Business Overview

Incorporated in Guernsey, closed-end investment company, NextEnergy Solar Fund Limited (LON:NESF) is limited by shares, which acquires solar energy-producing power plants on industrial, agricultural and commercial sites. The group is managed by NextEnergy Capital IM Limited, and NextEnergy Capital Limited has been appointed as the investment adviser for NextEnergy Solar Fund Limited.  NextEnergy Capital IM Limited and NextEnergy Capital Limited are governed by the NEC Group (NextEnergy Group).

Incepted in 2007, the NEC Group is focused purely in the solar industry and is into the development of the Photovoltaic technology and its entire value chain. The company has an experienced thinktank of 40 team members which are dedicated in this realm of the energy sector. The company has a strong presence in South Africa, Italy and the United Kingdom.

WiseEnergy International, the operating asset management division of the NEC Group, is dedicated for a client base of European banks and equity investors, which include private equity funds, publicly- traded funds specialising in solar investments and other financial institutions and manages and monitors in excess of 1.8 GW. The company also invests in active solar power plants in OECD countries outside the United Kingdom, up to 15 per cent of its Gross Asset Value.

NEC Group is dedicated to benefit its investors a sustainable and with attractive dividend returns in the long-term horizon by investing in various asset classes of the solar industry. The company also aims for capital appreciation for its investors through cumulative growth by reinvesting excess cash generated (in excess of the target dividend), which is in line with its investment policy.

NESF-Recent news

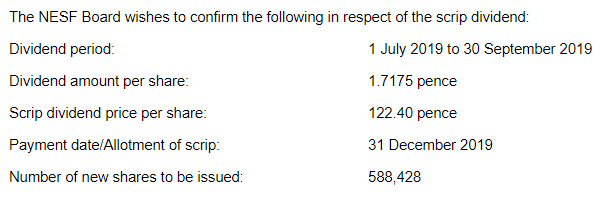

The company made an application to the London Stock Exchange with reference to list 588,428 ordinary additional shares for trading as a scrip dividend alternative to receive a cash dividend in respect of the dividend for the second quarter of the fiscal year 2020.

(Source: Companyâs filings, London Stock Exchange)

NESF-Business Performance for H1 FY20 period ended 30th September 2019

NextEnergy Solar Fund Limited witnessed another period of outperformance and robust results for the six-month period. The company did well due to improvements in financial management and operations from a technical perspective along with high levels of solar irradiation. The company focused on optimising it assets across the portfolio along with cost optimisation and technical improvements.

The company launched Hall Farm II, the maiden subsidy-free plant of the company with a capacity of 5.4MW, which was commissioned during the period and is also the first subsidy-free solar plant in the United Kingdom owned by a quoted investment company. The successful commissioning and development have given the company head start in establishing itself as an industry leader in this space and will give ample confidence to it in commissioning the next subsidy-free plant (currently under construction) of 50 MW capacity by the end of the financial year.

The company commissioning of Hall Farm II, its first subsidy-free asset in the United Kingdom in August 2019 has made it the first quoted company in the solar power sector to do so, achieving a milestone in this sector's path to a subsidy-free environment.

The company started building Hall Farm II in March 2019 and was operational on the grid by 5th August 2019. The company had the advantage of existing Hall Farm plant and oversized planning permission at the original site along with previously built grid access infrastructure.

Staughton, the second subsidy-free plant of the company, which is under construction and is progressing smoothly and shall be operational on grid by the end of current fiscal year, has a capacity of 50MW and is located near the Cambridgeshire/ Bedfordshire border, it is one of the largest assets in the portfolio of the company.

The achievements by the company are the perfect example and are perfect case study for subsidy-free solar PV assets in the United Kingdom in contrast to other technologies deployed in the energy sector, which require a comprehensive schedule of subsidies.

The companyâs Asset Manager and Investment Adviser continued to optimise the returns from the portfolio. They are focused on assetâs useful life extension, reduction of operation costs through revisiting existing contractual terms and forging new agreements over the past six months.

In the span of last five and a half years, since IPO, Â the company has achieved a 10 per cent of total annualised return for ordinary shareholders and 8 per cent of annualised NAV total return, which is near the target range of 7 per cent to 9 per cent of equity return for investors, from the IPO price level.

The company managed its finances prudently; it issued £100 million of preference shares, some of these were utilised to reduce debt obligations and enhance returns for its shareholders along with providing financial stability.

The electricity generated during the period by the companyâs portfolio on the current 705MW is equivalent to a saving of 131,000 tonnes in contrast to 123,000 tonnes of CO2Â emissions in the same period last year. The electricity is enough to cater to some 134,000 homes for six months in the United Kingdom.

The companyâs Profit before taxation was recorded at £21.1 million during the period in contrast to £18.7 million in the same period last year. The companyâs earnings per share was recorded at 3.62 pence during the period in contrast to 3.23 pence in the same period last year.

The company facilitated the total electricity generation of 515 GWh during the period as against 480 GWh in the same period last year. The companyâs solar assets (operating) increased to 89 during the period versus 87 recorded on 31st March 2019. The electricity generation was 5 per cent above the budget.

(Source: Companyâs filings, London Stock Exchange)

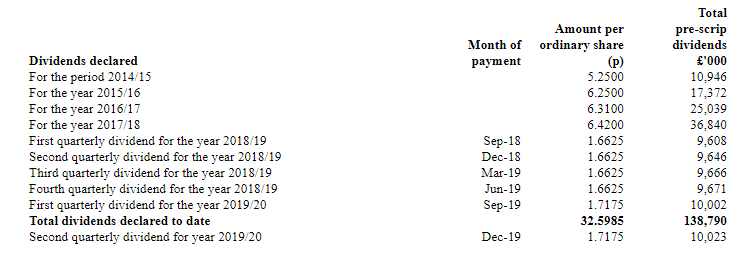

The companyâs net asset value per share was recorded at 111.20 pence during the period as against 110.9 pence recorded on 31st March 2019. The cash dividend of the company before the scrip stood at 1.3x during the period in contrast to 1.2x in the same period last year. The company declared a dividend of 3.44 pence per share during the period.

NESF-Stock price performance

(Source: Thomson Reuters) Daily Chart as on Dec-16-2019, before the LSE market close

At the time of writing at 08:43 AM GMT, on 16th December 2019, the shares of NextEnergy Solar Fund Limited were trading at a current market price of GBX 122.50 per share, which were down by 0.81 per cent from the last closing price on the previous day. While writing, the groupâs market capitalisation was approximately £720.22 million.

The shares of NextEnergy Solar Fund Limited traded at a high-price mark of GBX 125.00 on 13th December 2019 and at a low-price mark of GBX 108.61 on 25th June 2019 in the last twelve-month period. The companyâs shares were trading at 12.79 per cent higher than the last twelve-month low-price mark and at 2.00 per cent lower from the last twelve-month high-price mark as can be seen in the price chart at the current trading level.

While writing, the stockâs traded volume stood at 5,947. The stockâs 5-day daily average traded volume of the company was 1,024,513.40; 30 days daily average traded volume- 573,213.37 - and 90-days daily average traded volume â 597,060.30. The beta of the companyâs stock was recorded at 0.17, which indicates lesser volatility with reference to the benchmark index along with a dividend yield of 5.47 per cent.

The companyâs shares have generated a positive return of 4.22 per cent in the last quarter. From the start of the year to date, the companyâs stock was up by 7.39 per cent. Since last month, the companyâs stock has given investors a positive return of 0.82 per cent.Â