About Epwin Group PLC

Epwin Group PLC (EPWN) pioneered in low cost and maintenance fabricating solutions in the United Kingdom. Incepted in 1976, the company uses window fabricating solutions derived from PVC. The company has come a long way both organically and inorganically to achieve a market leading status in low maintenance solutions. In July2014, the company added another important event in its history by getting listed on the LSE AIM market. The company caters to new projects, retail and social housing, delivered by a network of window & door installers, manufacturers and merchants. The company has its own manufacturing tailormade for clients and sold under companyâs own brands. The company believes in investing in product differentiation through innovations in products & services.

EPWN-Financial highlights for H1 FY19 period ended 30th June 2019

The companyâs revenue was in accordance with the management expectations and stood at £140.0 million. The company saw good demand in Q1 due to advance purchasing by customers anticipating Brexit. This was followed by Juneâs poor weather and weaker demand in Q2. This can also be observed from construction data in UK. The insights show fall in momentum in the sector with respect to Q2, as political and economic uncertainty were at its peak. The companyâs revenue surged by 0.5 per cent on LFL (Like-for-Like) basis, after adjusting for acquisitions and closure of plant. The companyâs underlying operating profit (pre-IFRS 16 basis) surged by 10.7 per cent to £8.3 million in H1 FY 19. The companyâs underlying operating profit (reported basis) surged by 25.3 per cent to £9.4 million. The site rationalisation program launched in 2018 helped the company. The stability in prices of materials helped the company in recovering costs incurred during 2017 and 2018. The financial position of the company remains strong along with cash generation. The companyâs net debt at the end of the period stood at £29.2 million with debt to adjusted EBITDA OF 1X. Banks renegotiated with the company on more favourable terms and increased the revolving credit facility to £65.0 million along with overdraft facility of £10.0 million. The company announced an interim dividend which was up by 3 per cent over the corresponding period of prior year to 1.75 pence per share, which will be paid to the shareholders on 18th October 2019. The record date for dividend is 20th September 2019. The company had cash balances of £10.3 million in H1 FY19 as against £5.8 million at the end of H1 FY18.

Â

EPWN-Share price performance

Daily Chart as at 12-September-19, before the market closed (Source: Thomson Reuters)

On 12th September 2019, at 12:51 PM GMT while writing, EPWN shares were trading at GBX 82.2 per share; which were up by 0.24 per cent as compared to the closing price level of the previous day. The companyâs M-cap (market capitalisation) was recorded at £117.20 million at the time of writing.

On 19th September 2018, the shares of EPWN have touched a new peak of GBX 88.90 and reached the lowest price level of GBX 66.10 on 15th March 2019 in the last 52 weeks. The companyâs shares were trading at 7.5 per cent lower from the 52-week high price and 24.35 per cent higher the 52-week low price at the current trading level as can be seen in the price chart.

The stockâs traded volume was hovering around 34,899 at the time of writing before the market close. The companyâs 5-day stock's average traded volume was 63,157.40; 30 days average traded volume- 81,091.90 and 90 days average traded volume â 94,135.46. The companyâs stock is much less volatile in comparison with the index considered as the benchmark as the beta of the companyâs stock was recorded at 0.28.

The shares of the company have delivered a negative return of 1.56 per cent in the last quarter. The companyâs stock was up by 13.10 per cent from start of the year to till date. The companyâs stock has generated a positive return of 8.54 per cent in the last year along with a gross dividend yield of 6.04 per cent.Â

Â

About OnTheMarket Plc  Â

OnTheMarket plc (OTMP) is a British company which is into the business of managing property portals online backed by letting agents and real estate businesses. The portal is called OnTheMarket.com. This portal acts as a platform for the letting agents to host and showcase their properties and target accommodation seekers. This portal is equipped with a search engine and can be used to search available-for-sale or rental properties. The users can save their searches for future references and can subscribe to property alerts by creating an account on the portal. For letting agents, the portal is equipped with tools to broadcast property details, edit and advertise. The company caters to housing projects developers, online marketing agencies with respect to housing and commercial property advertisers. The company is a subsidiary of Agents Mutual Limited which was incepted in 2013. The portal was launched later in January 2015. On 9th February 2018, the company got admitted to the AIM. Its major competitors are Rightmove and Zoopla.

OTMP-Financial Highlights for FY19 period ended 31st January 2019

In the Financial Year ended 31st January 2019, the companyâs revenue was £14.172 million against £13.553 million for the same period of the last year, reflecting an increase of 4.5 per cent. The companyâs operating loss before specific professional fees, share-based payments and non-recurring items stood at £13.63 million in FY2019 against an adjusted operating profit of £3.88 million in FY2018. The loss reflects the increase in marketing expenditure and costs related to the expansion of the team. The operating loss for the period stood at £14.544 million against a loss of £10.839 million in the financial year 2018. The Loss before taxation for the period stood at £14.494 million against a loss of £12.070 million in the financial year 2018. The companyâs Loss after tax for shareholders was £14.500 million in FY2019 compared to £12.092 million in FY2018. The Basic and Diluted Loss per share stood at 24.02 pence in FY2019 against loss per share of 34.03 pence in FY2018.

Although the companyâs revenue increased for the financial year ending 2019, the profitability margins have remained stagnant or declined. The company operates in a challenging environment which requires continuous investment, sometimes at the cost of profitability, to stay ahead of competitors. The companyâs cash generation from its operations remained negative for the period.Â

OTMP-Share price performance

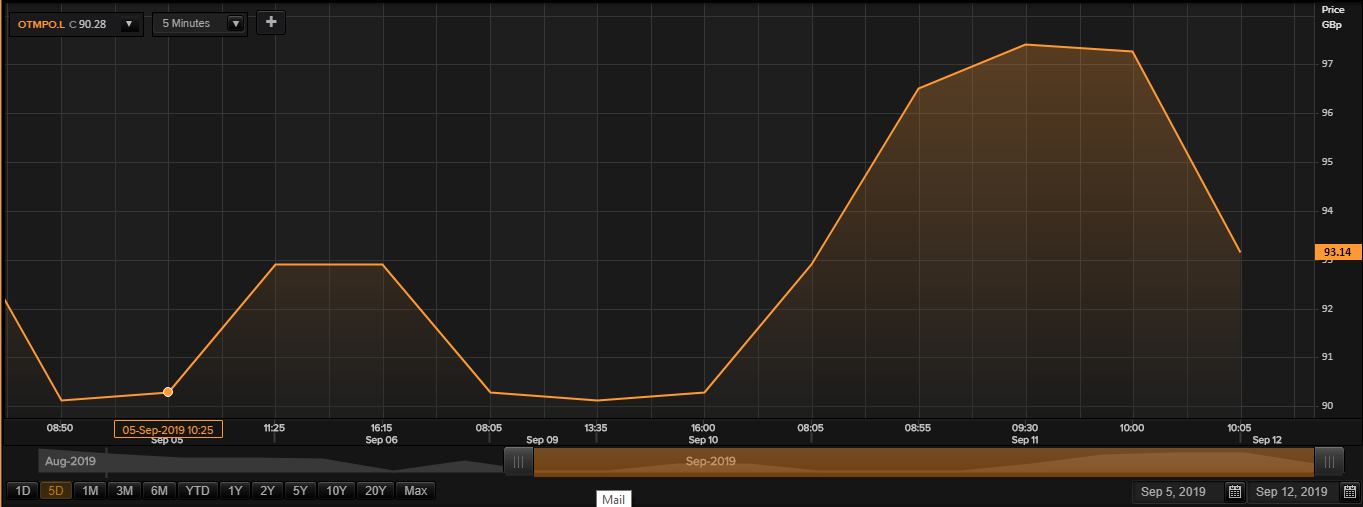

Daily Chart as at 12-September-19, before the market closed (Source: Thomson Reuters)

On 12th September 2019, at 12:56 PM GMT while writing, OTMP shares were trading at GBX 93.14 per share; which were down by 3.48 per cent as compared to the closing price level of the previous day. The companyâs M-cap (market capitalisation) was recorded at £61.62 million at the time of writing.

On 3rd October 2018, the shares of OTMP have touched a new peak of GBX 155 and reached the lowest price level of GBX 72 on 23rd January 2019 in the last 52 weeks. The companyâs shares were trading at 39.9 per cent lower from the 52-week high price mark and 29.36 per cent higher the 52-week low price mark at the current trading level as can be seen in the price chart.

The stockâs traded volume was hovering around 734 at the time of writing before the market close. The companyâs 5-day stock's average traded volume was 7,836.20; 30 days average traded volume- 16,499.87 and 90 days average traded volume â 26,111.28. The companyâs stock is much less volatile in comparison with the index considered as the benchmark as the beta (2Y weekly) of the companyâs stock was recorded at 0.64.

The shares of the company have delivered a negative return of 4.46 per cent in the last quarter. The companyâs stock surged by 5.46 per cent from start of the year to till date. The companyâs stock has generated a negative return of 34.58 per cent in the last year.Â