Â

Redrow Plc

Redrow Plc is the United Kingdom domiciled real estate development company. The company has operations across England and Wales. Its builds range from traditional family houses to premium apartment complex schemes. The company's property ranges use the suffix collection and are thus clustered. They include the Regent Collection, the Heritage Collection, the Bespoke Collection and the Abode Collection. The company has four subsidiaries, namely Redrow Real Estate Limited, Harrow Estates Plc, HB (HDG) Limited and Redrow Regeneration Plc.

The company has its shares listed on the London Stock Exchange on the Main Market Segment. There they trade under the ticker name RDW. The shares of the Company also form part of the FTSE 250 Index.

Trading Update

The company on 06 November 2019 came out with the Chairman's statement that he read out on the same day at the company's Annual General Meeting.

- The Chairman stated that the company, for the first 18 weeks of the current financial year, has given an encouraging trading performance. Its resilient trading despite the Brexit turmoil and a weak demand scenario in the wider housing sector is a testimony of its strong fundamentals.

- However, the average selling price realized by the company from private reservations during the first 18 weeks of the year was almost the same as that of last year, standing at £389,000 (For the first 18 weeks of 2019 the figures stood at £388,000).

- The balance sheet of the company, however, remains strong with net debt currently standing at £32 million, while in 2018 the company had a net cash £132 million on its books. The primary reason for this increase in debt is the £218 million cash returns to shareholders in the past one year, which includes the 'B share' payment.

Stock price performance at the London Stock Exchange

Price Chart as on 07 November 2019, before the market close (Source: Thomson Reuters)

On 07 November 2019, at the time of writing the report (before the market close, GMT 12.51 PM), RDW shares were trading on the London Stock Exchange at GBX 610.00.

The stock of the company has a 52-week High of GBX 661.00 and a 52-week low of GBX 455.32. The total market capitalization of the company at the time of writing this report was £2.13 billion.

Outlook

The recently announced general election in the United Kingdom and the purported impact it will have on the shape of the withdrawal deal prior to the United Kingdomâs withdrawal from the EU, has left the economy and the prospects of the housing market in an unpredictable state. However, the management believes that the company is better placed and will be able to deliver despite the turbulent political climate.

Halfords Group Plc

Halfords Group Plc is a United Kingdom domiciled, leading provider of motoring and cycling products and services. The company's products and services are offered through 450 company-owned Halfords stores, 318 garages (under brand name Halfords Autocentres) and 26 Performance Cycling stores (Under the brand names Cycle Republic, Tredz, Boardman and Giant). Services of the Company are also offered through web portals halfords.com, cyclerepublic.com and tredz.co.uk where customers can purchase merchandise and through halfordsautocentres.com where a client can book garage services online.

The shares of the company are listed on the London Stock Exchange in the main market segment where they use the ticker name HFD for trade.

Results Update

The company on 7 November 2019 came out with its interim results for the six-month period ending on 27 September 2019 along with a strategic update.

- The company's Like for Like sales for the six-month period declined by 2.4 per cent while working in challenging market conditions. The sales of the company have returned to growth trajectory only in the last six weeks of the reported interim period.

- In the company's Retail division, the cycling sales figures have performed well, and in the motoring division the company's core categories have also managed to gain market share. For big-ticket, discretionary items however, sales figures have been weaker.

- The company during the six-month period been a cash-generating company; the company's free cash flows for the period stood at £44.2 million, which is up by 29 per cent compared to the first half of last year.

- The company during this six-month period has entered into a strategic buying alliance with a leading player in the European motoring products and services market, Mobivia.

Stock price performance at the London Stock Exchange

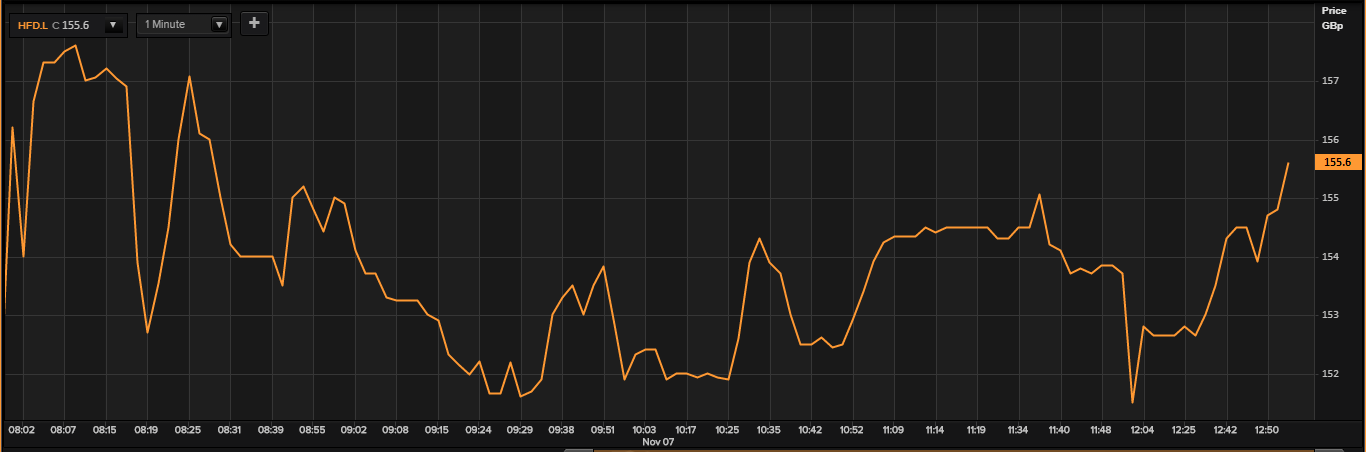

Price Chart as on 07 November 2019, before the market close (Source: Thomson Reuters)

On 07 November 2019, at the time of writing the report (before the market close, GMT 12.56 PM), HFD shares were trading on the London Stock Exchange at GBX 155.60.

The stock of the company has a 52-week High of GBX 316.40 and a 52-week low of GBX 150.00. The total market capitalization of the company at the time of writing this report was £303.65 million.

Outlook

The company, in the interim result statement document, has reaffirmed its profit guidance for FY20. The underlying profit before tax of the company (pre-IFRS 16) for the full year will be within the range of £50 million to £55 million.

The capital investment guidance, which was previously given to be around £35 million for FY20, has now been enhanced by £11 million. This increase has been made in order to fund the acquisitions of âMcConechy's Tyre Service Limitedâ and âTyres on the Driveâ.  A further cash outflow of £2-3 million is envisaged in the second half of 2020 on account of restructuring and integration expenses of these two companies.