Highlights

- Ten Entertainment’s shares rose by over 3 per cent over strong sales in its latest full-year trading update.

- The company’s like-for-like growth in FY 2021 was at 29 per cent compared to comparable trading weeks in 2019.

UK-based bowling group Ten Entertainment Group PLC’s (LON:TEG) shares jumped over 3 per cent today after the group posted strong sales in its latest trading update for the 52 weeks to 26 December 2021. The company became one of the highest risers on the index, following the news.

Ten Entertainment Group’s full-year trading update

The group reported a 32.4 per cent sales growth since May 2021 when compared to FY 2019 levels.

Its like-for-like growth in FY 2021 was at 29 per cent compared to the comparable trading weeks in 2019, excluding new opening.

The total group sales stood at £67 million, despite facing closures for around 38 per cent of the year. The group reported a record profit for every month since June 2021. It returned to full year profitability, offsetting the losses from lockdown in H1.

December trading period

The group’s December trading period was good but witnessed some impact on demand due to the UK’s introduction of certain restrictions in Wales and Scotland. Another factor that may have led to softening of demand was government messaging during the period.

The group recorded its highest-ever sales for the New Year and Christmas in the first week of FY 2022. It is expected to release its FY 2021 results later this year on 29 March

Outlook

The group expects to open about a minimum of 4 centres in FY 2022, stating that several of its centres were currently in the advanced phases of discussions.

Moreover, the group estimates its FY 2021 profit to be at the higher end of its market expectations and lead to lower levels of net debt due to continuing high consumer demand and having strong cost controls.

The group holds an optimistic outlook for FY 2022 due to the ongoing demand strength and resiliency displayed in its customer offer.

Related Read: How can the government support the Omicron-affected sectors?

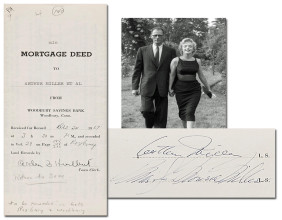

Ten Entertainment Group PLC’s (LON: TEG) share price performance

Ten Entertainment’s shares were higher by 3.25 per cent, trading at GBX 254.00 on 6 January 2022 at 12:09 AM BST. The FTSE All-Share index, which it is a part of, was at 4,248.50, down by 0.68 per cent.

The company’s market cap was at £168.13 million, and it has given shareholders a return of 25.48 per cent in the last one year as of 6 January.

Image source: Refinitiv