Highlights

- New car registration in the UK saw a 22% year-on-year decline in August month.

- Global supply chain issues and shortage of semiconductors are some of the key reasons for low sales.

- Automobile dealers continue to have a positive outlook towards the sector and expect sales to bounce back in September.

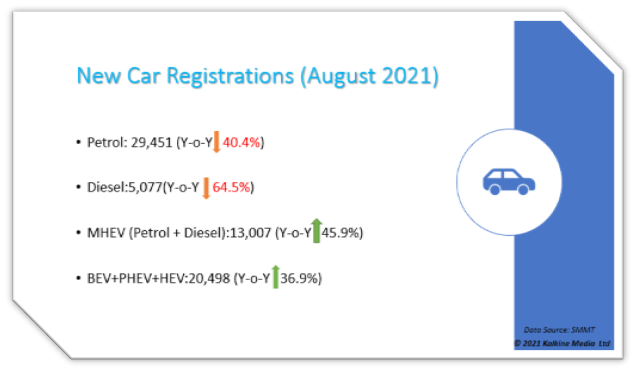

Car registration in the UK saw a drastic fall in August. New car registrations were at 68,033 units in the month, posting a decline of 22% year-on-year. It is the lowest monthly performance since August 2013 as per the latest data from the Society of Motor Manufacturers and Traders (SMMT).

Global supply chain issues and shortage of semiconductors are key reasons which continue to impact UK car production and sales. However, despite the plunge in sales of traditional gasoline cars, the demand for the latest battery-powered electric cars and hybrid cars continued an uptrend, with total sales up 36.9% year-on-year.

Though the numbers have been disappointing for the month, automobile dealers continue to have a positive outlook towards the sector and expect sales to bounce back in September, which is a key month for sales due to the introduction of the new number plate.

Let us explore 3 FTSE listed automotive retailer stocks that could be a good investment opportunity despite the decline in car registration numbers:

Vertu Motors Plc (LON:VTU)

The company operates a chain of retail automobile dealerships in the UK market. It offers new and used cars to its customers and provides aftersales related services as well.

The company expects profit before tax of at least £50 million in the six months ended 31 August 2021. However, the company raised some concerns on new vehicles supply, but the company’s revenue was largely not impacted and continues to move up, driven by the exceptional UK used car market.

Due to the strong performance reported in the current financial year, the company has upgraded its profit before tax estimate. It expects it to be in the range of £50 million to £55 million for the entire year (the previous estimate £40m to £45m).

Vertu Motors Plc’s shares are currently trading at GBX 57.60, down by 3.36% as of 14:23 PM GMT+1. The current market cap of the company stands at £219.56 million as of 6 September 2021. In the last one year, the stock has given a return of 131.44% to its shareholders.

Motorpoint Group Plc (LON:MOTR)

The company is one of the leading independent omnichannel vehicle retailers in the UK. It sells vehicles of various brands through its network of retail chains and online website.

Motorpoint Group Plc reported record sales in the first quarter of the financial year ending 31 March 2022, 61% of all the vehicles sold in the first quarter was through online channel, indicating good progress made by the company to shift towards digitalisation. Also, the company continues to expand its branch network and plans to open two new branches in Manchester and Maidstone this year.

Motorpoint Group Plc’s shares are currently trading at GBX 336.00, down by 0.30% as of 14:25 PM GMT+1. The current market cap of the company stands at £303.94 million as of 6 September 2021. In the last one year, the stock has given a return of 25.94% to its shareholders.

Related Read: Supply chain crises: Buy these 4 logistics stocks with over 100% return in a year

Auto Trader Group Plc (LON: AUTO)

FTSE100 listed company is one of the largest operators of the digital automotive marketplace in the United Kingdom. It provides an online car buying experience for retail clients.

The company reported revenue of £262.8 million, a decline of 29%, mainly due to a fall in the advertising revenue and various discount offered during the Covid-19 period. Profit before tax was down to £157.4 million. However, the average physical car stock on the site saw a rise of 1% at 485,000 cars during the full year ended 31 March 2021.

The company has started the new financial year in a strong position, and it expects to deliver high single-digit growth and operating profit margins in line with pre-pandemic levels.

Auto Trader Group Plc’s shares are currently trading at GBX 639.20, up by 0.79% as of 14:27 PM GMT+1. The current market cap of the company stands at £6,075 million as of 6 September 2021. In the last one year, the stock has given return of 18.11% to its shareholders.

.jpg)