on August-26-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Moneysupermarket.com Group PLC's shares were trading at GBX 302.40 and were up by close to 0.40 percent against the previous closing price (as on 26 August 2020, before the market close at 10:30 AM GMT+1). MONY's 52-week High and Low were GBX 402.10 and GBX 210.00, respectively. Moneysupermarket.com Group had a market capitalization of around £1.62 billion.

Business Outlook

The car and home insurance have picked up to the pre-covid level after the lockdown was eased; however, the travel insurance segment remains subdued. Money Service business performance remains challenging following low banking supply and tighter lending criteria. The Group would invest close to £5 million on marketing and the operating cost in H2 FY20 would be slightly higher than that in H1 HY20. The Group abstained from providing financial guidance and expects H2 FY20 earnings to be volatile.

FDM Group Holdings PLC (LON:FDM) – Declared the interim dividend of 18.5 pence per share

FDM Group Holdings PLC is a UK based company that is engaged in recruitment, training and deployment services. The Company deploys its own IT and business consultant referred to as Mounties to client locations. FDM Group specializes in services such as Murex, Business Intelligence, Cyber Security and IT Service Management.

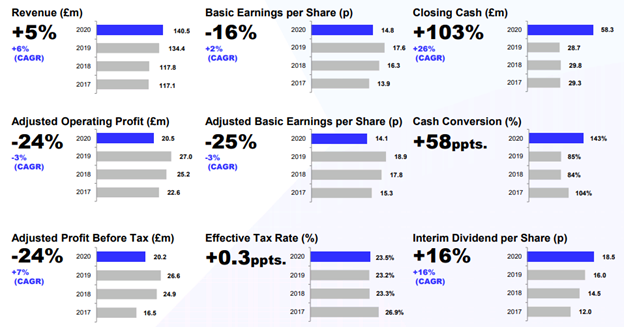

H1 FY2020 results (ended 30 June 2020) as reported on 29 July 2020

(Source: Company website)

FDM Group reported revenue of £140.5 million in H1 FY20, which increased by 5 percent year on year from £134.4 million in H1 FY19. The performance at the start was resilient; however, the business performance was affected due to the pandemic. The adjusted operating profit declined by 24 percent year on year to £20.5 million in H1 FY20 from £27.0 million in H1 FY19. The profit for the period declined from £19.1 million in H1 FY19 to £16.1 million in H1 FY20. The basic earnings per shares declined by 16 percent year on year to 14.8 pence. The cash flow from the operation was £30.8 million with cash conversion of 143.3 percent during the reported period. FDM Group announced the interim dividend per share of 18.5 pence that would be paid in September 2020. As on 30 June 2020, FDM Group had cash of £58.3 million. In H1 FY20, the Mountie utilization was 95.0 percent, with 45 percent working for clients in the UK & Ireland, 33 percent in North America, whereas 7 percent and 15 percent for clients in EMEA and the Asia Pacific, respectively. There were 3,656 Mounties deployed at the client site. FDM Group added 28 new clients in H1 FY20. As on 30 June 2020, it had most Mountie employed in the Banking sector.

Regional Performance in H1 FY2020

In the UK & Ireland, the Company reported revenue of £64.3 million, which declined by 8 percent year on year in H1 FY20 due to the impact of covid-19. The revenue in North America was £51.1 million, which was up by 9 percent year on year due to headcount growth. EMEA region reported revenue of £10.9 million with a full period of trading in the Netherlands. The APAC reported revenue of £14.3 million in H1 FY20.

Share Price Performance Analysis

1-Year Chart as on August-26-2020, before the market close (Source: Refinitiv, Thomson Reuters)

FDM Group Holdings PLC's shares were trading at GBX 1,020.00 and were down by close to 1.16 percent against the previous closing price (as on 26 August 2020, before the market close at 10:30 AM GMT+1). FDM's 52-week High and Low were GBX 1,103.80 and GBX 460.00, respectively. FDM Group had a market capitalization of around £1.13 billion.

Business Outlook

The Company is confident about its business model, and it is witnessing an uptick in the number of deals. FDM Group highlights that the second half of the year would remain challenging, and it isn't easy to access the headcounts of the Mountie. It expects that number of Mountie taking annual leave would be higher in H2 FY20 as they took fewer leaves in H1 FY20 due to the travel restrictions. FDM Group would focus on training Mounties and setting up new training facilities with expanding client base.