Vodafone Group PLC (LON:VOD) has inked a new partnership agreement with the Switzerland based company, Sunrise Communications Group AG, effective from 1st January 2020.

The customers of the Switzerland based company will benefit from a diverse spectrum of services that Vodafone Business services possess, which include voice & data roaming, central procurement and mobile connectivity.

As the companies operate in a similar space, the plan is to work on their combination of synergies such as Fifth Generation technologies (5G) to expand their footprint to deliver fixed/mobile services to Enterprises across Europe and beyond, and benefit their end-users from higher speed data networks. Vodafone Group has expressed its pleasure of adding Sunrise Communications to its Partner Market network and about offering an extensive range of innovative Enterprise products and services to its customers and working together with the Swiss entity.

Vodafone Group is confident of delivering growth in Switzerland and other partner networks as it possesses the ability to extend their footprint and expertise with access to a superior network and top-notch services.

Business overview: Vodafone Group PLC

One of the worldâs leading telecoms and technology service company, Vodafone Group PLC has wide-ranging experience in connectivity, the Internet of Things (IoT) and convergence along with facilitating financial services through mobile and digital revolution in the developing markets.

The telecommunication services group has presence across 20 plus nations, partnership with 40 plus other countries and fixed-line operations in 15 plus markets.

Vodafone Group had around 625 million active mobile connections, 22 million TV connections, 27 million fixed broadband connections, including all the customers in the portfolio of Vodafoneâs associates and JVs (joint ventures). The figures are reported as of 30th September 2019.

Incepted in 2002, Vodafone Partner Markets now has partnered with 28 companies across 41 nations worldwide. The entity forges strategic alliances with operators across the world to offer a diverse range of products and services that allows Vodafone to go beyond geographical boundaries.

Monaco Telecom will acquire VFML for a cash consideration of â¬250 million. Vodafone Group announced the signing of an agreement with Monaco Telecom (Monaco Telecom SAM) to sell 100 per cent of VFML (Vodafone Malta) on 19th December 2019. The company will announce the trading statement for the quarter ended December 31, 2019 on 5th February 2020.

Vodafone Group PLC Recent Business performance updates for H1 FY20

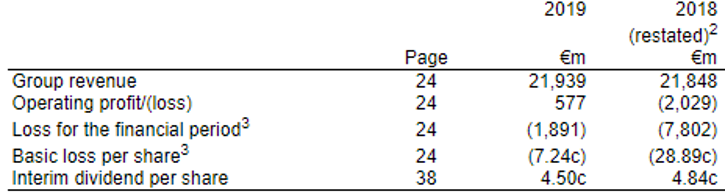

(Source: Companyâs filings, London Stock Exchange)

Groupâs service revenue surged by 1.5 per cent to â¬18.5 billion in H1 FY20 against the â¬18.3 billion in H1 FY19, while organic adjusted EBITDA was up by 1.4 per cent. The LAT (loss after-tax) for the H1 FY2020 period stood at â¬1.9 billion. Basic loss per share was reported at 7.24 Eurocents in H1 FY20 versus a basic loss per share of 28.89 Eurocents in H1 FY19, while adjusted earnings per share stood at 0.85 Eurocents in H1 FY20. The companyâs reported revenue increased by 0.4 per cent to â¬21.9 billion for the first half of the financial year 2020 ended 30th September 2019, in contrast to the corresponding period of the last year, due to the benefits derived from the acquisition of Liberty Global's assets in Central & Eastern Europe and Germany. The board of the group had announced an interim dividend per share of 4.50 Eurocents. The net debt of the company was recorded at â¬48.1 billion as on 30th September 2019.

Business overview:Â Sunrise Communications Group AG

Zurich based, Sunrise Communications Group AG is quoted on the SIX Swiss Exchange in Zurich with ticker symbol SRCG and is one of the leading companies in the Swiss telecom sector. The company is the largest telecom entity in Switzerland offering voice, data, TV and fixed-line services to the business and private customers. The Zurich based company is a pioneer in 5G segment and offers the best cellular network in the geographical area it covers. The company has coverage in more than 380 cities across Switzerland and Europe. The company provides 4G services to 99.98 per cent of the population of Switzerland. In addition, the Swiss company has a reach in 85% of households in Switzerland with its fixed-line services. The company also has an offering of fibre services.

Sunrise Communications Group AG: Q3 FY19 Business performance

Compared to the first three quarters of 2018, service revenue surged by 2.6 per cent, which was mainly driven by strong customer growth in mobile post-paid connections and landline internet and TV.

The total revenue decreased by 1.1 per cent compared to the prior year period. Adjusted EBITDA (excluding the impact of IFRS 16) surged by 3.4 per cent in the nine-month period ended September 30, 2019, mainly driven by service revenue growth.

The initial application of the new accounting standard IFRS 16 led to a decrease in operating expenses of CHF 34 million for the first nine months of 2019. Therefore, adjusted EBITDA, including the impact of IFRS 16 surged by 10.9 per cent.

Vodafone Group PLC Stock price performance

Daily Chart as on 24th-January-20, before the market closed (Source: Thomson Reuters)

On 24th January 2020, VOD shares were clocking a current market price of GBX 155.70 per share, while writing at 01:19 PM Greenwich Mean Time. At the time of writing, the companyâs market capitalisation was hovering around at £41.34 billion.

The companyâs shares were trading at 8.12 per cent lower from the 52-week high price mark and 27.39 per cent higher than the 52-week low price mark at the current trading level, as can be seen in the price chart. On 12th November 2019, the shares of VOD have touched a new peak of GBX 169.46 and reached the lowest price level of GBX 122.22 on 20th May 2019 in the last 52 weeks.

The stockâs traded volume was hovering around 17,590,779 at the time of writing before the market close. The companyâs 5-day stock's daily average traded volume was 60,308,882.60; 30 days daily average traded volume- 48,203,773.00 - and 90-days daily average traded volume â 63,689,779.69. The volatility of the companyâs stock was slightly higher as compared with the index taken as the benchmark, as the beta of the companyâs stock was recorded at 1.09 with a dividend yield of 4.86 per cent.

The shares of the company have delivered a negative return of 5.25 per cent in the last quarter. The companyâs stock surged by 5.07 per cent from the start of the year to till date. The companyâs stock has given investors 3.31 per cent of a positive return in the last one year.Â