Highlights

- Experts are predicting a travel boom this summer as the impact of Omicron is fading and travel restrictions are easing.

- As per FTSE Russell, easyJet may re-join the blue-chip index next month as the travel outlook improves.

With the fading impact of Omicron and easing travel restrictions, experts are predicting a travel boom this summer. The travel and tourism industry has suffered tremendously during the pandemic due to excessive regulations, but the future appears to be bright as travel firms are reporting significantly higher bookings at present.

UK travel and leisure firms easyJet and saga have recently predicted a massive boom for the travel industry. As the travel outlook has improved, budget airline easyJet may potentially join the FTSE 100 index again. In 2013, easyJet became a constituent of the FTSE 100 index till June 2019 when it got demoted. In December 2019, it joined the blue-chip index again but then it was hit hard due to the pandemic-related restrictions. In June 2020, it was demoted again to the FTSE 250 index. As per FTSE Russell, easyJet may re-join the blue-chip index next month.

© 2022 Kalkine Media®

Apart from easyJet, other travel firms may also gain from the easing of travel restrictions and a surge in bookings. Let’s take a look at 5 travel and leisure stocks, which may do well this summer.

Also Read: Top 10 most shorted FTSE stocks in February 2022

easyJet plc (LON: EZJ)

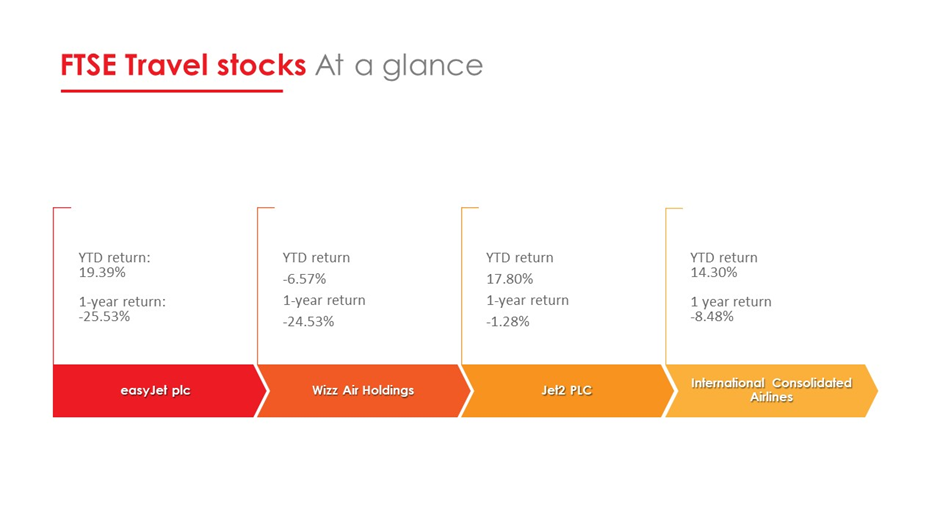

The current market cap of the UK-based transnational low-cost airline is £5,071.09 million as of 23 February 2022. The FTSE250-listed firm has not been able to perform well over the past year due to the pandemic, and its one-year return stands at -25.53% as of 23 February 2022. However, its performance has improved since the start of the year and its year-to-date return stands at 21.17%. easyJet plc’s shares were trading at GBX 674.00, up by 0.75%, at 9:04 AM (GMT) on 23 February 2022.

Wizz Air Holdings PLC (LON: WIZZ)

The current market cap of the Swiss airline group, Wizz Air Holdings PLC, stands at £ 4,110.54 million as of 23 February 2022. The FTSE250-listed firm’s one-year return stands at -24.53% as of 23 February 2022. Wizz Air Holdings plc’s shares were trading at GBX 4,040.00, up by 1.30%, at 9:18 AM (GMT) on 23 February 2022.

© 2022 Kalkine Media®

Jet2 PLC (LON: JET2)

The current market cap of the leading international airline business, Jet2 PLC, stands at £2,800.78 million as od 23 February 2022. The FTSE AIM UK 50 index constituent’s one-year stands at -1.28% as of 23 February 2022. Jet2 plc’s shares were trading at GBX 1,338.00, up by 2.53%, at 9:22 AM (GMT) on 23 February 2022.

Also Read: Centrica, National Grid, SSE: Are these energy utility stocks a good buy?

International Consolidated Airlines Group S.A. (LON: IAG)

The current market cap of the Anglo-Spanish globally operating airline, International Consolidated Airlines Group S.A., stands at £8,023.50million as of 23 February 2022. The value of the FTSE100-listed firm has gone down and its one-year return stands at -8.48% as of 23 February 2022. International Consolidated Airlines Group S.A.’s shares were trading at GBX 165.02, up by 2.07%, at 9:24 AM (GMT) on 23 February 2022.

.jpg)