Sanofi SA (LON:0O59)

Healthcare company, Sanofi develops solutions which involve extensive research, development, manufacture and marketing, specifically therapeutic solutions which are focused on the needs of the patients. The company has various business divisions such as Human Vaccines, Pharmaceuticals and others.

The research and development, production and marketing activities of Speciality Care, Diabetes and Cardiovascular, Consumer Healthcare and Generics, Established Prescription Products along with the commercial operations of various franchises is taken care by the Pharmaceuticals segment.

The extensive research and development, marketing and production activities for the groupâs vaccines operations along with the commercial operations of the group's vaccines division Sanofi Pasteur, is taken care by the Vaccines segment.

Sanofi-Recent development

According to a press release made on 23rd December 2019 by the company, the company commenced a tender offer to acquire the outstanding shares of common stock of Synthorx Inc for $68 per share in cash.

Synthorx Inc is focused on prolonging and improving the lives of people with autoimmune disorders and cancer, it is a clinical-stage biotechnology company.

Sanofi-Stock price performance

(Source: Thomson Reuters) Daily Chart as on Jan-02-20, before the LSE market close

The market capitalisation of the company while writing as on 02nd January 2020 (at 01:20 PM GMT) was approximately â¬112.07 billion.

While writing, Sanofiâs shares were trading at EUR 90.58 per share; which were 1.15 per cent higher in comparison to the previous day closing price level.

The shares of the Sanofi have struck a high of EUR 91.58 (as on Dec 23, 2019) and a low of EUR 71.49 (as on May 21, 2019) in the last twelve months. At the current price point, as quoted in the price chart, the companyâs shares were trading 1.09 per cent below the high price point attained in the last twelve months and 26.70 per cent above the low price point attained in the last twelve months. At the time of writing, the stock's todayâs volume stood at 2,743,452 with 173 trades executed.

Pfizer Inc (LON:0Q1N)

Research-based global biopharmaceutical group, Pfizer Inc is engaged in the discovery, development and manufacture of healthcare products. The company has a diverse portfolio of vaccines and medicines. The group manages its business through its divisions, namely, Essential Health (EH) and Innovative Health (IH). The commercialisation and development of vaccines and medicines are taken care by Pfizer Innovative Health (IH), which include consumer healthcare and rare diseases, inflammation and immunology, vaccines, oncology and internal medicine. The biosimilars and infusion systems, injectable generics, and other branded products are managed by Pfizer Essential Health (EH) along with its manufacturing business and research & development facility.

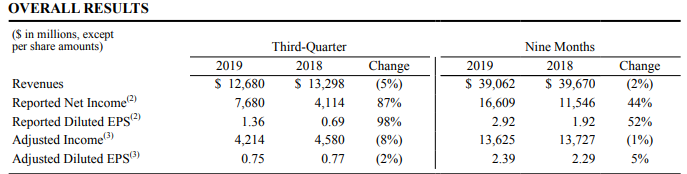

Pfizer-Business performance for Q3 FY19

(Source: Earnings press release, Companyâs website)

The Q3 2019 Revenues of the company were recorded at $12.7 billion, reflecting 3 per cent surge in Operational Decline. These revenues did not factor the impact of Consumer Healthcare, while the revenues for the Q3 FY19 remained flat operationally.

The diluted EPS of the company was recorded at $1.36 for the third-Quarter 2019, which was primarily driven by a gain associated with the joint venture completion of the consumer healthcare GSK. The Diluted EPS (adjusted) of the company was around $0.75.

The company raised the guidance range by $0.2 billion for revenues driven by operational improvement of $0.4 billion which was partially offset by changes in Foreign Exchange (FX) Rates to the tune of $0.2 billion.

The companyâs Diluted EPS (adjusted) guidance range was raised by $0.16, which reflected an operational improvement by $0.18.

GlaxoSmithKline Plc (LON:GSK)

GlaxoSmithKline Plc is a healthcare company, which focuses on the manufacturing, commercialisation, and development of pharmaceuticals vaccines and consumer healthcare products. The company offers over the counter (OTC) products for pain, relief, nutrition, skin health, oral health, and gastrointestinal disorders.

GSK-Recent News

In a complete response letter received from the US FDA, ViiV Healthcare (owned by GSK, Pfizer Inc and Shionogi Limited) can use investigational cabotegravir and rilpivirine for treating HIV.

ViiV Healthcare submitted the application for New Drug to the US Food and Drug Administration (FDA) on 5th December 2019. The company seeks approval of inhibitor used for the treatment of HIV-1 infection in adults with limited availability of treatment.

GSK-Business performance for FY19 3Q period ended 30th September 2019

The companyâs total revenue stood at £24,855 million and increased by 10 per cent (AER), while increased by 7 per cent on CER basis for the nine-month period in the financial year 2019. The companyâs pharmaceuticals sales increased by 1 per cent on a CER basis and by 4 per cent to £12,996 million on AER basis. The companyâs sales increased by 19 per cent on Constant Exchange Rate basis and by 23 per cent to £5,415 million on Actual Exchange rates in Vaccines. The sales were recorded at £6,424 million in the consumer healthcare segment.

The operating profit of the company went up by 29 per cent to £5,059 million on Actual Exchange rate basis for the nine-month period FY2019 versus £3,929 million for the nine-month period FY2018.

The PBT (Profit before taxation) of the company surged by 22 per cent at Constant Exchange Rate to £4,510 million for the nine-month period in FY2019 from £3,426 million for the nine-month period in FY2018.

The companyâs PAT (Profit after taxation) of the company increased by 37 per cent at Actual Exchange rates from £2,746 million for the nine-month period in FY2018 to £3,751 million in the nine-month period in FY2019. The earnings per share (EPS) of the company surged by 38 per cent from 49 pence for the nine-months in FY2018 to 67.7 pence for the nine months in FY2019 at actual exchange rates.

GSK-Stock price performance

(Source: Thomson Reuters) Daily Chart as on Jan-02-20, before the LSE market close

The market capitalisation of the company while writing as on 02nd January 2020 (at 01:37 PM GMT) was approximately £88.76 billion.

While writing, GlaxoSmithKline Plcâs shares were trading at GBX 1,785.20 per share; which were 0.35 per cent up in comparison to the previous day closing price level.

The shares of the GlaxoSmithKline Plc have struck a high of GBX 1,850.40 (as on December 20, 2019) and a low of GBX 1,429.80 (as on January 28, 2019) in the last twelve months. At the current price point, as quoted in the price chart, the companyâs shares were trading 3.52 per cent below the high price point attained in the last twelve months and 24.86 per cent above the low price point attained in the last twelve months.

At the time of writing, the stock's average daily traded volume for 5 days was 2,649,087.80; 30 days- 6,500,895.77 and 90 days â 6,763,417.79. The 5 days daily average traded volume of the shares of the company was down by 59.25 per cent in comparison to 30 days daily average traded volume. The shares of the company were trading above the 60-days and 200-days SMA while writing.

On a Year-on-Year time interval, the shares of GlaxoSmithKline Plc surged by approximately 19.30 per cent and were up by 1.97 per cent in the last quarter. GlaxoSmithKline Plcâs shares have delivered 1.43 per cent positive return in the last one-month period.