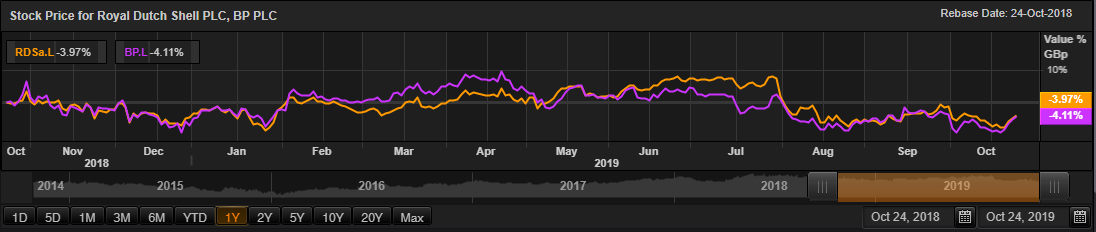

Some media sources reported that OPEC members might decide to cut production deeply in anticipation of weaker demand growth in December when they meet again. Below is a comparative chart for stock prices of above captioned stocks.

(Source: Thomson Reuters)

Royal Dutch Shell Plc

Royal Dutch Shell Plc (Identifier: RDSA) is a Hague, Netherlands-based international group of energy and petrochemical company, which engages in exploring, producing, refining and marketing oil and natural gas. RDSA-Recent News

As on September 30, 2019, the group reported third-quarter update. The company will achieve its target of integrated gas production between 930 and 960 thousand barrels of oil per day. Furthermore, the company expects LNG liquefaction volumes to be in the range of 9.0 and 9.30 million tonnes. The company expects an upstream production in the range of 2,600 and 2,650 thousand barrels of oil.

RDSA-Financial Highlights for H1 FY19

During the first half under consideration, the groupâs revenue stood at $174,278 million, which was 6.4 per cent below against $186,000 million recorded in H1 FY18, led by a dip in the revenue from all reportable segments during the period. The total revenue and the other income stood at $177,499 million in H1 FY19 versus $190,382 million in H1 FY18. The companyâs total expenditure has declined to $163,176 million in H1 FY19 from $172,405 million in H1 FY18. The PBT (Profit before tax) declined by 20.33 per cent from $17,977 million in H1 FY18 to $14,323 million in H1 FY19. The companyâs profit for the year attributable to the shareholders stood at $8,999 million in H1 FY19 as against $11,923 million in H1 FY18. The basic earnings per share for H1 FY19 was $1.11 versus $1.44 in H1 FY18. The diluted earnings per share for H1 FY19 was $1.10 versus $1.42 in H1 FY18.

The company has increased its competitive portfolio for the period with the introduction of first LNG cargo from Prelude and Appomattox and expect to generate added cash in future. The companyâs customer-facing and Upstream businesses are flexible and will contribute to generating cash flows to meet FY2020âs outlook.

RDSA-Share Price Performance

On 24th October 2019, while writing at 02:55 PM GMT, Royal Dutch Shell Plc shares were clocking a current market price of GBX 2,325.5 per share; which was more by 0.97 per cent in comparison to the last traded price of the previous day. The companyâs market capitalisation was at £182.69 billion at the time of writing.

On 07th May 2019, the shares of RDSA have touched a new peak of GBX 2,811.38 and reached the lowest price level of GBX 2,209.50 on 28th January 2019 in the last 52 weeks. The companyâs shares were trading at 17.28 per cent lower from the 52-week high price mark and 5.25 per cent higher the 52-week low price mark at the current trading level as can be seen in the price chart.

The stockâs traded volume was hovering around 2,481,718 at the time of writing before the market close. The companyâs 5-day stock's average daily traded volume was 5,040,030.40; 30 days average traded volume- 6,249,599.17 and 90 days average traded volume â 6,180,706.00. The volatility of the companyâs stock was 30 per cent higher as compared with the index taken as the benchmark, as the beta of the companyâs stock was recorded at 1.30.

The shares of the company have delivered a negative return of 10.23 per cent in the last quarter. The companyâs stock plunged by 0.20 per cent from the start of the year to till date. The companyâs stock has given investors 5.17 per cent of a negative return in the last year.Â

BP Plc

BP Plc (Identifier: BP) is a London-headquartered global energy business with a diverse portfolio across businesses, resource types and geographies, and operations in 78 countries worldwide. BP is a vertically integrated group with operations in all areas of the oil and gas industry, ranging from upstream, downstream and renewables businesses to manufacturing and marketing fuels and raw materials. The companyâs operations are bifurcated into four categories, namely: Rosneft, Downstream, Upstream and Other businesses & corporate.

BP-Recent News

On 4th October 2019, the company announced that Bob Dudley had decided to step down as a group chief executive officer (CEO) and from the company board. He will retire on 31st March 2020. On 29th October 2019, the company will announce the third-quarter results and dividend announcement.

BP-Financial Highlights for H1 FY19

The companyâs upstream production excluding Rosneft was 4.2 per cent higher than the previous year and averaged around 2,640 mboe/day in the first half of the fiscal year 2019. The companyâs production was 6.5 per cent higher than the second quarter of 2018 and stood at around 2,625 mboe/day.

Replacement cost profit was $3,870 million for the half-year, compared with $4,178 million in H1 2018, while underlying replacement cost profit was $5,169 million, compared with $5,408 million in H1 2018. Compared to a profit of $2,799 million and $5,268 million in the second quarter and the first half of 2018 respectively, profit was $1,822 million and $4,756 million for the same periods in 2019, corresponding to basic earnings per share of 23.47 cents in the first half and 8.95 cents in the second quarter. Subsequently, the company announced a quarterly dividend per ordinary share of 10.25 cents.

The prices of various commodities which the company markets can be subject to significant fluctuations, and as the prices are affected by global supply and demand, the company does not have any influence on the market prices, which can lead to a significant impact on the financials and affect the business assumptions. In the short-term, the company expects to face challenges from macroeconomic and geopolitical uncertainties, not least from the continuing global trade tensions, which has impacted global growth.

The group is well mitigated against any downside risk in any one region or commodity, as the group owns and operates assets in a wide range of commodities across many countries, offering the group a much-needed diversity. With the help of ongoing operating cash flow delivery and disposal proceeds from the $10 billion programme, the company expects gearing to trend down through 2020. By lowering costs through deploying the new technologies and deploying rigorous cost minimising programs, the company seeks to maximise output from its portfolio in an efficient way. The diversity in operations and strong industry connections underlie the future growth of the company, supported by strong fundamentals.

BP-Share Price Performance

On 24th October 2019, while writing at 03:02 PM GMT, BP Plc shares were clocking a current market price of GBX 510.9 per share; which was more by 0.88 per cent in comparison to the last traded price of the previous day. The companyâs market capitalisation was at £102.73 billion at the time of writing.

On 23rd April 2019, the shares of BP have touched a new peak of GBX 583.41 and reached the lowest price level of GBX 479.55 on 03rd October 2019 in the last 52 weeks. The companyâs shares were trading at 12.42 per cent lower from the 52-week high price mark and 6.53 per cent higher the 52-week low price mark at the current trading level as can be seen in the price chart.

The stockâs traded volume was hovering around 11,491,575 at the time of writing before the market close. The companyâs 5-day stock's average daily traded volume was 30,612,161.40; 30 days average traded volume- 33,106,922.23 and 90 days average traded volume â 32,140,995.78. The volatility of the companyâs stock was 41 per cent higher as compared with the index taken as the benchmark, as the beta of the companyâs stock was recorded at 1.41.

The shares of the company have delivered a negative return of 3.96 per cent in the last quarter. The companyâs stock surged by 2.11 per cent from the start of the year to till date. The companyâs stock has given investors 5.03 per cent of a negative return in the last year.Â