Summary

- Superdry Plc had reported a decline of 23.4% year-on-year in its revenue during H1 FY21 ended on 24 October 2020.

- The Company had demonstrated a loss of 38% store days during the 11-week period ended on 09 January 2021.

- The Company had maintained net cash of £54.8 million as of 09 January 2021.

- The underlying loss before tax was widened by more than four times during the first half of FY21.

Superdry Plc (LON:SDRY) is the consumer stock listed on FTSE All-Share index. The Company is a leading clothing retailer and wholesaler across the UK and Ireland. The shares have given a return of about negative 50.49% in the last 12 months.

Business Model

The Company has around 670 points of sale across the world, and products are sold through the eCommerce segment too. The Company also does trading through the wholesale segment. The Company sell its products through two broad channels –

- Retail – The retail division includes owned stores and eCommerce.

- Wholesale – The wholesale division includes franchise stores and licensed stores.

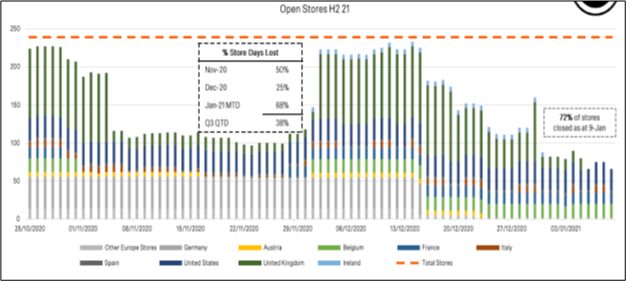

The status of operational stores across all locations as of 09 January 2021 is shown below –

(Source: Company presentation)

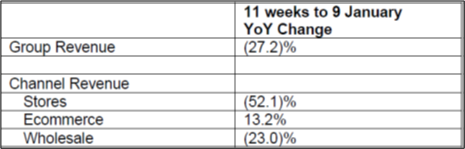

Trading Update (for the 11 weeks period ended 09 January 2021)

The Company had witnessed several operational disruptions due to regional and national lockdowns across the UK & Europe resulted in a loss of 38% store days during the 11-week period.

(Source: Company result)

As of 09 January 2021, 72% of the portfolio, i.e. 173 stores, were temporarily closed due to lockdowns.

Stores – The stores’ revenue had witnessed a decline of 52.1% during the period due to the significant loss of store days. The like-for-like sales were declined by 30.8% due to reduced customer activity following social distancing measures.

eCommerce – The eCommerce segment had partially offset the decline in stores’ sales and achieved revenue growth of 13.2% during the period. However, the Black Friday promotional period (for 11 days ended 30 November 2020) sales remained lower from the levels achieved in the prior year due to reduction in third party revenues.

Wholesale – The revenue across the wholesale segment was dropped by 23% during the period due to lower volumes for AW20 orders. However, the decline was partially offset by 29% growth of season orders made by online wholesale customers.

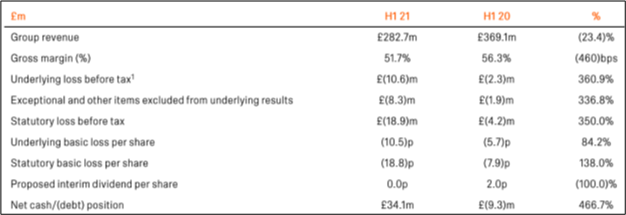

H1 FY21 Financial Highlights (for 26 weeks period ended 24 October 2020, as on 19 January 2021)

(Source: Company result)

- The Company’s revenue had plunged by 23.4% to £282.7 million during H1 FY21 adversely impacted by Covid-19 pandemic and the consequences of social distance norms required to maintain by the customers.

- The Company had lost around 23% of owned store trading days during the period.

- The sales across eCommerce business segment grew significantly by 49.8% during the period while store sales went down 44.8% reflecting the change in shopping patterns of the consumer. The eCommerce segment represented approximately 50% of total retail sales during H1 FY21, while it had accounted for just 27% of retail sales during H1 FY20.

- The Gross margin had also slipped by 460 basis points from 56.3% during H1 FY20 to 51.7% for H1 FY21 as the Company had increased its online promotional activity to sell off existing inventories.

- Regarding the profitability, the underlying loss before tax had widened by more than four times to negative £10.6 million during the period.

- The Company had improved on the liquidity aspect reflected by the healthy net cash balance of £34.1 million during H1 FY21. The efficient cost management had enabled the Company to maintain a strong financial position.

- The Company had not proposed any interim dividend during H1 FY21 amid a heightened level of uncertainty and several operational headwinds.

H1 FY21 Operational Highlights (as on 19 January 2021)

- The Company had received overwhelming response in the critical marketing campaigns conducted post the launch of the brand “AW20” across all channels.

- Regarding the sustainability measures, 100% of the AW20 outerwear jackets are using recycled materials.

- The Company had announced the brand partnership with Neymar Jr during the period.

Recent News

On 16 December 2020, The Company had announced Julian Dunkerton as the permanent Chief Executive Officer and Silvana Bonello as the Chief Operating Officer. The interim contract of Julian Dunkerton as the Chief Executive Officer was due to expire on 02 April 2021. He is holding a 20.3% stake in the Company.

Share Price Performance Analysis of Superdry Plc

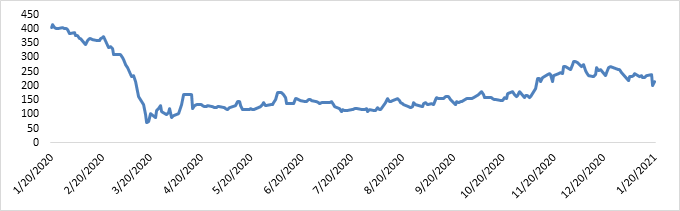

(Source: Refinitiv, chart created by Kalkine group)

Shares of Superdry Plc were trading at GBX 213.00 and were up by close to 5.97% against the previous closing price as on 20 January 2021, (before the market close at 09:30 AM GMT). SDRY's 52-week High and Low were GBX 426.80 and GBX 60.10, respectively. Superdry Plc had a market capitalization of around £164.89 million.

Business Outlook

The Company had not provided proper financial guidance considering the uncertainty and disruptions caused by Covid-19 pandemic. The duration of restrictions are still unknown, and the Company had realized the material uncertainty associated with it. The Company had highlighted store closures would remain for a while, and it would impact revenue adversely for the remaining part of FY21. The impact could be neutralized by Government furlough support and cost reduction in the form of rent waivers.

The Company would adopt a conservative approach towards promotional activity in 2021. The eCommerce segment would decelerate during Q4 FY21. The Company is well-positioned to tackle existing challenges as it had net cash of £54.8 million as of 9 January 2021 and it would continue to sustain favourable cash position throughout FY21. The Company had sufficient liquidity of £130 million available, including £70 million of the asset-backed lending facility. The wholesale revenue was anticipated to remain in line with the expectations during FY21.